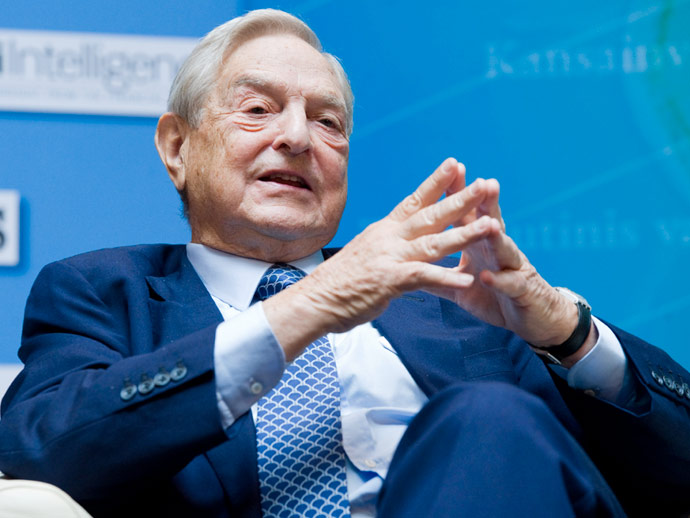

Soros Picks Up Apple Shares And Takes A Giant Position Against the S&P 500

Image via Flickr/ International Monetary Fund

Soros Fund Management, and George Soros, reported a new position in Apple, Inc. (AAPL). The Soros Fund Management 13F filing shows a new position of 66,800 shares in Apple with a market value of $26.45 million. Carl Icahn also recently announced his position in Apple on Twitter. Apple appears to be a popular hedge fund play in advance of some major product releases.

However, the most interesting news from the filing may be the largest holding in the portfolio. Soros now holds a massive put on the S&P 500 ETF (NAR: SPY) of 7.8 million shares with a market value of $1.28 billion. This position represents 13.54% of his total portfolio. It is an increase of 5.18 million shares over the previous 13F filing. The next largest equity holding is Google, Inc. (GOOG), with 396,953 shares representing 3.13% of the total portfolio.

The market should take notice when a famed investor like Soros takes such a massive bearish position. Soros is known for having made bold moves in the past, and has been accused of breaking down national currencies. He made around $1 billion on one day in 1992 when taking a bearish position against the pound sterling. There were rumors earlier this year that he made a massive profit betting against the yen.

However, it is difficult to decipher the meaning of the position. The 13F filing only discloses the position was entered into during the 2nd quarter, but does not narrow down dates of entry. Still, when an investor like Soros takes a huge bearish position, it behooves investors to take notice. Only time will tell if Soros gets it right.

Disclosure: The author has no position in any of the stocks mentioned, and does not intend to initiate a position in the next 72 hours.