19 Things To Learn From Extreme Cheapskates, And How To Turn It Into Cash

We work hard to bring you awesome editorial content. Some links on this page are from our affiliate partners which earn us a commission and help make this possible.

They’ll do anything to save a dime and their frugality knows no limits. Their lifestyles are so fascinating that they inspired a television show that aired for three seasons on TLC. But although most of the tactics used by “extreme cheapskates” are over-the-top and ill-advised, some of their ideas can be used as inspiration.

They’ll do anything to save a dime and their frugality knows no limits. Their lifestyles are so fascinating that they inspired a television show that aired for three seasons on TLC. But although most of the tactics used by “extreme cheapskates” are over-the-top and ill-advised, some of their ideas can be used as inspiration.

Here are 19 things you can learn from some of the world’s cheapest people, and how you can take a less extreme approach to save tons of cash.

1. Don’t let extra space in your home go unused (or unpaid for).

Felipe P. Lima Rizo

If you have extra space in your house, listing a room can be a great way to pay your mortgage or earn extra spending money. Airbnb has made it incredibly easy to offer up space on a temporary basis. The website will walk you through every step, even suggesting a market rate price for your space. Depending on where you live, this can be an extremely lucrative side hustle.

You may also want to consider a more permanent solution, listing part of your home to a long-term tenant. Just don’t be like this extreme cheapskate, who was so frugal that she set up a divider in her house, charging tenants extra if they wanted to use the washer, dryer, or kitchen.

2. Make every penny work for you.

Olichel on Pixabay

It’s true that interest rates aren’t what they were during your parents’ generation, but that doesn’t mean there isn’t money to be made. Adopt an “every penny counts” mentality and make sure you put your hard-earned money to work in the best way possible.

Online banks are typically where the best rates can be found. Check out CIT Bank which is currently offering a 2.25% APY interest rate on an online savings account. The best part is that you only need $100 to open an account with the bank. Don’t worry about coming up with a huge initial deposit – you just need $100 to open an account.

See which CIT Bank account is right for you.

3. Fill up your car with paying passengers.

Tom Cochereau on Unsplash

If you’re like most Americans, you spend a substantial amount of your life inside your car. Why not make money while you’re behind the wheel? Uber has revolutionized the taxi industry, allowing everyday people to make money while they take passengers to their destinations. The best part about driving with Uber is that you always remain in control – you make your own schedule, and decide which journeys to accept.

Lyft is another great outlet that allows you to be a driver on your own time. According to the company, some of its drivers make more than $800 by only working on Friday nights and weekends – not too shabby. There’s never been a better time to try it out, as Lyft is currently offering a bonus to new drivers.

Get access to a $300 Lyft bonus.

There’s nothing wrong with being a legitimate Uber or Lyft driver, but try to refrain from becoming like the extreme cheapskate who charges her friends for mileage and gas every time she drives them someplace.

4. … And food deliveries.

Tim Mossholder on Unsplash

One of the cardinal rules that many extreme cheapskates live by is to never drive anywhere unless it’s absolutely necessary, or if they can somehow make money by doing it. That’s why UberEats is a great option, allowing drivers to make extra money while delivering food. The concept is simple – customers order food from their favorite restaurants via the app, and the UberEats driver picks up the order from the restaurant and delivers it to the customer. Drivers make their own schedules and work as little or as often as they want.

DoorDash offers the same concept and flexibility, allowing delivery drivers to become “dashers” for the company. In addition to making extra money, many dashers say they enjoy the job because it allows them to get to know their city better and introduces them to new restaurants. It’s a win-win for anyone who wants to make extra cash while exploring the area they live in.

5. Save money while driving.

Photo by Matthew Henry from Burst

The next best thing to making money while driving is saving money while driving. Metromile lets you do just that, offering pay-per-mile car insurance if you live in California, Illinois, New Jersey, Oregon, Pennsylvania, Virginia, or Washington. To use the service, drivers simply plug a device called a “Pulse” into their car. This allows the company to easily measure a person’s mileage.

