12 Money Moves Every 38-Year-Old Should See For Their Future

It’s our mission to make money matters a little less insane. We provide financial editorial content free for all and are supported by affiliate partners included in this post which earns us a commission. We hope you enjoy our content and subscribe to our newsletter.

At every phase in life, it’s important to make smart financial decisions. But right now, at your current age, there are a handful of opportunities you can take advantage of — money moves that perhaps you didn’t know existed only a week ago.

Here are 12 money moves 38-year-olds should know about. Check them off your list this week and make your money work harder for you!

1. You Could Leave Your Family with $1.5 Million

Kelly Sikkema on Unsplash

At your age, one of the smartest money moves you can make is to protect your family’s financial future. Many people underestimate how much money is needed to provide for their families after they die. This is why life insurance is a must.

The older you are, the more expensive life insurance becomes. And because today is the youngest you’ll ever be, there’s no better time than today to get a life insurance policy.

Plus, with a company like Bestow, you can actually lock in your rate. As you age and your health declines, you’ll get to keep paying that same low premium.

Bestow’s policies start from as little as $16 a month, and you can get a quote in minutes — without providing a medical exam or filling out paperwork!

And with coverage of up to $1.5 million, you can leave your family with a significant amount of money after you pass.

Get your free quote from Bestow today and make sure your family’s future is secure.

2. You Could Swap Out Your Auto Insurance Policy for a Much Cheaper One in Minutes

Josh Rinard on Unsplash

You’re probably paying way too much for your current auto insurance policy, but who can blame you? Shopping for car insurance isn’t exactly fun — not to mention, it’s incredibly time-consuming.

But with EverQuote, you no longer have to do the shopping. Provide a few details about your car, and this insurance comparison site will find rates from multiple companies — perhaps including some that you’ve never checked out — for you to compare in one place.

The best part? The service is free to use, so you don’t have to pay the site a thing to save money on auto insurance.

Get your quote from EverQuote today and see how much you could be saving!

3. You Could Invest in the Stock Market Today with Just $5

Austin Distel on Unsplash

You don’t need to be rich to invest in the stock market. Actually, today, you can invest in the stock market with as little as $5.

Stash is a company that allows you to invest in fractional shares — meaning you can invest as little as $5 and get pieces of well-known companies, such as Apple, Tesla, Amazon, and other well known companies.

And get this — just for creating and funding your personal portfolio with at least $5, you’ll get a $5 welcome bonus added to your portfolio*.

What’s more, with a Stash banking account(*1), you can earn pieces of stock from top brands when you use the company’s Stock-Back® card(*2).

Sign up for Stash today and start investing with just $5!

4. You Could Switch to a Cheaper Homeowners or Renters Insurance Policy in Minutes

Sidekix Media on Unsplash

When was the last time you checked your homeowners or renters insurance rates? For many people, there are cheaper rates floating around but they just don’t know where to look.

With EverQuote, you can get multiple quotes at once with very little effort. Here’s how it works — you provide a few details about your home and this insurance comparison site will find rates from various companies for you to compare.

This service is free to use and could help you make the switch to a cheaper policy in minutes.

Try EverQuote today and find out how much you could be saving on homeowners or renters insurance!

5. Business Owners, You Could Get a Free $300 Advertising Credit to Reach New Customers

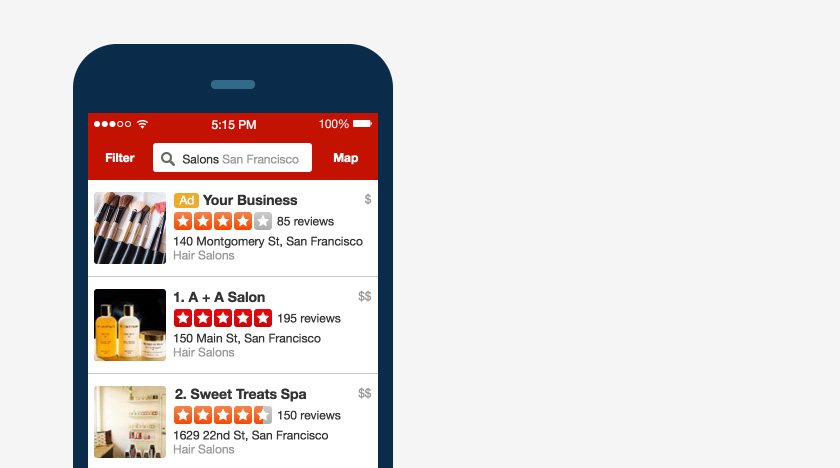

Yelp

Finding new customers isn’t easy. But maybe you’re making it harder than it needs to be by searching in all of the wrong places.

