KPN Pushes Carlos Slim Back

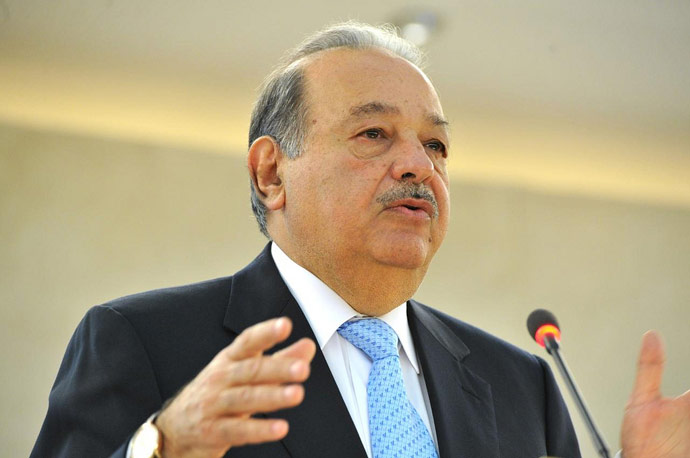

Image via Flickr/ United Nations - Geneva

Carlos Slim, Mexican business magnate and investor, is once again in the headlines after it was announced he is threatening to walk away from his KPN bid. Slim has a diversified portfolio to say the least with holdings in Philip Morris, the New York Times, Saks, Caixabank, and America Movil. Through his long, and controversial career, Slim has amassed an estimated $61.4 billion fortune, currently the second largest estimated worth in the world. However, 2013 hasn’t been a great year for the guy despite a broad market rally and strong economic data. Year to date Slim’s portfolio is down by more than 18 percent, or about $13.8 billion.

On Friday, Carlos Slim threatened to walk away from his $7.2 billion euro ($9.5 billion) offer to buy the 70 percent of Dutch telecom Royal KPN he doesn’t already own. The threats came after a foundation linked to the company, KPN Foundation, mounted a “poison pill” defense to defend the rights of the company’s shareholders, workers, and customers.

In a statement from Slim’s company, America Movil, he stated if KPN “maintains its current position and seeks to prevent the offer from proceeding, to the detriment of KPN’s customers, employees and shareholders, and also to the detriment of telecommunication services in the Netherlands, all of whom America Movil firmly believes will benefit from the offer, America Movil is prepared to withdraw its offer.”

Slim had offered 2.4 euros per share for the company, a decent premium to the current trading price, however, the foundation believes Slim is acting hostile and therefore his bid must be stopped. Following today’s announcements, shares of KPN fell sharply by 5.6 percent to 2.16 euros per share. Still, shares are well above the lows seen just a couple years ago. Slim started accumulating his 30 percent position in the company when shares traded at a measily 8 euro cents per share. The future of KPN is going to be turbulent to say the least.

Earlier in the year the company was forced to issue 3 billion euros worth of new shares with the help of Movil whom took part in the underwriting. Even after the new issue, KPN is weighted down by 9.5 billion euros in net debt as of the most recent filling. The majority of problems started when smartphones started to emerge. KPN was unable to sustain its margins, thus lowering income, as its customer base began to search for cheaper alternatives. Over the coming weeks it will be interesting to see if the KPN Foundation folds to the pressure.