Need Money Now? 35 Legit Ways To Get Money Quickly

This post includes links to our affiliate partners that earn us a commission. We’re letting you know because we believe in honest money. Now back to learning about ways to earn, save, and grow.

Sometimes you need cash, and you need it fast. Maybe the rent is due, and you’re a little short, or perhaps you ran into an emergency that your emergency fund couldn’t handle.

If you need money now, you may turn to a cash advance on your credit card. We all know that the interest rates on credit cards are high but did you know the rate on a cash advance might be even higher than it is on purchases? There’s also no grace period on credit card cash advances. The moment you pull that money off the card, it starts accruing interest.

When you’re in a situation where you need money now, you might also consider a payday loan. A payday loan is an even worse choice than a credit card cash advance. Payday loans often come with triple-digit interest. Taking out a payday loan is a sure-fire way to make an already bad situation worse.

Before you panic, take a deep breath and check out these 35 legit ways to get money when you need cash now.

Get Money Quickly with a Personal Loan (Up to 100k)

Getting a personal loan online is fast and easy. Personal loans are simply loans that can be provided for ‘personal’ reasons – such as paying for a medical expense, credit card debt, home renovation, etc. – compared to an auto loan or mortgage. You can read about all the things you can do with a personal loan to learn more.

When you get a personal loan online, you can have the money within just a few days.

1. Fiona: Get offers for up to $100k from multiple lenders in seconds.

Fiona

Fiona is an online personal loan marketplace that does all the hard work for you. Just fill out a simple form and Fiona will check offers from all the top personal loan providers for you in seconds (saving you lots of time).

Based on the info you provide and your creditworthiness, Fiona will match you with the right offer to meet your needs.

Borrowers can get loans in amounts from $1,000 to $100,000.

2. Get up to $50k from a company that will look at more than your credit score.

Alexander Mils on Unsplash

Upstart is a personal loan company that believes you’re more than your credit score. Founded by ex-Googlers, it will take into consideration your education and job history when giving you a rate (although you still need a credit score of at least 620). Borrowers can get loans in amounts from $1,000 to $50,000.

If you’re unsure what your credit score is, check it for free with Credit Sesame.

Home Equity Loan To Get Cash Now

Your home is probably your most significant investment, and you can tap into it to get money quickly with a home equity loan.

3. Figure: Turn your home into a source of fast cash.

Jesse Roberts on Unsplash

Figure offers home equity loans ranging from $15,000 to $150,000 with repayment terms of five, 10, 15, and 30 years. Apply online, and you’ll receive an offer. This doesn’t impact your credit score.

If you choose to accept the Figure home equity loan, you can have the money in as few as five days. The only fee Figure charges borrowers is an origination fee of up to 3% of your initial draw.

Negotiate Your Bills As A Way To Free Up Cash

When you need to make money fast, you might not think of cutting costs as a way to do it. But when you negotiate your bills, you’ll be amazed at how much money you can free up every month.

4. Credible: Save thousands on your student loans.

Credible

Paying back student loans each month can feel like an endless journey, but – luckily – there is a way to ease the pain and cost.

Did you know you could refinance your student loans and get a lower interest rate in minutes? Refinancing your student loans just means replacing your existing loan with a new loan with less interest. Refinancing can save you thousands over the life of the loan, and lower your monthly bill starting this month.

Credible is an online loan marketplace that makes the student loan refinancing process a breeze. You can compare prequalified refinancing rates from up to 10 lenders in 2 minutes without affecting your credit score. It’s also 100% free to do!

Credible has a best rate guarantee that will give you $200 if you find a better rate elsewhere.

