Here’s How Much Money the Average 31-Year-Old Has (And 8 Ways To Move The Needle)

It’s our mission to make money matters a little less insane. We provide financial editorial content free for all and are supported by affiliate partners included in this post which earns us a commission. We hope you enjoy our content and subscribe to our newsletter.

Want to know how your current wealth compares to others your age?

Well instead of giving you that number at the beginning of the article, you’ll find it at the end of the article!

Why? Because making new money moves can be something people want to do but dont take the time to look into, even if they might just take a couple minutes!

Scroll down to see potential ways to increase your net worth, and how you compare at the end of the article.

8 Ways For 31 Year Olds To Stack Your Net Worth Today

Every 31-year-old would love to have more money to his or her name. Here are eight different ways with potential to boost your net worth.

1. Save Hundreds Right Now On Your Car Insurance

SouFian Bouzroud on Unsplash

While auto insurance is a necessity, it can also be pretty expensive. But it doesn’t have to be — you might be able to save hundreds on your auto insurance this year.

Let EverQuote tell you in two minutes if this is possible. This site will return multiple auto insurance quotes for you to compare in one place.

That’s a lot of time you’ll save. Just fill out a quick questionnaire.

If you find cheaper insurance than you currently have, EverQuote can help make the switch super easy.

It might save you hundreds of dollars a year.

2. Invest in the Stock Market and Get a Free $5 Bonus

Ishant Mishra on Unsplash

Think you need to be wealthy to invest in the stock market? Think again. Today, you can invest with almost any amount — even $5!

That’s all it takes with Stash. This app was built to make investing easy and allows you to even invest in fractional shares if you’d like, so you can buy small pieces of your favorite companies — Apple, Amazon, Tesla, you name it — with as little as five bucks.

By creating a portfolio and funding it with at least $5, Stash will even deposit a $5 welcome bonus right into your new account.

Stash provides tools and so much more for all levels of investing needs.

To get started, sign up for Stash today and make your first deposit!

3. Diversify Your Investments By Investing In Fine Art

Vlad Kutepov on Unsplash

For years, blue-chip artwork was an area that only the super-rich could get involved in. But Masterworks has made it so that anyone can get started investing in top-tier pieces!

Investing in blue-chip artwork — which, according to Artprice, has outperformed the S&P by more than 250% from 2000 – 2018 — might be a good way to diversify your investments and safeguard your money in a fluctuating economy.

Here’s how it works. On the platform, you can invest in a portfolio of iconic works that have been carefully crafted by Masterworks’ team of research professionals. You can wait for Masterworks to sell the artwork at some point during the next 3-10 years, or you have the option to sell your shares to other investors on Masterworks’ secondary market.

You’ll only need to pay a small management fee, and in return, you’ll get all administrative costs covered, professional storage, insurance, regulatory filings, and annual appraisals.

To start investing, simply request an invite for membership today!

See important disclaimer: masterworks.io/disclaimer

4. Potentially Save Thousands on Your Mortgage With This Simple Move

Pixabay on Pexels

Your house is probably your biggest investment, which means it’s also one of your greatest opportunities to save money.

By refinancing, you could potentially save thousands of dollars on your house. Here’s how it works — you find a new home loan that, ideally, has a lower interest rate and better terms, and then use it to replace your current home loan. Sounds simple enough, right?

Because it is. And with Figure, you can check your mortgage refinance rates in just a few clicks without even impacting your credit score!

Find a loan with a lower interest rate and apply with Figure’s 100% online application. Once you’re approved, Figure will help you close out your new loan quickly so that you can start enjoying your new savings as soon as possible.

To start, check your mortgage refinance rates with Figure today and find out how much you could be saving on your house!

Figure Mortgage Refinance is only available in the following states: AK, AL, AR, AZ, CA, DE, FL, GA, IA, ID, IN, KS, LA, MA, MI, MO, MS, MT, NC, ND, NE, NH, NJ, NM, NV, OH, OK, OR, PA, SD, TN, WA, WI, WV.

5. Reduce Your Student Loan Bills With This Move (Check in 2-Minutes)

BBH Singapore on Unsplash

Millions of Americans are drowning in student loan debt. But did you know that there’s a way to save on your student loan bill and get a $300 bonus in the process?