Instead, consider that many potential customers might already be looking for you —online.

Yelp is one of the largest online directories in the world, and millions of customers use the platform each month to search for restaurants, home services, healthcare providers, and all kinds of businesses.

When your business signs up with Yelp, not only will you be able to reach more customers online but you’ll also get a free $300 advertising credit to start!

Over 29 million businesses, including many of your direct competitors, are already using Yelp to find new customers. Keep up with them and even get ahead of the competition by advertising on the platform.

Sign up with Yelp today, get your free $300 advertising credit while this offer lasts, and start finding more customers for your business!

6. You Could Potentially Save Thousands on Your House With This Simple Move

Pixabay on Pexels

Your house is probably your biggest investment, which means it’s also one of your greatest opportunities to save money.

By refinancing, you could potentially save thousands of dollars on your house. Here’s how it works — you find a new home loan that, ideally, has a lower interest rate and better terms, and then use it to replace your current home loan. Sounds simple enough, right?

Because it is. And with Figure, you can check your mortgage refinance rates in just a few clicks without even impacting your credit score!

Find a loan with a lower interest rate and apply with Figure’s 100% online application. Once you’re approved, Figure will help you close out your new loan quickly so that you can start enjoying your new savings as soon as possible.

To start, check your mortgage refinance rates with Figure today and find out how much you could be saving on your house!

Figure Mortgage Refinance is only available in the following states: AK, AL, AR, AZ, CA, DE, FL, GA, IA, ID, IN, KS, LA, MA, MI, MO, MS, MT, NC, ND, NE, NH, NJ, NM, NV, OH, OK, OR, PA, SD, TN, WA, WI, WV.

7. Diversify Your Investments By Investing in Fine Art

Vlad Kutepov on Unsplash

For years, blue-chip artwork was an area that only the super-rich could get involved in. But Masterworks has made it so that anyone can get started investing in top-tier pieces!

Investing in blue-chip artwork — which, according to Artprice, has outperformed the S&P by more than 250% from 2000 – 2018 — might be a good way to diversify your investments and safeguard your money in a fluctuating economy.

Here’s how it works. On the platform, you can invest in a portfolio of iconic works that have been carefully crafted by Masterworks’ team of research professionals. You can wait for Masterworks to sell the artwork at some point during the next 3-10 years, or you have the option to sell your shares to other investors on Masterworks’ secondary market.

You’ll only need to pay a small management fee, and in return, you’ll get all administrative costs covered, professional storage, insurance, regulatory filings, and annual appraisals.

To start investing, simply request an invite for membership today!

See important disclaimer: masterworks.io/disclaimer

8. You Could Leave Your Family Up to $8 Million

Jimmy Dean on Unsplash

At your age, life insurance may not be at the top of your mind. Maybe you’re even banking on your savings to provide for your family if something were to happen to you. But in reality, your savings probably only scratches the surface of what is needed.

This is why life insurance is so important, at any stage of life! But here’s where it’s critical for someone your age to get life insurance — the older you get, the more costly life insurance becomes. So, there’s no better time than today to get a policy.

And with Ladder, it’s easy. All you need is a few minutes to complete the company’s application form, and you won’t even need to provide a medical exam or fill out physical paperwork.

Plans start at just $12 a month — a price that most people can afford. Plus, Ladder offers coverage up to $8 million. That’s more than enough to make sure your family is taken care of if you were to pass unexpectedly.

Your premium might be higher tomorrow, so don’t wait to get life insurance. Apply for Ladder life insurance todayand find out how affordable life insurance can be.

9. You Could Use Your Home to Get Access to Up to $250,000

Rowan Heuvel on Unsplash

Being a homeowner has its perks. One of the more overlooked opportunities is the ability to get access to money that can be used for all sorts of purposes — fixing up your home, paying medical bills, or funding a family vacation!

That’s exactly what you get with a HELOC (home equity line of credit). A HELOC is a low-interest loan that uses the equity in your home as collateral.

Figure is an online lender that could help you get up to $250,000 against the equity in your home.

Plus, they make the process incredibly easy. Their application is 100% online application and it takes only 5 minutes to fill out. If you’re approved, you could get your funds in as little as five days!

Learn more about Figure and how your can use your status as a homeowner to get the money you need!

10. You Could Get Free Credit Monitoring with This Company

Shutterstock

Whenever you need to borrow money, your credit score typically impacts how much you’re able to borrow and the interest rate you’re able to get.

So, the higher your credit score, the better. And regardless of how old you are, you can always take steps to improve it.

Credit Sesame is a site that equips you with all sorts of important tools to help you on your journey towards better credit. They give you credit score monitoring, product recommendations, ID theft protection, and much more — and it’s free to use!