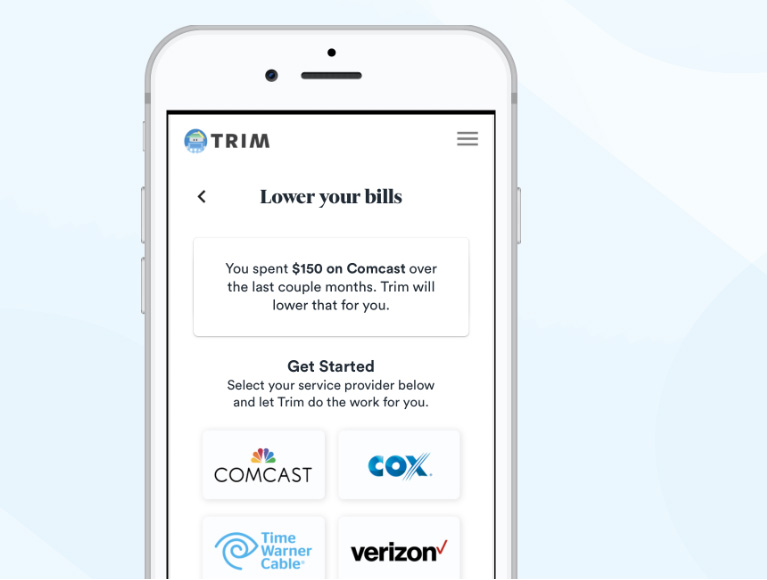

5. Trim: Eliminate those monthly expenses that are draining your bank account.

Trim

Trim will be one of your favorite personal finance apps, and it’s totally free to sign up. It analyzes your spending looking for recurring monthly payments like subscription services, your Comcast and auto insurance bills. Trim will ask if you want to cancel any of your subscriptions. If you do, Trim does it for you! No digging up your username and passwords, logging in, and canceling.

Trim also negotiates and finds better rates for you. It’s genuinely the lazy, frugal person’s best friend!

Don’t Wait Until Payday, Get Paid Today

You worked today but won’t get paid until Friday. What if there was a way to get paid right now for work you’ve just completed.

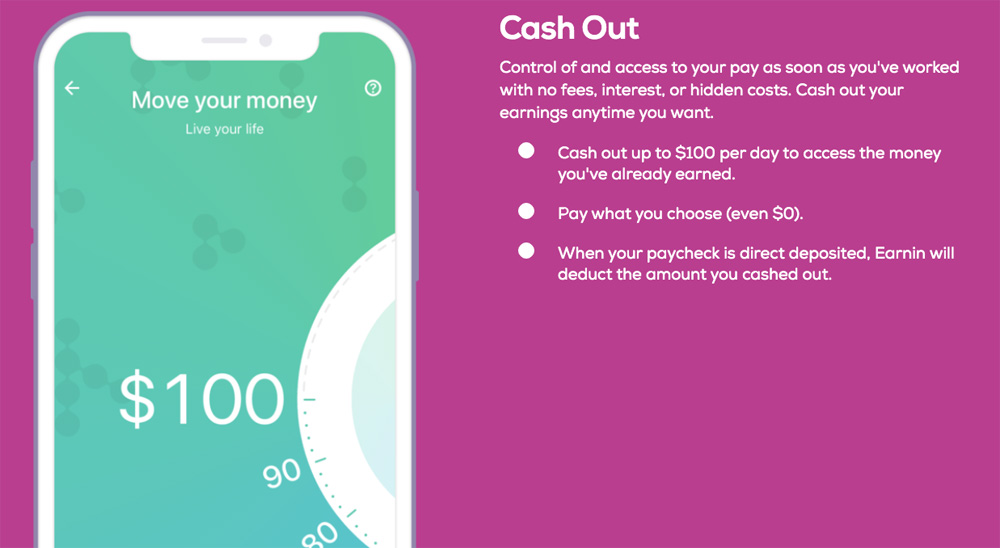

6. Earnin: you worked today, get paid right now.

Earnin

If you’ve got a paycheck on the way but need money now, Earnin can help.

Earnin gives you control of and access to your pay as soon as you’ve worked with no fees, interest or hidden costs.

You can cash out your earnings anytime you want, up to $100 per day. When your paycheck is direct deposited, Earnin will deduct the amount you cashed out.

Side Hustles to Make Money Now

We live in the age of side hustles. Making money on the side is nothing new of course, that’s what a second, part-time job was for. But the difference between a part-time job and a side hustle is the amount of flexibility each offers.