You could refinance your student loans. The process of refinancing is quite simple. In short, you replace your current student loan debt — whether it’s just one loan or multiple loans — with a single lower interest loan, and/or better terms. Simple enough, right?

With online loan marketplace Credible, you may be able to break the vicious cycle that is student loan debt.

In two minutes, you can check your refinancing rates and get options from up to 10 lenders, competing for your business.

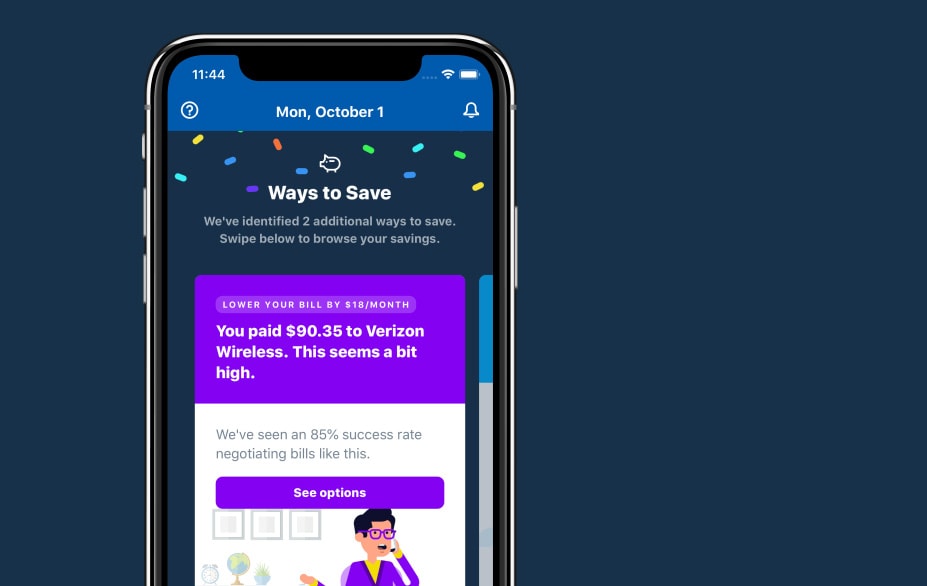

11. You Could Save Up to $1,000 with This Simple App

Truebill

You’re no stranger to the bills and expenses coming out of your checking account each month. But that doesn’t mean it’s easy to track all of these items.

Truebill could help you out in a huge way. This app shows you all of your expenses in one place, and with your permission, will actually cancel the ones you don’t want!

But that’s not all. Truebill even negotiates bills for you. Rather than spending hours on the phone arguing over your cable bills, phone bills, and more, Truebill will do the heavy lifting for you — working to negotiate better rates so that you’re saving both time and money every month.

All in all, these changes could quickly save you up to $1,000 a year (perhaps even more). All you have to do is download the Truebill app today!

7. Get Rid Of Credit Card Debt

Avery Evans on Unsplash

Credit cards often come with extremely high interest rates that keep users trapped in debt.

If you have credit card debt, you could eliminate it today by getting a personal loan through Fiona.

By getting a personal loan that has a lower interest rate and using it to wipe out your credit card debt, you’ll be left with lower payments going forward.

This marketplace will find you multiple offers on personal loans without any impact to your credit score. Run a search, compare all your options conveniently in one place, and find personal loan options that range from $1,000 to $100,000.

All it takes is two minutes to check out your rates with Fiona and potentially find a loan that wipes out your credit card debt and saves you thousands.

8. Invest Like The Wealthy With Just $100

cottonbro on Pexels

Titan is a premier investment firm that was built for everyone, it manages $500 million for 25,000 clients.

It says it aims to grow your capital over the long term by following their time-tested investment philosophy: identifying the rare species of stocks known as “compounders” and holding on tight.

And they don’t just invest your capital — they explain everything.

Titan is a diverse team of veteran Wall Street investors, engineers, operations, investor relations, and product folks. Their employees and advisors have worked at some of the leading institutions in the world.

Best of all, the minimum to get started investing with Titan is just $100.

Create an account now in just 2 minutes.

4 Ways to Protect Your Net Worth Today

It’s hard to grow your wealth when you’re not safeguarding what you already have. Here are four ways you can protect your net worth.

