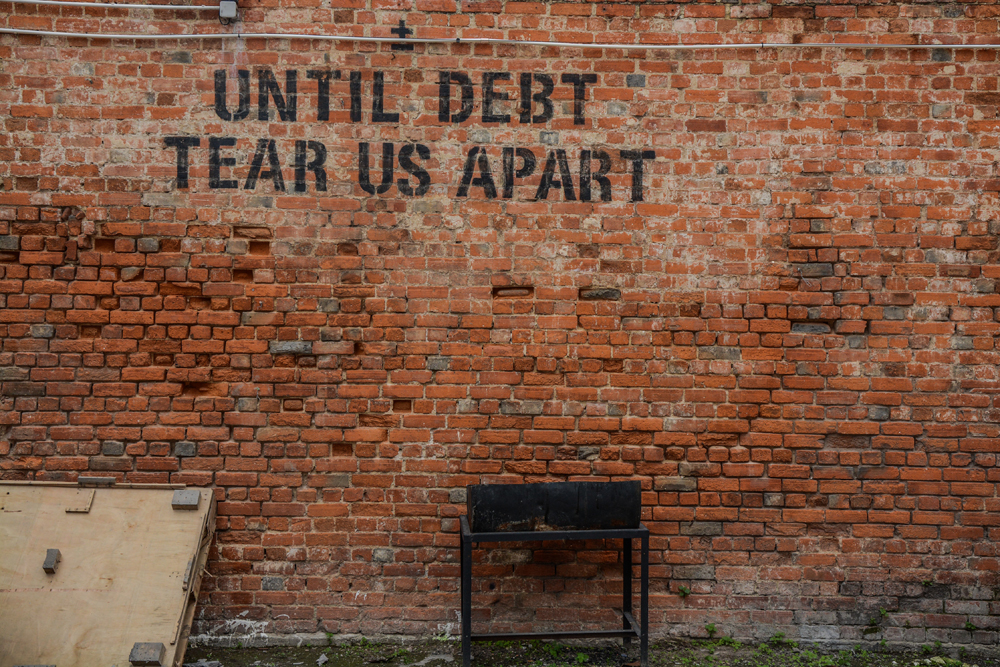

10 Financial Mistakes That Ruin A Marriage, And How To Prevent Them

Money problems are the root of all evil. When you’re single, it’s tough to make ends meet, with rent, bills, surprise expenses — all on one income! Once you get married, you think it’s going to be so much easier: another income, two people sharing rent, paying off the same bills, having each others’ backs in the event of a crisis. Not to burst your bubble, but there are some unexpected financial issues that arise in marriage. Here’s a heads up on what you should think about before you get married — or even after you’ve been married for years.

1. The Problem: Engagement Rings

Before you get married, an engagement ring seems like such a huge deal. And it is pretty important because it symbolizes your commitment. But too many people think an engagement ring should also symbolize what income bracket you’re in (or, more likely, you wish you were in). For the most part, no proposal is a surprise. If you’re in a serious relationship, you’ve probably (hopefully) talked about the future. Maybe you’ve even talked about what kind of engagement ring would be just right. Forbes states that the average price of an engagement ring is $5,000, but can expect to spend as little as $1,000.

How to Prevent It:

If that $5,000 price tag sounds a bit high to you, talk with your partner. Maybe you can buy an antique ring, or use a family heirloom, or just have matching wedding bands. It’s important to be on the same page of this issue since it’s the start of a major commitment. Don’t let an engagement ring break the bank — or your relationship.

2. The Problem: Weddings

So you’ve talked to your partner about engagement rings, and bought one that fits your budget and your style. Now it’s on to the wedding plans! Cost of Wedding puts the average wedding expense at just over $25,500. Pretty pricey for a few hours of fun! The site also says that most couples lately have been spending less than $10,000 on their weddings, which is a drastic difference.

How to Prevent It:

You can use Cost of Wedding to custom budget your wedding based on location, number of guests, location expenses, and more. Even if you haven’t started planning your wedding yet, this site is a great way to get a general idea of your budget and start talking about how you both want the day to be. If the wedding doesn’t seem as important as things to come in the future, like going on an adventurous honeymoon, buying a house, or building a nest egg, make that clear to your partner.

