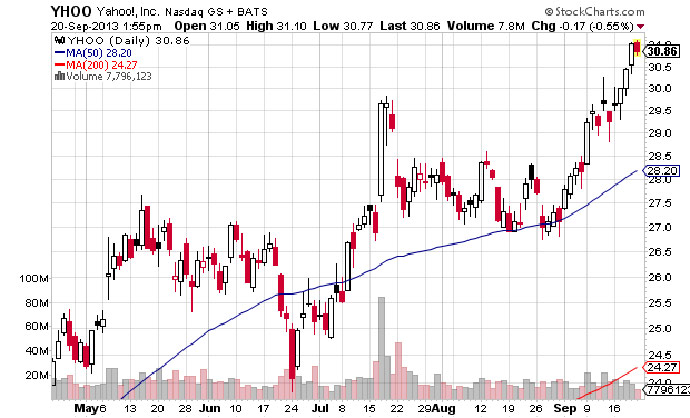

Yahoo Moves Above $30 For First Time in 5 Years… Where Does It Go From Here?

Yahoo! Inc. (NASDAQ: YHOO) has found its footing since Marissa Mayer took over in July of 2012. The share price has nearly doubled since she took the helm as President and CEO of the corporation. The price recently broke through the $30 level for the first time since February of 2008. Since 2008, a string of CEOs destabilized the Company, and let to a large decline in the share price. Now, the question is how much higher the stock can go as Mayer’s turnaround continues.

While overall revenue has dropped slightly, Mayer has helped to improve profit margins. Yahoo reported second quarter earnings in late July of $331.5 million, at 30 cents a share, versus a profit of $226 million for the prior year period. Quarterly revenue dipped slightly to $1.07 billion from $1.08 billion, excluding traffic acquisition costs. The Company’s display ad division reported revenue of $423 million, down 11% from the prior year period, while search advertising revenue fell to $403 million, down 5% year-over-year. Yahoo further revised down revenue for the third quarter, presenting a range of $1.01 billion to $1.06 billion. Analysts had projected revenue of $1.12 billion. The Company further revised down full year revenue estimates to $4.45 billion to $4.55 billion, having previously predicted revenue of $4.5 billion to $4.6 billion. Despite the revisions down in revenue, the share price has popped nearly 15% since the reported results.

As part of its earnings, Yahoo has realized large revenue increases in its equity investments in Alibaba and Yahoo Japan. Yahoo holds a 24% interest in Alibaba, which is China’s largest e-commerce retailer. Yahoo acquired its interest in the retailer in 2005 with an initial stake of $1 billion. Half of that interest was sold in 2012 for $7.1 billion before taxes. Alibaba may be moving towards an IPO in the next few years, at which point more value will be unlocked for Yahoo’s investment.

Mayer said that, as she begins her second year as CEO, Yahoo will focus on four key areas: search, mobile, display, and video. Mayer has spearheaded a number of acquisitions during her tenure, spending around $1.15 billion on new companies and businesses. These acquisitions have been focused on bringing more mobile users to Yahoo. A few of the acquisitions include Stamped, a social mobile review app, Summly, the news summary app built by a 17-year old, and Loki Studios, a mobile gaming developer. The most prominent acquisition was the around $1.1 billion paid for Tumblr. This acquisition was more controversial due to the high price tag. The goodwill associated with the transaction was valued at around $750 million. Yahoo justified the goodwill value by indicating the acquisition would bring a significant amount of users to Yahoo’s social network. By comparison, the Tumblr acquisition price only included around $74 million in tangible assets. The founder of Tumblr, David Karp, now has a net worth estimated around $200 million after the Yahoo acquisition.

Yahoo has a current market cap of $32.86 billion, with a current P/E ratio of 8.62. The stock has a short interest of 2.44%, with 23 million shares being shorted as of the end of August. The share price has risen over 93% in the past year. The stock is currently trading above its 50-day and 200-day SMAs. Due to the substantial growth of the share price, after years of price depression, it is difficult to gauge at what levels there may be resistance.

Mayer has made bold moves during her first year in charge, and the share price has risen as a result. However, it is difficult to predict how much more the value could go up. Further, revenue growth in key advertising areas has been sluggish, which could be a concern in coming quarters. Still, Yahoo continues to be a work in progress as Mayer moves her vision for the Company forward.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.