27 Easy Ways To Save Money You Can Start Doing Now

This post includes links to our affiliate partners that earn us a commission. These affiliate partners help make it possible to bring you free content. Now back to learning about ways to earn, save, and grow.

No matter what your income level is or how much money you have, adding to your savings is always a great thing.

We live in a time where saving money goes far beyond clipping coupons and going to a cheaper gym. Nowadays, there are tons of easy ways to save money that won’t cause any pain — including some you’ve probably never thought of before.

If you take advantage of a handful of these today, you’ll be amazed at how the savings add up.

Continue reading to get a detailed list of some of the best ways to save money.

1. Understand & Better Your Credit Score For Free

Shutterstock

Staying on top of your credit is one of the easiest ways to save money. It enables you to make sure you are getting the fairest and lowest interest rates possible. A lower interest rate means a lot of money saved when using your credit card or buying a home or car. Knowing where your credit stands is absolutely vital, and Credit Sesame offers this (and much more) for free.

Credit Sesame gives every user a free credit score, free credit analysis (updated monthly), and free credit monitoring. Signing up is super easy. You’ll be able to set up alerts so that you’re notified when anything on your credit report changes, and Credit Sesame even includes free theft protection to help make sure your finances are secure.

Get a free credit score and analysis from Credit Sesame.

2. List a Room with Airbnb (Use the Extra Money for Your Rent or Mortgage)

Patrick Perkins On Unsplash

Airbnb has become a great way for people to save money on rent or mortgage payments. There’s potential to earn sizeable money listing space, which you can use to reduce your monthly living cost.

Even if you don’t have a full unoccupied apartment to list, you can earn several thousands of dollars annually just by listing a spare bedroom. If you have any spare space in your home, it’s easy to get started, and the platform suggests a market price for you to list your home. You can learn more by reading our ultimate guide to listing your space on Airbnb.

You always remain in control when it comes to who stays at your place and how much you charge.

Sign up to become an Airbnb host.

3. Lower Your Credit Card Bills Now

Shutterstock

Have credit card debt? A lot of people are being crushed by high credit card interest rates. A personal loan can help you to refinance or consolidate your credit card debt and potentially save thousands of dollars.

Personal Loan interest rates typically start well below credit card interest rates. You can borrow up to $100,000 (no collateral needed) and can have the money as soon as the next business day.

Here’s how to save:

- Apply for and get approved for a personal loan (make sure the loan has less interest than your current credit card debt).

- Use the personal loan to pay off the credit card debt.

- Start paying off the personal loan at a lower interest rate.

- A pretty great money-saving tip huh?!

Here are 2 top choices for personal loan companies:

→ Credible: In just minutes you can get prequalified rates from multiple lenders (saving you lots of time). Loan amounts up to $200,000.

→ Upstart: This loan company believes your credit score doesn’t paint the complete picture. Upstart takes more than just your credit score into consideration when evaluating you as a borrower – they also factor in education, area of study and job history when deciding if you get approved. You do still need a credit score of at least 620 with Upstart. Personal loans range from $1,000 to $50,000

Personal loans can also be used for emergency expenses that suddenly pop up, medical expenses, moving costs, and a plethora of other situations that call for a quick lump sum of cash.

4. Make Money Off Your Car While You’re Not Using It

Samuel Foster on Unsplash

Owning a car is no cheap decision, but – thankfully – you can rent your vehicle when it’s not in use to offset the cost of car ownership. Services from popular car sharing companies Turo and Getaround make this possible.

Turo is currently available in 5,500 cities while Getaround is available across the U.S.

Car owners get to decide when and how they rent their vehicles. Turo allows car owners to keep up to 90% of the trip price, and people have made upwards of $30,000 by posting their car to Getaround.

Both services include insurance (to the tune of $1,000,000) and 24/7 roadside assistance. Both services also offer smart technology, including app-powered door unlocking, which makes it more convenient for car owners to rent their cars.

Sign up to list your car on Turo and sign up to list your car on Getaround.

(Pro Tip: List your car on both platforms to get your car rented more.)

5. Save Thousands On Your Student Loans

Shutterstock

You may be eligible for a much lower interest rate on your student loans and not even know it yet. One of our favorite easy ways to save money is student loan refinancing with Credible, which just means you replace your existing student debt with a new, lower-interest loan.

This can literally save you thousands of dollars and is a no brainer! It doesn’t cost anything to refinance your student loans and you may be able to lower your monthly payment and pay off your debt faster.