Most part-time jobs require you to adhere to a specific schedule, someone else’s schedule, which may not always be convenient or even possible for some people. But most side hustles let you work on your schedule. If you have some free time, you can get money quickly.

7. Airbnb: Share your home and rake in the profits.

Joseph Albanese on Unsplash

Most of you are probably familiar with Airbnb. It allows people to list their entire home (or apartment or condo), or just a room in their home to travelers. You might think that unless you live in an in-demand area that you can’t make money on Airbnb – but that isn’t true.

Not everyone who rents an Airbnb is on vacation. Some might be visiting relatives or friends, traveling for business, or looking for a temporary place to stay in a new city until they can get the lay of the land and rent an apartment or buy a home. So even if you don’t live in a vacation destination, it can still be worthwhile to list your space.

Very worthwhile. Some people rent their home out a few nights a month, which generates enough income to cover their mortgage payment! Check out our ultimate guide to listing your space on Airbnb to learn more.

8. Turo: Turn your car from a money pit to a money earner.

Jimmy Chang on Unsplash

Think of Turo like Airbnb for cars!

Turo is an especially good way to get money quickly if you work from home and your car is just sitting in your driveway idle. You create a profile for your car, including pictures and your rates (or you can let Turo set the prices for you) and choose when to make your vehicle available to renters.

Renters can book, locate, and unlock your vehicle straight from the app with your approval. You’re covered with up to $1 million in liability insurance, and your car is contractually protected against theft and physical damage, unless you have commercial rental insurance and choose to waive protection offered through Turo Insurance Agency for yourself and your customers.

9. Getaround: If you need money now, your car can help.

Alora Griffiths on Unsplash

Getaround is similar to Turo. You create a profile for your car, set your rates, and accept or decline potential renters. Some Getaround users have made over $30,000 renting out their car.

You don’t have to meet to drop off and pick up your car, your car can be rented and unlocked with the Getaround app with your approval. Even if you do work from home, this is nice because you don’t have to worry about meeting renters to hand over the keys. Every trip includes $1,000,000 insurance and 24/7 roadside assistance.

(Pro tip: sign up and list your car on both Turo and Getaround to maximize earning potential)

10. Rover: What better way to make money than by spending time with dogs.

Matt Nelson on Unsplash

If you’re a dog lover, Rover will be your favorite way to get money quickly. Rover connects people who need someone to care for their dog, which can mean boarding a pet in your home, dog sitting in the dog’s house, or dog walking.

You’ll create a profile on the site which includes information about your availability, which services you offer, the size of the pets you’re willing to handle, and your rates. The fact that you set your rates makes Rover one of the most appealing options for making money fast. If you’re not sure what to charge, take a look at the prices of similar pet sitting services in your area.

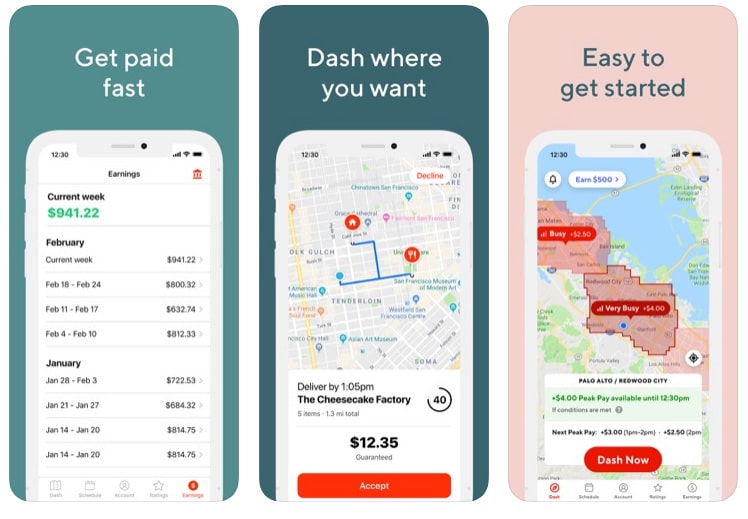

11. DoorDash: Make money feeding people who don’t want to cook.

DoorDash

DoorDash is a food delivery service. Many restaurants are moving away from employing dedicated delivery drivers and instead using services like DoorDash to make deliveries. As a Dasher, you’ll pick up restaurant orders and deliver them to people’s homes and offices.