Metromile is designed for people who drive less than 200 miles per week – which happens to be 65% of US drivers. Those who fit that criteria could see their car insurance bill cut in half – in fact, the average person who signs up manages to save $500 a year. The website offers free quotes, allowing potential consumers to compare Metromile rates with their current insurance provider.

It’s a breakthrough concept which is customized to fit your driving habits. After all, why should you have to pay the same rate as someone who spends far more time on the road than you do?

Get a free Metromile auto insurance quote.

If You Don’t Live In A State Where MetroMile Is Currently Availabe … or want to shop around a little more, get a free auto quote from Liberty Mutual. Drivers who switched saved an average of $509. Benefits that come standard are a 12-month rate guarantee, 24/7 customer service, and lifetime repair guarantee.

Get a free Liberty Mutual auto quote.

6. Watch your utility usage.

Pixabay

It’s no secret that turning off lights when you leave a room and taking shorter showers can have a pretty big impact on your utility bills. However, there are also lesser used tactics which can mean even bigger savings.

For a smaller electricity bill, try hanging your clothes to dry instead of using a dryer. In addition to saving you money, it also reduces your carbon footprint and increases the life expectancy of your clothes. Dimmer switches are also a great way to save money, as they allow you to only use the amount of light that you actually need.

It’s also worth taking advantage of a free home energy audit from your local utility company. Doing so can provide tips of how to cut back on your energy usage and keep more money in your pocket.

The ways to cut back on household utilities are endless, but just make sure you don’t go completely overboard, like this family who shares the same bath water every day.

7. Never spend unless you’re getting rewards.

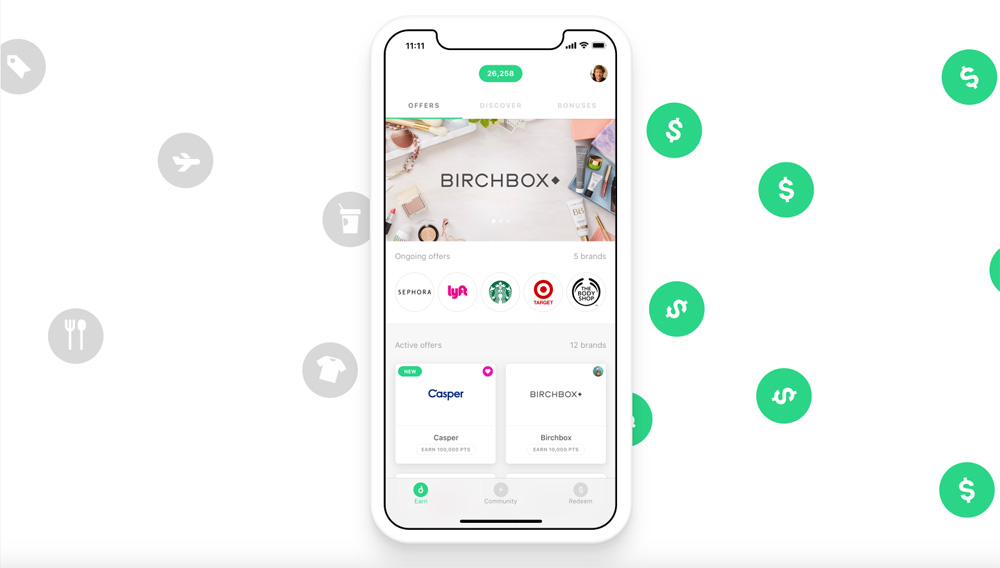

Drop

Drop allows you to turn your purchases into rewards and discounts by using a simple app.

You’ll automatically get points by linking your credit and debit cards to the app, and you’ll get more points for shopping at the places you already shop – whether that’s your local grocery store or your favorite restaurant.