More than eight million people are currently using Credit Sesame to improve their credit scores. You can, too. Simply take 90 seconds to create an account.

Sign up for Credit Sesame today and raise that score!

11. You Could Save Up to $1,000 with This Simple App

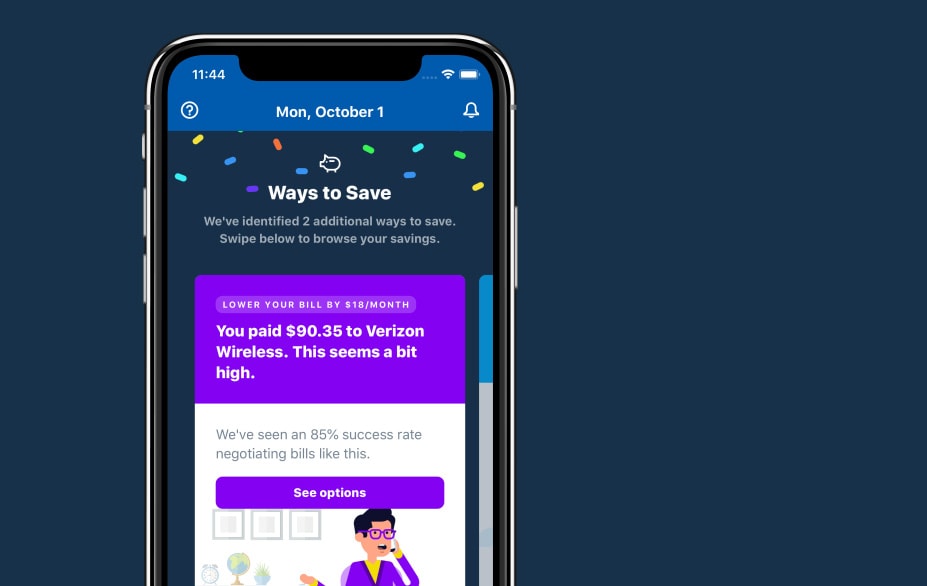

Truebill

At your age, you’re no stranger to the bills and expenses coming out of your checking account each month. But that doesn’t mean it’s easy to track all of these items.

Truebill could help you out in a huge way. This app shows you all of your expenses in one place, and with your permission, will actually cancel the ones you don’t want!

But that’s not all. Truebill even negotiates bills for you. Rather than spending hours on the phone arguing over your cable bills, phone bills, and more, Truebill will do the heavy lifting for you — working to negotiate better rates so that you’re saving both time and money every month.

All in all, these changes could quickly save you up to $1,000 a year. All you have to do is download the Truebill app today!

12. You Could Potentially Save Thousands on Your Student Loans with This Site

Pixabay on Pexels

Tired of being in student loan debt at this point in your life? You could potentially get out of debt faster and pay less in interest fees simply by refinancing your student loans.

Refinancing is the process is replacing one or more loans with a new loan that, ideally, has a lower interest rate and better terms.

And with Credible, you could refinance your student loans quickly and potentially save thousands of dollars.

It’s easy to get started. Simply fill out the site’s online form, and in 2 minutes, they will show you up to 11 student loan refinance offers in one place. And get this — this check won’t even affect your credit score!

When you apply, approved, and close out your new loan, you’ll even get a welcome bonus of up to $300. Check your student loan refinance rates with Credible today to get started!

You’re at the Perfect Age to Make Smart Money Moves

There are plenty of great money moves you can make at your age — moves that help you provide for your family, invest for the future, and earn a little extra money right here and now.

Capitalize on these 12 opportunities this week and reap the rewards of doing more with your finances.

*Wall Street Insanity is a paid affiliate/partner of Stash. Promotion is subject to Terms and Conditions. To be eligible to participate in this Promotion and receive the bonus, you must complete the following steps: (i) click through the link above, (ii) successfully open a Stash Invest Account (otherwise known as your personal portfolio) in good standing, (iii) link a funding account (e.g. an external bank account) to your new Stash Invest Account, AND (iv) initiate and complete a deposit of at least five dollars ($5.00) into your Stash Invest Account.

(*1)Bank Account Services provided by Green Dot Bank, Member FDIC

(*2)Stash banking account opening is subject to identity verification by Green Dot Bank. In order for a user to be eligible for a Stash banking account, they must also have opened a taxable brokerage account on Stash. Bank Account Services provided by Green Dot Bank and Stash Visa Debit card (Stock-Back® Card) issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Visa is a registered trademark of Visa International Service Association. Investment products and services provided by Stash Investments LLC, not Green Dot Bank, and are Not FDIC Insured, Not Bank Guaranteed, and May Lose Value.