The amount of money you make will vary as there will be certain days and times that are busier than others. If you already work a standard 9-to-5 job, DoorDash can be a great way to get extra money quickly because the busiest times for deliveries tend to be evenings and weekends.

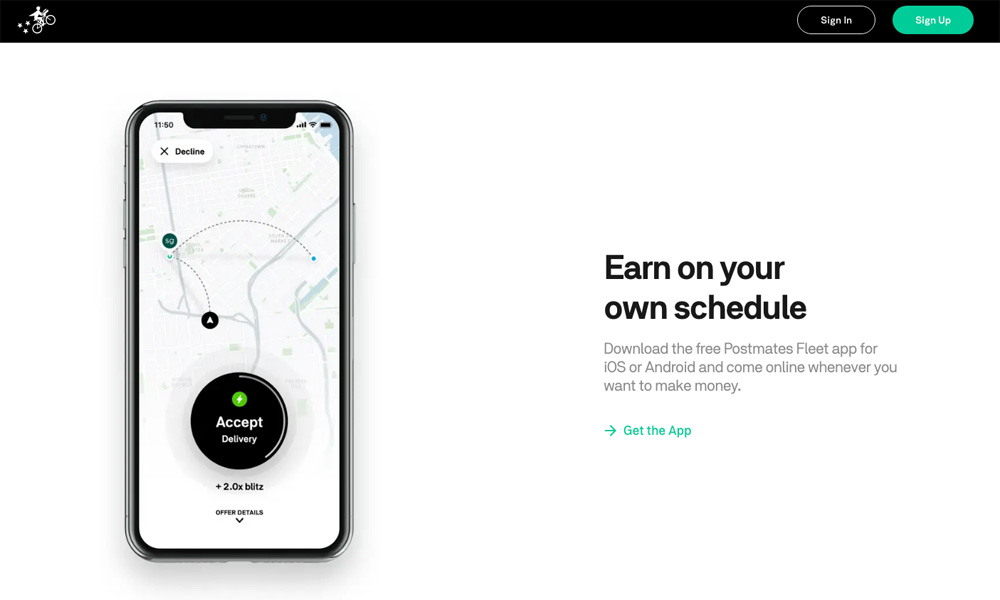

12. Postmates: People need more than food delivered to their doors.

Postmates

Postmates is similar to DoorDash, but drivers pick up and deliver not only restaurant orders but things like groceries, alcohol, coffee, and evening clothing as well. Drivers pay for the items via a pre-paid debit card provided by Postmates. You can deliver via car, bike, scooter, moped, or motorcycle.

Your income driving with Postmates will depend on the volume of orders coming in during a shift. Get free weekly deposits or cash out your earnings instantly anytime you want.

13. UberEATS: And you thought Uber was just for getting a ride.

@charlesdeluvio on Unsplash

UberEATS is a branch of Uber, the ride-sharing service. Drivers pick up and deliver restaurant orders.

Delivering with Uber comes with a lot of flexibility. Grab your car, bike, scooter, or even shoes, and deliver whenever you want—for an hour, a weekend, or throughout the week. You can set up Instant Pay to get same-day payouts up to 5 times a day.

14. Instacart Shopper: If you love food shopping, why not get paid for it?

Clark Young on Unsplash

If you love grocery shopping, becoming an Instacart shopper might be right up your alley. Customers place grocery orders through Instacart, and the list is sent to shoppers who shop for and deliver the items to the customer.

The income potential varies by a number of factors including the city you live in, and you can earn extra money via special promotions and bonuses. Instacart isn’t as flexible as most of the other options on this list. Shoppers can choose their own hours, but they must commit to those hours ahead of time, unlike something like driving for Uber where you can just turn on the app whenever you’re ready to work.