Credible is an online loan marketplace that will give you pre-qualified refinancing rates in 2 minutes from up to 8 lenders (a huge time-saver). If you find a better rate elsewhere, Credible will give you $200 (terms apply: visit Credible for details). They make the whole process extremely easy.

6. Refinance Your Mortgage To Save Money

Gustavo Zambelli on Unsplash

A mortgage refinance replaces your home loan with a new one and can help you save money by reducing your interest rate. People also refinance to reduce their monthly payments, pay off the loan faster, get rid of FHA mortgage insurance or switch from an adjustable-rate to a fixed-rate loan.

LoanDepot could help you refinance your home loan with ease. It just takes a few minutes and answering some questions to see loan options. LoanDepot has over 1,700 licensed lending officers across the US and our no steering policy means you get a loan expert to help you find the best loan for your goals and not the best plan for their wallet. It has funded over $100 billion in loans since 2010.

See mortgage refinance options at LoanDepot.

7. Maximize Your 401k with Blooom

Fabian Blank on Unsplash

Signing up for an employer-sponsored 401k is always a good idea, but simply opening the retirement fund is just the beginning. There is much more that needs to be done to make sure that your 401k is growing as quickly (and cheaply) as it can. Fortunately for all of us with a 401k, Blooom can do all the work for us.

The experts at Blooom, having come from successful careers managing investments on behalf of millionaires, are some of the best when it comes to optimizing 401ks. For anyone who signs up, they offer an unbiased analysis of your retirement fund to eliminate unnecessary costs, hidden fees, and anything else that doesn’t make sense for your retirement planning.

After they’re finished doing a top-to-bottom review of your 401k, and double-checking the evaluation’s findings, they provide ongoing support by monitoring your account for any changes and dealing with rebalancing when it’s time. On top of that, this seasoned team of experts provides you with access to a certified investment planner who can answer any of your questions at any time.

Making smart choices is more beneficial the earlier you start, especially when it comes to your 401k.

Get a free 401k analysis from Blooom.

8. Get a Checking Account with Low Fees and High Interest.

Pixabay on Pexels

Axos Bank Rewards Checking account offers high interest and a suite of digital tools with no monthly maintenance fee. It was named the best stand-alone checking account by Time.com. Stop throwing money away with bank fees and get:

- High interest.

- Never pay monthly maintenance fees again.

- No need to neep a minimum balance to avoid fees.

- No overdraft or non-sufficient fund fees.

- Make unlimited withdrawals from any domestic ATM for free.

Open an Axos Bank Rewards Checking account.

9. Rack Up the Most Interest Possible With A Savings Account

Sharon McCutcheon on Unsplash

Making money while you sleep with no effort is a no brainer. CIT Bank is a top online banking option that can help you do just that. The only work is opening an account which you can do online in a few minutes.

A bank account with CIT Bank can earn you 20x more interest than the national average. It offers multiple types of online banking accounts to fit your needs. Their Savings Account Builder requires just a $100 minimum to open an account and is a top option.

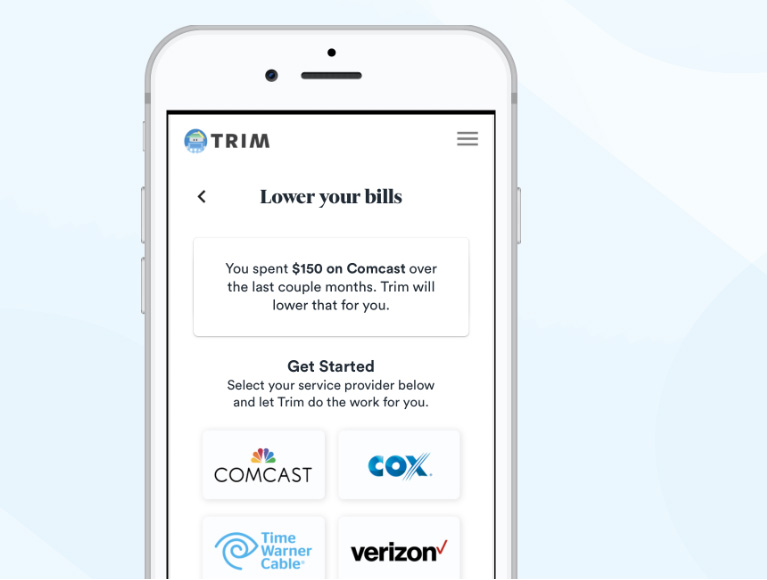

10. Slash Your Monthly Bills with Trim

Trim

Despite the fact that there are so many easy ways to save money, we aren’t doing the best we could be – and that’s because it sometimes takes more effort than we care to make. This is exactly why Trim was designed, to help us meet our savings goals – all while not having to put in hardly any effort ourselves.