You can redeem your points for gift cards once you’ve accumulated enough (1,000 points are worth $1). This is done directly in the app, allowing you to browse the selection of rewards on offer before deciding how to cash in.

Join Drop today ($5 signup bonus using code holidaybonus) and see why more than 1 million people are already using the app.

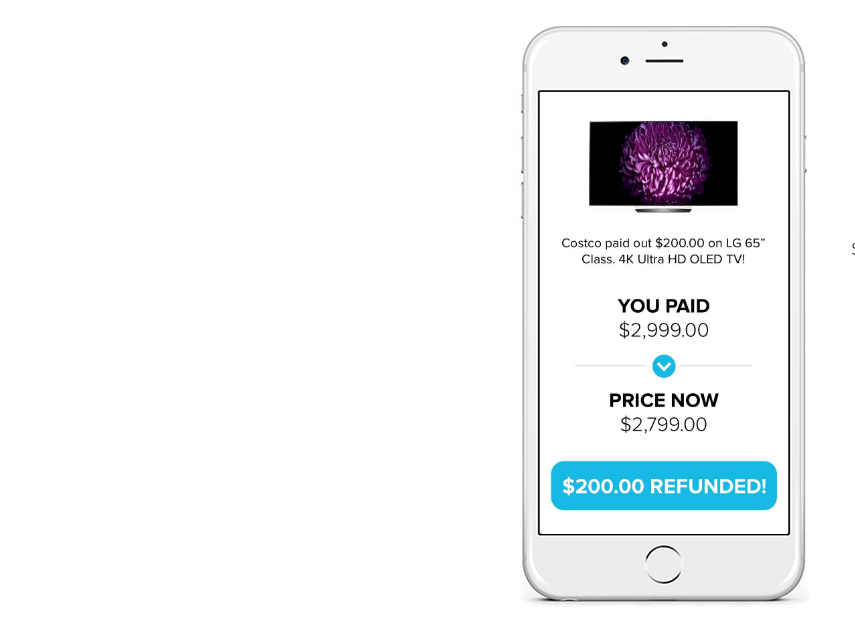

8. Realize that cash-back can happen even after you buy something.

Paribus

Many amateur cheapskates might believe that once a transaction is completed, the savings are over. However, that’s not always the case. Paribus continues to search for price drops and late deliveries after you order merchandise online, and lets you know if a store owes you money back.

The concept surrounds a policy that many stores have – if you buy an item and the price drops soon after you bought it, they’ll give you a refund for the difference. But tracking that information is time-consuming. Enter Paribus, which tracks the things you’ve already bought. Whenever there’s a price drop, it gets the refund for you.

All you have to do is sign up on the website, using the email address you use for your online shopping. This allows Paribus to go through your email and search for receipts from retailers. When it finds those receipts, it tracks the price of those items online. Once it realizes that a price has recently dropped to a level below what you spent, it contacts the retailer on your behalf and asks for a refund.

In other words, it does all the work for you and you have nothing to lose.

Paribus compensates us when you sign up for Paribus using the links provided.

9. Make money doing the things you already do online.

Steinar Engeland on Unsplash

Cheapskates might oppose paying for wifi, but why not offset your internet bill, or better yet make money off of your online activities. MyPoints is a great way to make money by doing the things you already do on the internet. Get points when you shop online, watch videos, play games, or answer surveys. Turn those points into gift cards or get cash back with Paypal or Visa gift cards. It’s incredibly easy (and smart).

Simply head to the website and sign up for MyPoints. You’ll earn a $10 Amazon gift card just for making your first purchase.

Once you’re a bona fide MyPoints member, you can make money by doing the things you already do – just make sure you go through the MyPoints website to do them. For instance, if you want to purchase items at Walmart, don’t go directly to Walmart.com. Instead, click on the Walmart link on the MyPoints site.

Sign up for MyPoints and get a $10 Amazon card.