15. Lyft: Take passengers around town.

Victor Xok on Unsplash

Most of us are familiar with the ride-sharing app Lyft even if we’ve never used it ourselves. While driving with Lyft, you pick up people who request a ride via the Lyft app on their phone and take them to their destination.

Driving with Lyft gives you a ton of schedule flexibility. You can also make more money with increased pricing during peak hours, and Lyft lets you earn and keep the whole tip amount from your passengers. Lyft is currently offering a $1,000 guarantee to new drivers.

16. Uber: A go-to for those who need money now.

freestocks-photos on Pixabay

Uber is a ride-sharing service like Lyft. Drivers give rides to those who request them through the Uber app.

Drivers can set their own hours, and there is no minimum number of hours required. Those that drive with Uber get to choose how and when they get paid.

Get Money Quickly with Survey & Reward Sites

Survey sites are great because you can earn money in your downtime while doing things like watching TV or waiting for your pasta water to boil. Survey sites aren’t quite passive income, but they are one of the fastest and easiest ways to make a few bucks when you need money fast.

Reward sites are a consumer favorite because they pay you for things you already do. You can earn cash and free gift cards for making everyday purchases, watching movies, and more.

17. Survey Junkie: Earn points for giving your opinion.

Survey Junkie

Survey Junkie is great for lots of reasons. It’s one of the best paying survey sites available, where you can earn $1 to $3 per survey, and most surveys take about 15 minutes. There are lots of surveys available. The minimum to cash out is just $10, and you can redeem your points for actual cash via PayPal rather than just for gift cards.

18. PointClub: Set a goal and reach it as you climb each tier.

PointClub

PointClub is unique among survey sites. Rather than earning points and then choosing how you want to cash those points out, you set a goal (like $50 via PayPal), and then you work on earning points to reach that goal.

There is also a tiered system. The higher your tier, the more points the surveys are worth. To move up to the higher levels, it’s essential to log in and take at least one survey each day, but this isn’t difficult as PointsClub offers lots of surveys.

19. Vindale Research: When you need money now, this is the best paying survey site out there.

Vindale Research

Vindale Research touts themselves as the best paying survey site on the internet, and you will occasionally see surveys paying as much as $75! If that’s not reason enough to sign up, this might persuade you: Vindale doesn’t work off a point system. Each survey earns you cash, not points, so you don’t have to pull out the calculator to figure out if a survey is worth your time.

You can be paid via PayPal or mailed a check.

20. InboxDollars: So many ways to earn that you’ll have your money in no time.

InboxDollars

InboxDollars offers users more ways to earn than just surveys. You can shop, search the web, watch videos, read emails, and play games to earn money quickly. This is another site that rewards users with dollars rather than points.

You’ll need a minimum of $30 to cash out which you can do via paper check, an ePayment, or pre-paid debit cards. InboxDollars has paid its members over $56 million in rewards.

21. Swagbucks: Earn points doing everyday tasks you usually do for free.

Swagbucks

Swagbucks pays out 7,000 gift cards each day. It offers numerous ways for users to earn points. Earn points taking surveys, shopping (what the app is best known for), watching videos, doing online searches, and playing games.

Points can be turned into cash via PayPal in denominations of $25, $50, $100, and $250, or into gift cards with denominations between $1 and $100. Check out our full Swagbucks review to learn more.

22. MyPoints: Frequent online shoppers will love earning money with every purchase.

MyPoints

MyPoints offers several ways to earn points, including taking surveys, shopping online, buying local deals, (via Groupon or Living Social), printing coupons, watching videos, and doing online searches.

The minimum threshold for a cash payout via PayPal is $25. The thresholds for gift cards vary from card to card.

23. Nielsen Panel: The most passive money you’ll ever make.

Nielsen

Yes, this is the same Nielsen that does TV ratings. Nielsen collects data on many things, including how people use their mobile devices. Of all the passive income apps out there, Nielsen Panel is the most passive.

