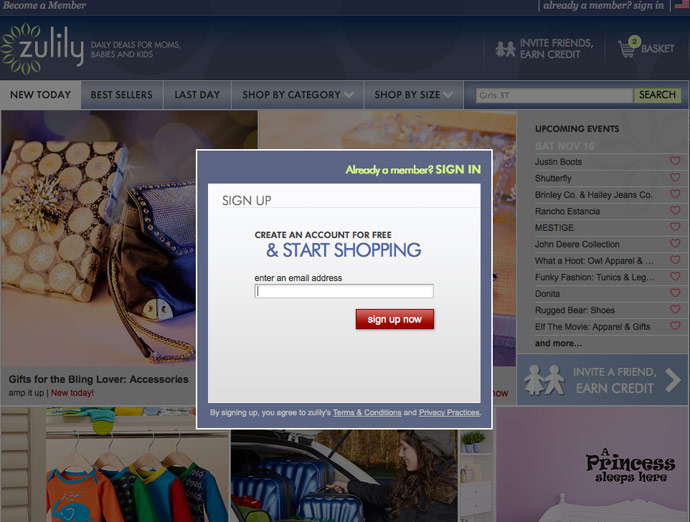

Zulily Makes IPO Debut Today

Zulily Inc., the online site that deals in products for moms and children, launched its IPO today. The company’s offering was met with great enthusiasm, as 11.5 million shares were offered to the public. Of the shares offer, 45 percent were offered to insiders, with the remaining 55 percent going to the public market.

The company had initially set its IPO pricing in the $16 to $18 price range for shares, but the actual IPO price ended up coming in above those estimates. The price for shares was raised to the $18 to $20 range, and the stock was actually offered at $22 per share. Overall, the company raised $253 million during the IPO.

Zulily Is Strong

The Seattle, Washington based company has reported growth and earnings that are very attractive to investors. During the first three quarters of the year the company posted a profit of $155,000 on $438.7 million in revenue. These numbers are very strong when compared to the $13.6 million loss reported during the same period last year on only $202.8 million in revenue. In 2010 and 2011, the company reported operating in the red and suffering losses. However, that trend seems to have reversed and company has finally found its niche.

Daily Deals

In spite of the fact that Zulily deals with the moms and children niche, it is very similar to Groupon. It markets itself as a site that offers daily deals for moms. Groupon Inc (NASDAQ:GRPN) has had a rough time in the public market, although other Internet companies seem to be doing well. For instance, RetailMeNot Inc (NASDAQ:SALE) has seen its share price rise by 55 percent since its IPO in July.

Investors Of Note

The largest shareholders in Zulily are its chairman, Mark Vadon, Maveron Capital, and Zulily CEO Darrel Cavens. August Capital, Andreessen Horowitz, and Trinity Ventures are other investors to take not of. The company was able to raise a total of $139 million in venture capital through the IPO that was managed by Goldman Sachs, BofA Merrill Lynch, Citigroup, and RBC Capital Markets.

The shares will be listed on the Nasdaq Stock Market under the symbol ZU.

Disclosure: Author represents that he has no position in any stocks mentioned in this article at the time this article was submitted.