10. Build your credit to avoid paying high interest.

Shutterstock

A good cheapskate knows never to use a credit card, but we may not always be able to do this. The next best thing is to make sure you have great credit to lower your potential interest rate. If you don’t have credit, then you should definitely use Self Lender.

Head to Self Lender to create a credit builder account. Credit builder accounts help you establish your credit history (not all of us have been paying with plastic for forever) and save money responsibly. Instead of racking up debt on a credit card, you can create a small loan with Self Lender which earns interest as you pay it off and build your credit.

Self Lender’s credit builder account is a small loan that’s held in a certificate of deposit account for 12 months. It’s FDIC insured, in your name, and earns you interest. As you pay the account, your payment history is reported to all 3 credit bureaus. In one year, you’ve established your credit history, and the money in your account unlocks with interest. Literally, you’re building credit while you save.

Credit builder accounts are easy to get started. You pay an administrative fee ($9-$12 based on your monthly commitment), and then choose a monthly payment (these range from as low as $25 a month to $150). At the end of your payment plan, you will have built credit and earned interest. After 24 months, $25 a month earns you $525. After 12 months, $150 a month earns you $1700.

11. Keep track of your credit to avoid paying high interest.

Shutterstock

Never let your credit get bad in the first place, keep track of it for free. You’ve got no excuse not to do it. Head to Credit Sesame to get your credit score, financial profile, and ongoing reports and tracking for free online and via the mobile app.

Credit Sesame gets your free credit report by pulling credit information from TransUnion’s VantageScore. But this isn’t a one-time service. Credit Sesame notifies you of how your credit score changes every month, and if you’re especially vigilant, you can also sign up to receive real-time, daily, or weekly monitoring alerts as well.

Credit Sesame also advises you on how you can adjust your spending habits to improve your score. Advanced analyticals give customized recommendations for which cards or loans will help you save.

You can also keep track of loans, credit cards, and market options for when you’re ready for your seriously adult purchases, like your next car or home. Trending charts make changes in your financial situation easy to understand and review.

Your free Credit Sesame account also provides Identity Theft Protection at no charge, along with fraud resolution assistance. If you’re ever a victim of identity theft, you’re protected by Credit Sesame just by getting an account.

Sign up now to get serious about your finances.

11. Never pay for anything you don’t need.

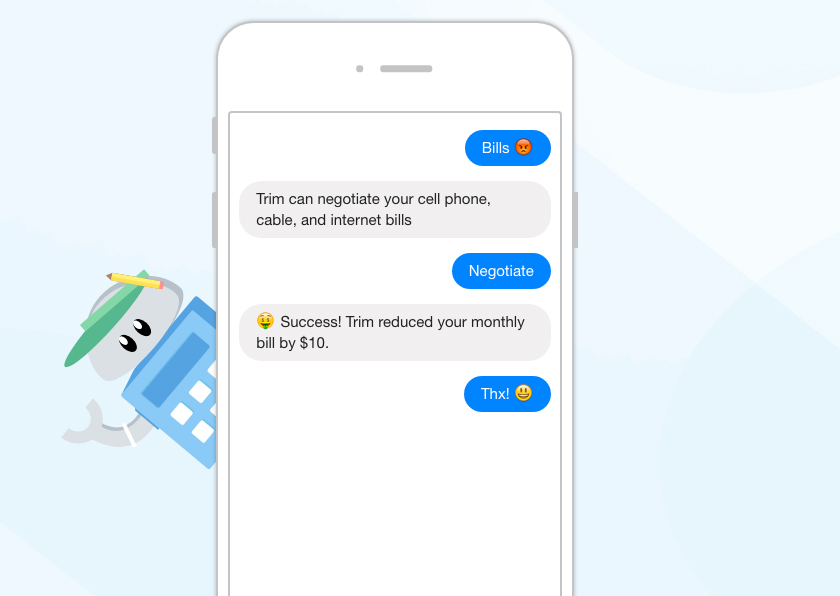

Trim

This is definitely something an extreme cheapskate, or just about anyone would say. That’s why you should get Trim. Remember those subscriptions you signed up for? Yea we forgot too, but Trim didn’t. Not sure if you should pay full price or if there’s a coupon for that? Trim knows that too.