All you have to do to earn points is to download the app onto your mobile devices. It works quietly in the background collecting consumer data like which sites you visit (the URL only, not the content of the site), how long you stay on a website, the time of day visited, etc. You’ll earn points which can be converted to gift cards worth $50 each year.

Shop with an App To Make Money Now

Who wants to waste their time with those paper coupons you get in the Sunday paper that save you a quarter when you buy three boxes of cereal? Not worth the time or trouble. If you want to save money shopping, it’s all about apps now!

24. Rakuten: A new name for an old favorite.

Rakuten

If the name doesn’t sound familiar, how about Ebates? Rakuten is the app formerly known as Ebates, and when you join the site and make your first eligible purchase, you’ll get $10! Users can earn as much as 40% in cash back when they shop with more than 2,500 online retailers.

Every quarter, you’ll receive your cashback rewards via PayPal or check.

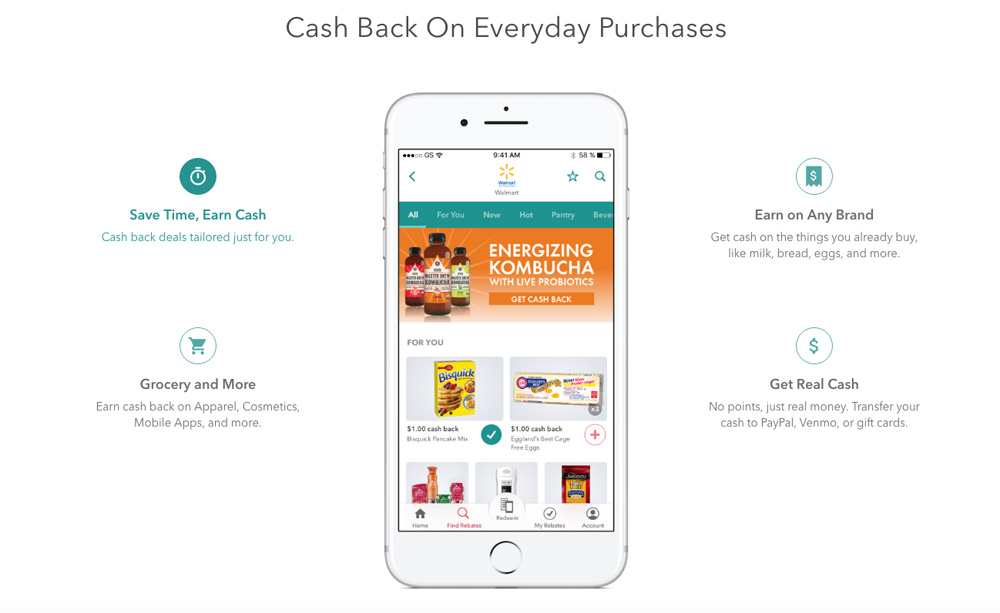

25. Ibotta: Don’t throw away that receipt. Turn it into cash.

Ibotta

Ibotta gives you cash back for both online and brick-and-mortar shopping. The app saves you money on lots of things, including grocery items, travel, restaurants, and drug stores. Upload a copy of the receipt showing the eligible items you purchased, and the amount will be added to your account.

Once your account has at least $20 in it, you can transfer it to your PayPal or Venmo account. You can read our full Ibotta review to learn more.

