7 Money Moves For Renters During The Coronavirus Crisis

It’s our mission to make money matters less insane. We provide financial editorial content free for all and are supported by some of our affiliate partners included in this post which earns us a commission. We hope you enjoy our content and subscribe to our newsletter.

The coronavirus pandemic has had a financial impact on most Americans. Whether you’ve been laid off or your work hours have been cut back, you might feel that paying the rent is harder than before.

While you’re self-quarantining, what better use of the extra time you’ve got on your hands than to make money moves that will help you stay afloat and even get ahead?

Whether you rent a house or apartment, check out these seven important money moves that will help you thrive financially — even during a pandemic!

1. Throw Away Your Current Auto Insurance Policy — This Site Could Find You a Deal That Helps You Potentially Save Hundreds

Dan Gold on Unsplash

That car that’s currently sitting in your garage while you’re self-quarantining? You’re probably paying way too much to keep it insured.

Get rid of your expensive auto insurance bill today by checking out other rates with EverQuote, a service that makes shopping for affordable auto insurance easier than ever.

Fill out a short form about your vehicle and this company will do all of the dirty work for you — finding rates from multiple insurance companies for you to compare in one place.

Need help along the way? Connect with an EverQuote licensed agent to make sure you maximize your savings.

Don’t wait for another costly auto insurance bill to come around — check out what you could be saving on auto insurance with EverQuote today!

2. Swap Out Your Renters Insurance Policy for a Cheaper One — This Site Can Help You Do It in Minutes

Brandon Griggs on Unsplash

Renters insurance is a requirement for many houses and apartments, but that doesn’t mean it should cost you an arm and a leg.

You might be paying way too much for renters insurance and not even know it; in which case, EverQuote could potentially help you save hundreds. Fill out a brief questionnaire, and in two minutes, this insurance comparison site will find you multiple renters insurance rates to compare in one place.

EverQuote even allows you to bundle your renters insurance with other policies, including auto — another money move that helps EverQuote users save more money!

Keeping your stuff safe is essential, but do it affordably. Fill out EverQuote’s short questionnaire today and let the great rates come to you!

3. You Could Save Up to $1,000 with This Simple App

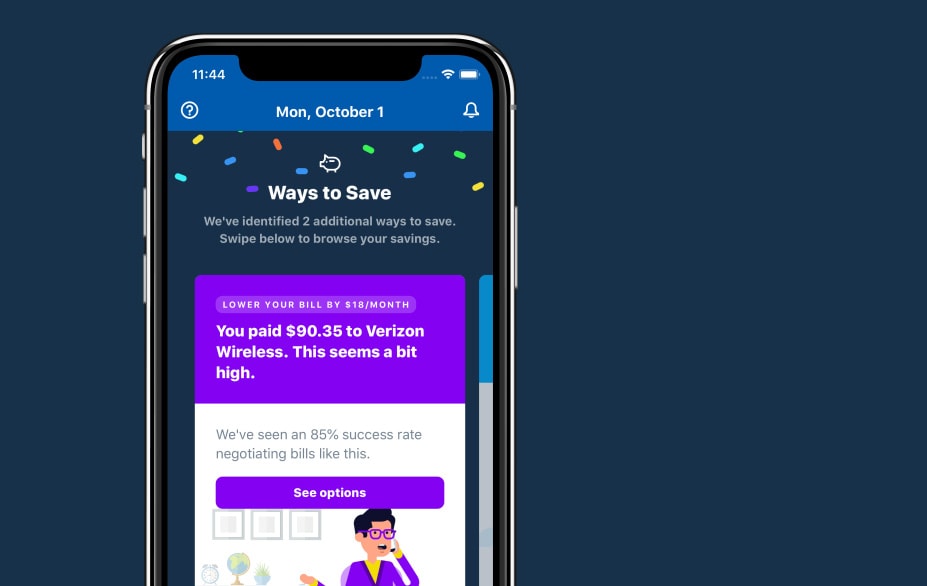

Truebill

You’re no stranger to the bills and expenses coming out of your checking account each month. But that doesn’t mean it’s easy to track all of these items.