Instead, get an automated financial planner. Yeah, you can totally afford that! Because it’s free. Trim is a free money-saving assistant that tracks your spending habits, suggests spending cuts for things you don’t really need or use, and even negotiates your cable and internet bills.

When you sign up for free with Trim, Trim scans your financial history to show you all of your subscriptions and helps cancel anything you don’t want to pay for anymore.

After that, Trim moves into full-on financial planner mode. It communicates you via your Facebook Messenger account or phone number with spending and balance alerts. Once it’s been linked to your card, it can also automatically apply coupons and special savings — at no cost to you.

Trim is constantly adding new features to help you out with financial planning and saving. The latest tool is the Bill Negotiator, which automatically negotiates your Comcast bill for you. This is the one place where Trim takes a cut — if they help lower your bill, they take 25% of the savings the first month. After that, though, your savings are all yours.

12. Say goodbye to rip-off phone contracts.

Rohit Tandon on Unsplash

Mobile phone companies are notorious for trying to rip off their customers with overpriced contracts and hidden fees. Cheapskates have caught onto those methods and are opting for Mint Mobile instead.

The company offers its customers pre-paid plans, allowing them to skip the contract. In other words, you’ll never again find yourself counting down the days until you can break free from the chains of your service provider. What a great feeling.

This 4G LTE phone plan works nationwide, and new users can even keep their current phone number. Mint Mobile is the fastest way to save money on your monthly phone bill, and their plans start at just $15 per month – and that includes unlimited talk and text with 2 GB of mobile data.

Mint Mobile can provide you with a new phone, or you can simply keep your current phone and insert the free SIM card they provide. They even have a free, 7-day risk-free trial, just so you can test out their great service plans before fully committing.

Just don’t go too overboard when it comes to cutting phone costs, like this extreme cheapskate who refuses to dish out money on a phone and instead walks to the library every time she wants to make a call.

See Mint Mobile’s low-cost no-contract plans.

13. Never overpay for TV.

JESHOOTS.COM on Unsplash

Cheapskates probably don’t have cable, but you probably shouldn’t either. Sling TV is the same thing but cheaper. You can customize the channels you want for max savings.

Instead of paying an arm and a leg for hundreds of channels just so you can watch your favorite one or two, customize your cable plan with Sling TV. Sling TV is free of everything you hate about other cable companies — there are no lengthy and convoluted contracts or hidden fees, and it’s easy to stream on any and all of your devices.

Sling TV’s go-to plans include $20 a month for 25+ channels, $25 for 40+ channels, and $40 for 50+ channels. If you’ve got a specific TV addiction like news, comedy, or sports, you can add on a handful of channels for just $5 a month as well.

Sling TV links to all of your favorite& devices, too. You can watch TV on your phone, XBOX, computer, and TV.

Get your first 7 days free with Sling TV.

14. Shop around for groceries.

Gratisography on Pexels

Never paying full price for anything is another great motto to live by if you’re looking to bring out your inner cheapskate. Thanks to modern technology, it’s never been easier to compare prices at various grocery stores before buying items. Log in to Instacart, see what grocery stores in your neighborhood are available for delivery, and compare prices.

Once you’ve picked your items, Instacart delivers those items to your home in as little as one hour. Pretty impressive, right? It allows you to save time, energy, and money, letting you spend your valuable hours doing something more fun than grocery shopping.

If you’re particular about the produce you buy, don’t worry. Instacart focuses on quality, and the website assures you it will “pick the freshest produce with the perfect ripeness.” Just sit back, relax, and let Instacart do the work for you.

While never paying full price is a great mantra, just make sure you don’t become like this extreme cheapskate, who even haggles for gasoline and fast food items.