With Trim, the app does all the work itself. After users give it permission to do so, it evaluates your monthly bills and subscription fees and automatically figures out easy ways for you to save money. It’ll negotiate and attempt to cut your cable bill cost on your behalf, and much more. Trim users saved over $1,000,000 in the last month.

Trim is a nifty app that can help anyone out there save some extra money by cutting down on unnecessary spending.

11. Use a Home Equity Loan to Get a Better Rate

Scott Webb on Unsplash

If you have a lot of debt to consolidate, a home improvement project that requires new funds, or any other major purchase that life has dropped in your lap, you can easily use Figure to get a home equity loan. A home equity loan is exactly what it sounds like, allowing you to tap into your home’s equity to get a better rate on a loan.

Known as the “fastest home equity loan on the planet,” borrowers get approved in just 5 minutes when they apply for a Figure Home Equity Loan – and receive their funds in only 5 days. In many cases, a home equity loan can be one of the best ways to save money when you’re in a pinch.

Not only do they get incredibly high marks for top-quality customer service, But Figure also offers cheap terms with fixed monthly payments, no appraisal fee, no maintenance fees, and have loan options that begin at $15,000 and go as high as $100,000.

Get a fast quote for a Figure Home Equity Loan now.

12. Start Saving For Your Child’s College Future Today

CollegeBacker

CollegeBacker can help you open a tax-advantaged investment account called a 529 College Savings Plan in just 5 minutes. It grows tax-free and can be withdrawn tax-free to pay for your child’s education costs – just like a retirement account for college. They’ll even give you a $25 VIP Match when you fund the account with $25.

CollegeBacker believes every child should have a college fund, so they have no mandatory fees and instead work for tips. They never take commissions and always suggest low-fee 529 plans. They even use 1% of the money you tip them to reach low-income families around the country.

13. Shrink Your Car Payment

Pixabay on Pexels

MyAutoLoan offers an easy way to save money by slashing your monthly car payments – or getting a low-cost auto loan for a purchase of a new or used vehicle.

Thinking about getting a new or used car? With MyAutoLoan, you can get quotes from up to four lenders in minutes. The application process takes just a few minutes to find out if you’re approved because the site believes getting a car loan should be fast and simple.

Already have an auto loan? Check out how much you could save by viewing refinancing options MyAutoLoan generates for you. You don’t have to stick with your high-interest loan – you can start saving every month by refinancing, which means replacing your current auto loan with a lower interest loan.

Check out how much you can save with MyAutoLoan.

Easy ways to save money on insurance

One of the best ways to save money when it comes to your regular bills is by finding ways to shave off your insurance costs – which is much easier than you might think.

14. Quit Overpaying on Homeowner’s & Renter’s Insurance

Chastity Cortijo on Unsplash

Have you really taken a close look at how much you’re paying for homeowner’s and renter’s insurance? You are likely paying much more than you need to be, and Lemonade can change that.

Not the refreshing beverage or the Beyoncé album – the affordable insurance company that offers top-quality plans with reasonable price tags. Lemonade offers renter’s insurance starting at just $5 per month, and homeowners can get insured for just $25 per month.

The best part about Lemonade is that if you are already insured, they will take care of the switching for you, so you don’t need to deal with any of the hassle.

Lemonade doesn’t believe is being a greedy insurance company. They simply take a flat fee from the premium you pay (unlike most insurance companies). Lemonade then takes the remainder of your premium and donates it to causes closest to your heart!

Lemonade is an insurance company that’s classified as a Public Benefit Corporation, dedicated to the good of society, and a great movement to be a part of.

Get a free quote from Lemonade.

15. Save Money on Car Insurance

William Krause on Unsplash

Liberty Mutual offers very affordable auto insurance plans nationwide, and drivers who switch save an average of $509 annually. It’s a reliable and well-known insurance provider that offers nifty benefits like a 12-month rate guarantee, lifetime repair guarantee, and 24/7 customer service.

Get a Liberty Mutual quote to see how much you can save.

16. Save on Life Insurance with Ladder

J carter on Unsplash

Life insurance plans from Ladder involve no brokers, no upselling, and the ability to cancel or change your plan whenever you want at no cost. The cheap life insurance prices they offer are locked in, guaranteed, and signing up is incredibly fast.

Ladder is the life insurance plan of the future, giving consumers transparency and fair prices. In the modern era, we embrace the minimalistic and easy ways to save money, and that now extends to our life insurance policies.

