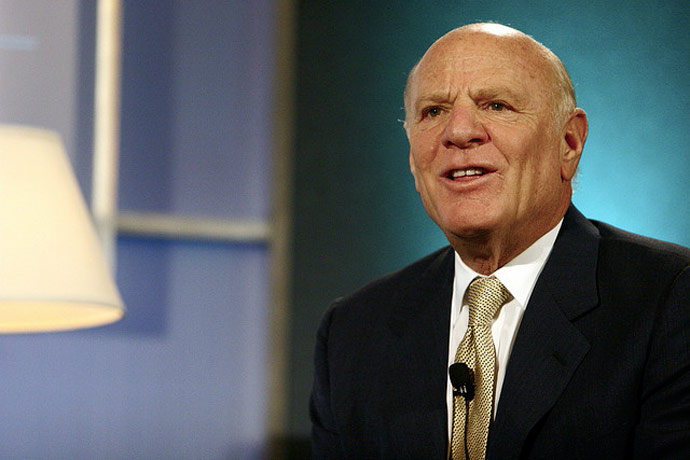

JPMorgan Mortgages Handled ‘Quite Well’ Says Barry Diller

Image via Flickr/ Kris Krug

This morning brought a rousing defense for JPMorgan Chase in the scandal involving the bank’s lending practices in its mortgage department. Interestingly enough, the defense of the bank’s actions comes from Barry Diller, the chairman of IAC. According to CNBC, Diller vouched for the bank’s actions, saying that it was handling its business properly considering its size and reach.

Barry Diller’s Positions

IAC is one of the largest holders of Internet property in the world, with websites like Match.com, Ask.com, About.com, and HomeAdvisor in its portfolio. Diller is also the chairman and senior executive of Expedia.com, one of the world’s largest travel sites.

JPMorgan’s Defender In Action

Diller’s comments were made at the Dealbook conference, where he reiterated that JPMorgan had handled itself “quite well” considering the amount of pressure that had been put on the bank to find and correct the issues. This pressure includes a $13 billion fine that Diller says he thinks is a bad idea.

He said, “What I want to know about the $13 billion is: where is it actually going? A relatively small portion of it goes to the people who were actually harmed. The vast majority of it goes to the government.”

Diller criticized the government for its attempt to force the bank to pay such a large fine over the issues involved, saying that JPMorgan would not carry the brunt of the blow, but rather the shareholders would be the ones to suffer. After all, the $13 billion has to actually come out of someone’s earnings; and when is the last time you heard of the executives of a company who were willing to pay a fine out of their own pockets?

He also noted that the sheer size of JPMorgan Chase makes it almost a guarantee that problems can be found if someone digs deep enough into the paperwork. He said, “You can’t run a business like that without having all sorts of issues.

JPMorgan Chase & Co. Snapshot

JPMorgan Chase & Co. (NYSE:JPM) is the largest bank in the United States, and is a publicly traded company. The stock is up more than twenty percent since this time last year, even in the face of federal investigations and fines. The bank currently has a market cap of $203.37 billion and has become one of the most recognizable icons of Wall Street.

Watch the video of Diller’s comments below.

Disclosure: Author represents that he has no position in any stocks mentioned in this article at the time this article was submitted.