Get your first delivery free with Instacart.

15. Let Voiced Market bring you great deals.

rawpixel on Unsplash

Paying full price is something that a cheapskate never does, but saving serious dough can be time-consuming. Why not sit back and let Voiced Market bring you exclusive deals that will leave you – and your wallet – happy?

Voiced Market believes in bringing you quality products at a fraction of their regular retail price. It doesn’t matter whether the product comes from a big or small brand – you’ll find loads of great things on the deal site, from hugely discounted meal delivery subscriptions to software and business products, clothing, and household items.

A great bonus is that Voiced Market dedicates a percentage of its profits to help feed and educate those in need. This means you can purchase high-quality products, save money, and do something good at the same time. It’s a win all around.

16. Never overpay for your prescriptions.

Joshua Coleman on Unsplash

Even with insurance, prescriptions can be costly. However, there are ways to lower your costs. Blink Health offers more than 15,000 drugs which are marked down by as much as 95%. That’s huge, and can mean everything to someone who is struggling to pay for their medications each month.

The company was founded by two brothers, in an effort to bypass insurance companies. Blink Health goes straight to drug makers, cutting out the insurance middleman. You go to the website, click on the drug that your doctor prescribed, pay online, and print out a receipt to take to one of 60,000 participating pharmacies – including major ones like Walmart and Kroger. You don’t pay anything at the pharmacy, because you’ve already paid online.

This tactic is often much cheaper than a person’s insurance co-pay, and makes a lot of sense for people who have extremely high insurance deductibles. At the very least, you have nothing to lose.

Visit Blink Health and see how much they can save you.

17. Never underestimate the value of second-hand clothes & rented outfits

Lauren Robers on Unsplash

Depending on where you live and the kind of circles you run in, you might find there’s still a bit of a taboo surrounding used clothing. Try to wipe that completely from your mind.

Thrift stores, consignment shops, garage sales, and estate sales are often treasure troves of new or lightly used clothing, and it’s not uncommon to find designer labels. Once you get into the game, you’ll soon identify the best neighborhoods to find bargains, and you’ll start to see that “used” clothing often means it’s just been sitting in someone’s closet for years, with the tags still on.

If you’re a woman who loves quality clothing, don’t head to the mall to buy your favorite brands. In fact, you may not want to buy them at all. Rent the Runway is a godsend for fashionistas who want to stay up-to-date with trending styles without forking over a ton of cash. The concept is exactly as it sounds – pick out clothing you love, pay a small fee to rent them, and get a chance to wear more outfits without actually buying them.

Let go of your inhibitions and unleash your fashionable side in a less conventional way. Just don’t be like this extreme cheapskate, who approaches the houses of recently deceased people, asking if she can rummage through their closets.

18. … Or second-hand furniture.

Michael Browning on Unsplash

Decent furniture can be extremely expensive if you’re buying it at full-price from a furniture store. That’s why you shouldn’t do it. Instead, check out garage sales and moving sales. Great deals can also be found at thrift stores and on Craigslist and eBay.

In addition to the obvious money savings, shopping for used furniture also gives you the chance to snag a cool antique or a quirky one-of-a-kind piece. That’s certainly an added bonus in a world full of IKEA living rooms that all seem to look alike.

Just don’t go too far, like this extreme cheapskate who sees no problem dumpster diving for her home furnishings.

19. Take care of what you have.

Kaboompics on Pexels

Frugal living is all about doing the best you can with what you have. When you take better care of your possessions, they’ll last longer and save you money in the long-run. This rule applies to everything you own, from your clothing to your car and house.

However, don’t be like this extreme cheapskate, who wrapped his entire home in plastic wrap in order to protect its resale value.

Life is expensive, and there’s absolutely no shame in cutting corners wherever possible – within reason. Just keep in mind that going to extreme lengths to save a few pennies isn’t always worth the hassle.