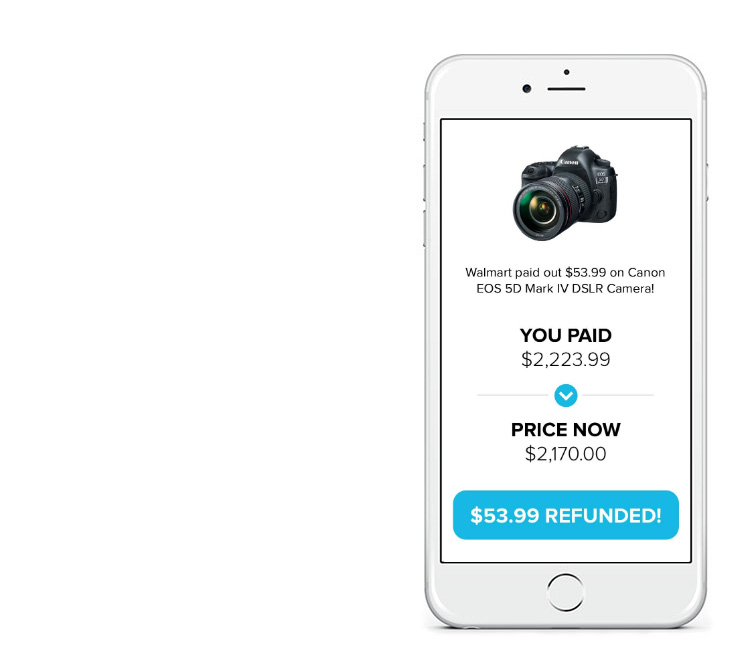

26. Paribus: Get the refund you didn’t know you had coming.

Paribus

Paribus tracks your eligible online purchases through the receipts in your email, and when it sees a price drop for something you recently purchased, the app sends you a notification and sets about getting you any refund you’re entitled to.

If you book a hotel room and the price drops before your stay, you’ll get a notification from Paribus. Plus, if you have a package that is late being delivered, Paribus can help you get compensated for the delay.

Paribus compensates us when you sign up for Paribus using the links provided.

27. Shopkick: Get your kicks just walking into a store.

Shopkick

Shopkick doesn’t even require you to buy anything to earn rewards! You earn points (called “kicks”) by entering a store and scanning certain items with your smartphone. Each time you scan, you earn more “kicks.”

You can earn further kicks for doing things like purchasing items and watching movies. These kicks can then be redeemed for gift cards. To learn more, read our full Shopkick review.

28. Drop: Link your card and earn money.

Drop

Drop is an app that rewards users for shopping with their partnered retailers. Link your debit or credit card to your Drop account, and when you spend money with those retailers, you earn points.

The points can be redeemed for gift cards. Read our full Drop review to learn more.

Freelance to Make Money Now

The internet is making freelancers out of all of us, even those of us who work a regular job. And why not? It’s a great way to get money quickly.

29. TaskRabbit: Because everyone needs a little help around the house.

rawpixel on Unsplash

When you read the word “freelancer,” you might think of people who can do things like build websites or write articles. If you don’t have those kinds of skills, you might think freelancing isn’t something you can do. But with TaskRabbit, you too can freelance.

TaskRabbit is a site for people who need odd jobs done with people who can do the odd job. Tasks can include things like putting together a piece of furniture, hanging paintings, bartending for a party, cleaning houses, or doing yard work.

Taskers are paid per hour or per job. Customers name their price and taskers bid on the job.

30. Fiverr: Put your skills to work.

Joseph Gruenthal on Unsplash

Fiverr is a more traditional freelancing site. Freelancers list their services for things like writing, graphic design, translation, and voice-overs. They also set their rates and despite the name of the site, can charge more than $5.

Clients peruse the sight and choose the right freelancer for the job.

Clean Out Your House

Not many of us look forward to cleaning out closets, the garage, the attic, the cabinets. But if you sell the stuff, you’re willing to part with, making a little money can be a pretty good incentive to do a purge.

31. Gazelle: Because no one needs a drawer full of old electronics.

Gazelle

Gazelle will give you money for your old electronic devices, including smartphones, tablets, computers, and iPods. Enter the make and model, answer some questions about the condition, and Gazelle will make you an offer.

If you accept the offer, mail the item in. Gazelle will confirm the condition and if it’s in the same condition you stated, pay you for your device.

32. Decluttr: Turn the stuff cluttering up your house into cash.

decluttr

Decluttr is similar to Gazelle but accepts a broader range of items including DVDs, CDs, Blu-ray disks, games, books, phones and tablets. You can use the app to scan the barcodes of the items you want to sell or search for them on the desktop site. Based on this information, you’ll get an offer.

If you accept, ship the items, and upon receiving them, they’ll be inspected. If they pass inspection, you get paid.

