Carl Icahn Putting The Squeeze On Apple

Image via Flickr/ Adam Fagen

Activist investor Carl Icahn is at it again, and this time he’s playing for the big bucks. The most recent story involving Icahn was his sale of nearly half of his stake in Netflix Inc. (NASDAQ:NFLX). This sale netted him a profit of more than 450% and left him with a hefty return.

Today the big news involves Tim Cook and Apple Inc. (NASDAQ:AAPL), and Icahn is ready to play hardball to get his way it seems. Carl Icahn has written a letter to Tim Cook which was posted on Thursday to his new Shareholders Square Table, asking Apple Inc. (NASDAQ:AAPL) to boost its returns to shareholders. He wants Apple to increase the share buyback program and incorporate $150 billion in buybacks.

In an earlier interview with CNBC, Icahn said “ I feel very strongly about this. I can’t promise you the stock will go up and I can’t promise you they will do the buyback. But I can promise you that I’m not going away till they hear a lot from me concerning this.”

If he stands by these words, Icahn may be looking to squeeze rewards for investors from the giant coffers of Apple’s treasury.

Icahn Launches Website For Shareholders

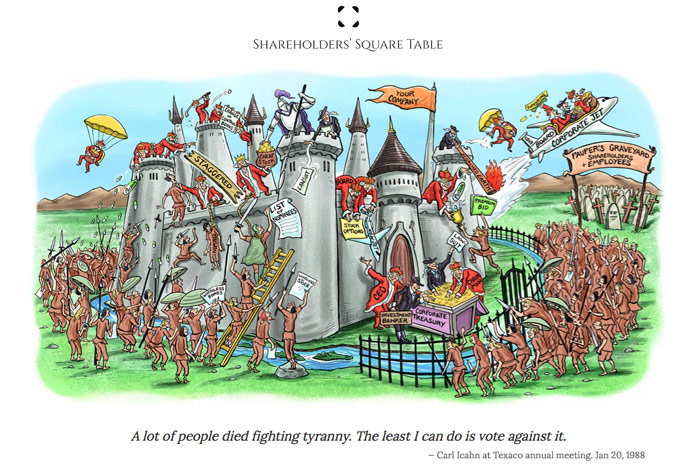

Screenshot of Shareholder’s Square Table website

Icahn launched a website called the Shareholders’ Square Table today that includes the letter he sent to Tim Cook. He plans to use the website and the published letter to put pressure on Apple Inc. (NASDAQ:AAPL) to comply with his demands.

Anyone who knows anything about Wall Street knows that Carl Icahn never makes an investment he doesn’t plan to be actively involved with. With the exception of his recent stake in Netflix Inc. (NASDAQ:NFLX) he is renowned for pushing for reform and high profit margins in companies he sinks his cash into. Apple Inc. (NASDAQ:AAPL) appears to be yet another giant corporation to come under his heavy handed influence.

Can Icahn Make Apple Bear More Fruit?

Icahn has often been able to make his investments highly profitable by forcing the companies he purchases shares in to alter their current policies. If he has his way at Apple Inc. (NASDAQ:AAPL) then the company will rise in value. With analysts expecting the stock to top $900 per share last year, the company fell short of those expectations and left many investors brokenhearted. This might be an opportunity for Tim Cook to turn that around and give back to investors. Time will tell if Cook and Apple follow Icahn’s advice and open the streams of cash flow. Until then investors may have to be satisfied with the sweet drippings of the smaller dividends squeezed from the cider press in the treasury.

Disclosure: The author has no position in the stocks mentioned in this article, and does not intend to initiate any position in the next 48 hours.