Lululemon: Sheer Yoga Pants And Continuing Volatility

Image via Flickr/ lululemon athletica

Lululemon (NASDAQ: LULU) recently reported mediocre second quarter results, while its stock continues to move in volatile trading patterns. A widely-reported design defect further has the Company wiping egg off its face. While the yoga industry continues to grow, Lululemon has some near-term challenges facing it.

Lululemon had second quarter revenue of $344.5 million, which was a 22% rise year over year. However, net income fell from $57.2 million to $56.5 million. Diluted earnings were $0.39 per share, ahead of consensus estimates of $0.35 per share. Comparable store sales increased by 8%, while direct to consumer revenues rose 39% to $49.4 million. However, there was some negative news. The Company lowered its 2013 revenue estimates from a previous range of $1.645 billion to a range of $1.665 billion to $1.625 billion to $1.635 billion. Additionally, Lululemon cut its 2013 earnings guidance from $1.96 to $2.01.to $1.94 to $1.97 a share. The Company currently has a high P/E ratio of 39.5

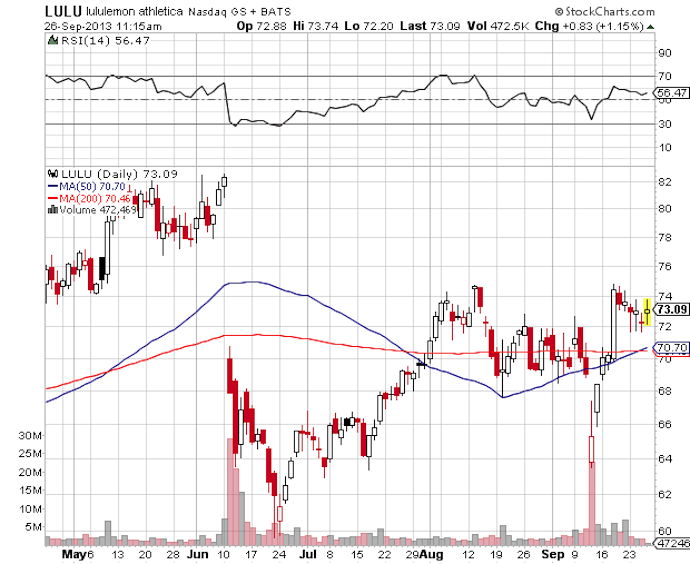

Lululemon shares dropped nearly 8% on the revised outlook, on high volume of 15 million shares fueling the descent. The price then rose dramatically over the next five trading days, from a low of $63.5 up to $74.81 on September 18th. This was an increase of over 17%. Not surprisingly, Lululemon has a high beta of 2.35 and a monthly volatility of 3.10%. The stock hit a 52-week high of $82.50 in June 10th, and then scraped a low of $59.60 a couple of weeks later on June 24th. The volatility is likely influenced by the high short interest, with a short float of 28.83% and a short ratio of 7.80. 21.275 million shares were being shorted as of 9/13.

The drop in price in June was in response to news of a shake-up at the helm of the Company. Lululemon announced on June 10th that Chief Executive Christine Day was leaving her post after nearly five and a half years. Shares fell 17.5 percent on June 11 which wiped out nearly $1.62 billion of market capitalization.

The share price is currently trading around $73.50, about 4% above its 50-day and 200-day SMAs. The price is 11% off its 52-week high. Volume has generally been trending lower since the announcement of earnings earlier in September. Still, the stock is subject to large spikes in trading volume which fuel the wide price swings. For example, daily volume hit a yearly high of around 29 million shares on June 11th, while daily volume was only 1.6 million on September 24th.

Earlier in the year, Lululemon faced an embarrassing issue with some of its yoga pants being recalled due to a manufacturing defect which caused the pants to be too sheer. The Company announced in March that it was pulling its Luon model pants from stores and on-line sales due to the sheerness issue. Lululemon has faced continual flack for the misstep. A shareholder suit was filed in U.S. District Court in Manhattan which accused the Company of hiding the defects in the pants, as well as not disclosing discussions regarding the departure of Day. The suit is seeking class-action status for shareholders between March and June of 2013.

Yoga has been unofficially pegged as a $6 billion industry. Thus, while the yoga-wear sector is likely to expand, Lululemon is currently facing some challenges. Further, the volatile share price trading patterns are likely to continue. A long term investment in Lululemon is certainly not for the faint of heart.

Disclosure: The author has no position in the stocks mentioned in this article, and does not intend to initiate any position in the next 72 hours.