33. Pawn It: An old school solution when you need money now.

Shutterstock

While you’re cleaning out your house, the items that sites like Gazelle and Decluttr don’t accept might interest a pawn shop. Pawn shops buy things like jewelry, electronics, tools, and musical instruments.

People think of pawn shops as places to go to get a loan using your items as collateral. Once the loan is paid off, you get the items back. But pawn shops also straight-up buy things too, and you’ll generally be offered more if you’re selling an item rather than pawning it.

Get Money Quickly by Recycling:

Paweł Czerwiński on Unsplash

We should all practice more recycling because it’s better for the environment than tossing things we no longer need into a landfill. If you’re not recycling, maybe a little financial incentive is in order.

34. Scrap It and Recycle: Be green, make money.

When we think of recycling, we often think of things like glass, plastic, paper and metal cans. There are plenty of other everyday items you can recycle for money like wine corks and used electronics.

Recycling aluminum cans can be a source of extra cash. Metals like steel, copper, brass, and aluminum can all be recycled for cash at a scrap yard. If you have a vehicle that isn’t worth anything on the used-car market or even for a trade-in, you may be able to get something for it at a scrap yard.

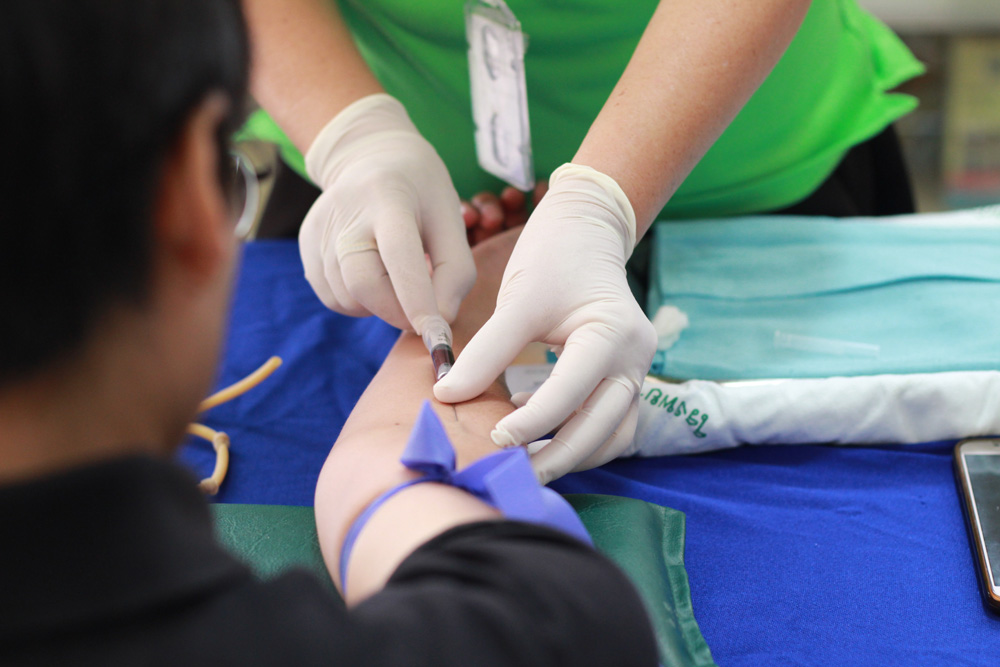

35. Blood Money: Do a good deed, make some cash.

Pranidchakan on Pexels

People often donate blood but did you know that you can make money selling plasma? It’s true, and you can do it several times a month and make as much as $20 to $50 per visit. There are plasma centers all across the U.S. so everyone should be able to locate one near them.

It’s Out There

If you need money now, it’s out there!

There are so many ways to get money quickly no matter what skills you have and no matter how little extra time you have. Making extra money is easier than ever, thanks to the internet and the sharing economy.

And after your immediate financial problem is resolved, you might realize that spending some of your free time making some extra money isn’t too bad – and may even continue doing it so you can build an emergency fund and not find yourself in this situation again!