3. The Problem: Not Talking About Money

The crucial solution in the first two problems is talking to your partner. If you never talk about money, you’ll never get anywhere, and you might find yourself bitter and in the middle of a divorce. It’s fairly common for a spender and a saver to be married, so don’t feel like you’re already on the brink of divorce for that reason alone.

How to Prevent It:

It’s important to tell your partner how you feel about money, how you want to save, and what goals you’re saving for. Make sure you listen to your partner’s thoughts on these points, too. Once you open the lines of communication, you’ll be able to collaborate about how you want money to be saved and spent.

4. The Problem: Being Emotional About Money

When you work hard and save your money, and then your spouse wants to blow it all on a new car, you get emotional. It’s understandable, but it’s not the best way to handle money — even in something as emotional as a marriage.

How to Prevent It:

It sounds strange, but it’s best to approach money from a business standpoint. Don’t think of the money as your money and their money, it simply belongs to the business, and you are the executives trying to decide how to allocate these funds. If the emotional aspect is out of the equation, you’ll be able to talk with your partner logically about money, and eliminate a lot of fights.

5. The Problem: Merging Accounts Too Soon

There’s advice saying married people should share banks accounts, there’s advice saying married people should keep their own personal accounts, and there’s advice saying you should have a joint and separate account.

How to Prevent It:

You know what all of that conflicting advice is really telling you? Do what feels right to you. If you have a big savings account and your partner is a notorious shopper, don’t feel guilty about keeping your own account. This is something that will be sorted out in your open, level-headed conversations about money with your partner, but it’s also something you should both agree on, and both feel comfortable with.

6. The Problem: Not Having an Emergency Fund

A new study found that only 39% of Americans have $1,000 in their emergency fund. That sounds like a nice chunk of change to have just sitting in your bank account, but think about your life. What if you were in a car wreck — how much would all of those expenses set you back? If you’re a renter, you don’t have to worry about household issues, but if you’re a homeowner, almost anything that goes wrong in your house could cost at least $1,000.

How to Prevent It:

Not having money to pay off a major expense would put a huge strain on your marriage, so instead of putting yourself and your spouse in that situation, talk about a nest egg. How much would you like to have put away for an emergency? Set a goal and start saving towards it each month from your paychecks.

7. The Problem: Not Having Fun With Money

This might sound contrary to all of the advice so far, but while you’re thinking about a nest egg, think about putting some money away for fun. Too often, money is only thought about or talked about when it’s a problem. Money doesn’t always have to be a sore spot in your relationship.

How to Prevent It:

Talk with your partner about how you like to have fun together. Do you want to take a romantic vacation and get away from everything for a week? Or splurge and take the family to Disneyland? It doesn’t even have to be a big trip; what about putting aside enough money to go out to a fancy restaurant once a month? Set a goal and start saving for this fund as well.

8. The Problem: Not Being Honest About Money

Sometimes you might grab fast food for lunch, then feel bad about that minor expense and hide it from your spouse. Or go on a shopping spree where purchases kept piling up because you really wanted them. You might have student loans that you’re pretty sure you can pay off on your own, or debt from credit cards you maxed out in college. Once you’re married, issues like this aren’t just yours, they belong to both of you. Depending on how you file taxes, student loans and other debts could affect your tax refunds.

How to Prevent It:

Never think that your partner doesn’t need to know your spending habits and your debts. Remember, once the open lines of communication about money are open, you need to keep it that way. You’re married, so your partner knows you and should be understanding about any financial issues you bring to them. But if they’re not, think about what you can do to help, and maybe skip that spending spree next time.

9. The Problem: Filing Taxes Incorrectly

You might think you could filed married but separately to keep that debt info from affecting your spouse, but make sure you know all of the facts, first. Filing jointly prevents you from getting the maximum number of deductions, according to H&R Block.

How to Prevent It:

Look into what credits you get from filing jointly, and if you’re not sure of the best option, prepare the tax return both ways before you file it. See what benefits you get filing separately versus filing jointly, and then submit the return that gives you the most refund.

10. The Problem: Not Having a Will

You’re in love — you’re newlyweds, or you’re celebrating a major anniversary and the kids are at home with a babysitter. It doesn’t matter who you are — you need a will. If you die without a will, the state and courts decide what happens to your money and property.

How to Prevent It:

There is a certain hierarchy to this, so a spouse usually gets precedence, especially for joint assets, but you don’t want to take a chance. You and your partner need to have wills drawn up, and make sure you update them as life circumstances (like new children, new properties, and more) change.