1. You Could Leave Your Family with $1.5 Million (Bestow)

Sai De Silva on Unsplash

At your age, one of the smartest money moves you can make is to protect your family’s financial future. Many people underestimate how much money is needed to provide for their families after they die. This is why life insurance is a must.

The older you are, the more expensive life insurance becomes. And because today is the youngest you’ll ever be, there’s no better time than today to get a life insurance policy.

Plus, with a company like Bestow, you can actually lock in your rate. As you age and your health declines, you’ll get to keep paying that same low premium.

Bestow’s policies start from as little as $16 a month, and you can get a quote in minutes — without providing a medical exam or filling out paperwork!

And with coverage of up to $1.5 million, you can leave your family with a significant amount of money after you pass.

Get your free quote from Bestow today and make sure your family’s future is secure.

2. Get an Affordable Pet Insurance Policy to Keep Your Pet Healthy and Happy

Chewy

You’re not only responsible for your property and your family but also your pet. Unfortunately, bills from the vet can really pile up and hurt your bank account.

But with Embrace, you could get an affordable pet insurance policy that keeps your pet in great health. Started by real pet parents, this company covered over 93% of all of their claims in 2019.

As plans are tailored for dogs or cats, you can choose the plan you need and get coverage for illnesses and injuries, emergency care, hospitalizations, and more.

And get this — for every year in which you don’t receive a claim payment, Embrace will actually reduce your deductible by $50.

You can get a free quote from Embrace today in minutes. Find out just how little it would cost to keep your pet healthy and safe!

3. Build the Health Insurance Policy You Need (and Can Afford!)

Brooke Cagle on Unsplash

Let’s face it — health insurance is really expensive. Plus, options are limited, so you don’t always get the coverage you need or the deductible you want.

Fortunately, there’s a new way to do health insurance — Sidecar Health. This company allows you to completely customize your health insurance plan!

With your plan, Sidecar Health will send you a payment card, which you’ll use to access your benefits for medical services. After a visit, you’ll be charged 20% as the “estimated expense” and the remaining 80% will be charged to your Sidecar Health payment card as the “estimated benefit.”

Sidecar Health is currently available in AL, AR, AZ, FL, GA, IN, KY, MD, MS, NC, OH, OK, SC, TN, TX, and UT.

Take a photo of your bill and submit it through the app; your account will then be credited or debited accordingly, depending on what your plan covers. As a member, you can also wave goodbye to out-of-network fees, as your plan will work with any doctor!

Through Sidecar Health, members are able to save 40% or more on the cost of care. Get a free quote from Sidecar Health today and finally get the health insurance plan you’ve always needed!

4. Get the Best Extended Warranty for Your Car

Evgeny Tchebotarev on Unsplash

You’re only ever one breakdown from having to fork out hundreds of dollars (thousands, in some cases) to get your car back on the road!

Well, with Olive, you can get an extended warranty for your car for an affordable price each month.

Olive allows you to tailor a plan to coverage needs and monthly budget, and your rate is fixed for the life of your term. You can also cancel at any time without penalty!

What’s more, there’s no waiting period. After your first payment, your coverage will start at midnight. You’ll be covered up to 185,000 miles, with no annual mileage restrictions.

And filing a claim is easy. Use Olive’s RepairPal tool to find a repair shop near you and Olive will pay your bill directly so that you don’t have to wait for reimbursement.

Finally, Olive invests a portion of your premium in renewable energy, sustainable infrastructure, social services, and other community programs at no extra cost to you.

Get a free instant quote from Olive today and you could have an affordable extended warranty for your car by midnight!

So What’s The Average Net Worth Of A 31 Year Old?

When we talk about how much money someone has, we typically refer to net worth. In simple terms, this is the total value of all of your cash and assets, minus all of your liabilities and debts.

So, here are the numbers. You fall right inside the 25-34 age bracket, and according to CNN Money, the average net worth of a person this age is roughly $9,000.

But it’s also known that the super-rich tend to skew these numbers pretty drastically. One study estimates that the average 31-year-old might only have a net worth of closer to $2,032.

Either way, it doesn’t have to be an uphill climb to get ahead, improve your net worth and reach more of your financial goals. Some smart financial moves on this list can go a long way.