Truebill could help you out in a huge way. This app shows you all of your expenses in one place, and with your permission, will do things like cancel subscriptions you’ve forgotten about!

But that’s not all. Truebill even negotiates bills for you. Rather than spending hours on the phone arguing over your cable bills, phone bills, and more, Truebill will do the heavy lifting for you — working to negotiate better rates so that you’re saving both time and money every month.

All in all, these changes could quickly save you up to $1,000 a year (maybe more). All you have to do is download the free Truebill app today!

4. Protect Your Family’s Future by Leaving Them with an Extra $1,000,000

Cottonbro on Pexels

Pandemic or not, you always want to make sure your loved ones are provided for. But most people underestimate the savings needed to cover their family’s bills and expenses should something happen to them.

But that’s where life insurance comes in. With Bestow, you can get coverage between $50,000 and $1,000,000, and it may cost you as little as just $16 a month — allowing you to protect your family for roughly what you’re paying for Netflix.

What’s more? Bestow is completely online, so you can get a free quote in 60 seconds without filling out paperwork or providing a medical exam. Bestow even uses non-commissioned agents, which means you can get assistance without fear of being hassled or upsold.

Life insurance premiums get pricier as you get older, which means the best time to lock in your premium is today. Get your free quote from Bestow now!

5. Get Rid of Your Current Student Loans — This Site Could Help You Reduce Your Bill in Two Minutes

Shutterstock

Even during a pandemic, your private student loan payments are still due. And although your federal student loans are on hold, you may still want to stay up to date on those payments — especially when you can take advantage of interest rates that are as low are they are today.

Well, get this — with Credible, you could potentially save thousands on student loans by refinancing them. Refinancing is the process of replacing a loan (or multiple loans) with one that, ideally, has a lower interest rate and better terms.

Credible is a marketplace that allows you to compare rates from multiple lenders in one place. Take two minutes to fill out one simple form and Credible will take it from there, finding you great rates while you sit back and relax.

Not only is this rate check fast and free but it also won’t impact your credit score. What’s more, when you complete your refinancing through Credible, they will even give you a $300 welcome bonus!

Check your refinancing rates with Credible today and lower that student loan bill each month!

6. Use This Site to Get Rid of This Month’s Credit Card Bill

Avery Evans on Unsplash

Struggling to pay your credit card bill? By getting a personal loan with a lower interest rate and using it to wipe out all of your credit card debt, you’ll be able to make payments on one account going forward and potentially save hundreds —perhaps thousands — in interest fees.

And through Credible, getting a personal loan is made easy. Fill out one simple form, and in just two minutes, the site will find you multiple lenders to compare in one place. At any time, you’ll be able to reach out to the company’s Client Success Team to help determine which loan is best for you.

Personal loan amounts range from $1,000 to $100,000 — giving you enough money to pay off your credit card debt. You can also borrow money for other things, such as paying the rent and other bills.

Check out your personal loan options through Credible without any impact to your credit score. If you find a better rate elsewhere, Credible will even give you $200 under their Best Rate Guarantee!

7. When You Pay For Things, Get Money Back Automatically

Shutterstock

You probably use a debit card often, but your debit card probably doesn’t give you cash back.

Change that with Aspiration.

An FDIC-insured Aspiration bank account will give you unlimited cash back on your debit card purchases and a $100 bonus if you use your Aspiration debit card to make at least $1,000 worth of purchases within the first 60 calendar days from account opening.

Not to mention, you’ll get unlimited fee-free withdrawals at 55,000+ ATMs. If you upgrade to a paid plan ($3.99 a month) you’ll also earn interest of up to 1.00% APY on your account funds.

What’s more, Aspiration bank believes in no hidden fees; so you’ll enjoy extra money in your pocket at every turn.

Sign up now in just minutes and take advantage of the bonus offer. Fund your account with $100 or more and try it out today.

Get Your Rent and Other Expenses Paid with These Simple Money Moves

Ready to make sure your rent and other bills get paid this month? A few smart money moves and you could go from struggling to thriving during the coronavirus pandemic.

These money moves will help you — not only today while money is tight, but also in the future, once the pandemic has finally passed and the economy recovers. Stay home, stay safe, and stay financially savvy!