Get a quick and free Ladder life insurance quote.

Ways to save money with cashback, surveys and rewards

When it comes to easy ways to save money, not enough people participate in online surveys or take advantage of cashback programs – which can help you rake in some serious extra savings while you’re doing your typical shopping or just playing on your phone while waiting in line at the coffee shop.

17. Save Money by Shopping (Seriously!)

rawpixel.com on Unsplash

Did you know that there is a way you can earn free rewards just by doing the same online or in-store shopping you would normally do? It may sound too good to be true, but you can save a ton of money by simply signing up for some cash back programs that reward you for shopping at some of the most popular retailers and restaurants in the country.

→ Rakuten offers a $10 signup bonus and gets shoppers up to 40% cash back at over 2,500 online stores. Every quarter you receive either a check or a PayPal transfer of your cash rewards. There are no points with Rakuten, as well as no fees or forms to fill out. It’s quite possibly one of the best ways to save money on your regular online purchases.

→ Ibotta offers a $10 sign up bonus and helps you get real cash back on everyday things you buy like groceries, cosmetics, apparel and more. You’ll feel better the next time you buy milk or eggs knowing you saved money without having to do anything. Ibotta has already helped users get over $500,000,000 in cash back.

→ Drop is a free app that you can sign up for in minutes and start earning free gift cards at your favorite stores. After you sign up, link your credit or debit card to your Drop account, and anytime you spend money with their partners (which include super-popular retailers like Amazon) you start to rack up points. Drop lets you redeem your points for free e-gift cards from some of the most widely-shopped brands out there. Read our full Drop review to learn more.

18. Do Surveys for Free Rewards

Christin Hume on Unsplash

→ Survey Junkie pays you for your opinion, and you can cash out via PayPal or a gift card after accruing just $10 of points. Help shape the consumer landscape by giving your honest feedback.

→ PointClub lets you earn cash by taking surveys and polls. They’ll give you a $5 signup bonus.

Other notable survey sites you should check out (sign up for more than one to take advantage of the best offers):

19. Scan Bar Codes for Free Gift Cards

Shopkick

Some ways to save money can involve a simple tap on your smartphone. Shopkick is one of the best-kept secrets out there: users earn free money just by walking into stores and scanning items with their smartphones. On the platform, you earn “kicks” every time you scan certain items, which are converted into free gift cards at top retailers.

You can imagine Shopkick as a sort of scavenger hunt that actually nets you some free gift card funds, and the rewards are sent directly to your phone – you don’t need to actually ever buy anything to get paid. There are also ways to earn gift cards by making purchases and watching videos online.

Earn by scanning stuff with Shopkick.

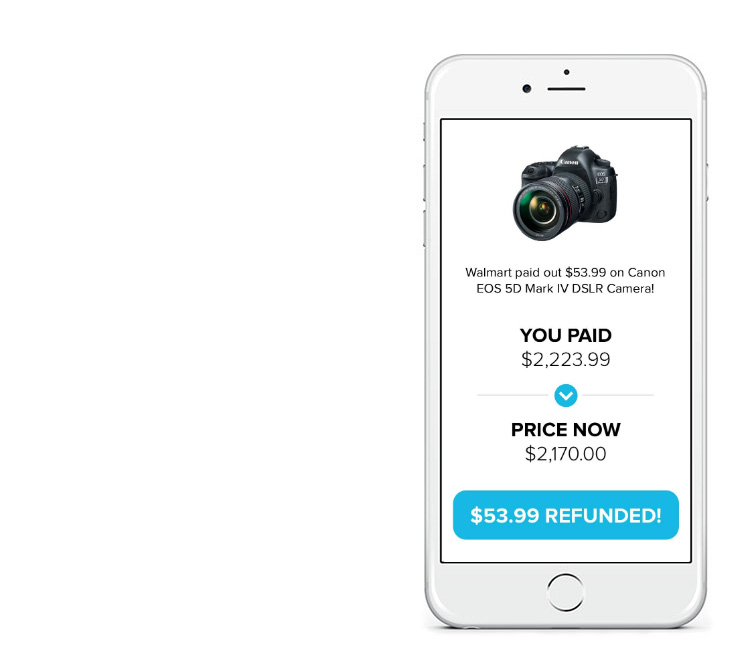

20. Get Automatic Refunds

Paribus

Have you ever bought something and found out afterward that the price went down? Losing out on savings like that is incredibly frustrating, but – thankfully – Paribus is here to help. With Paribus, which is part of Capital One, users get automatically notified and refunded whenever the platform detects that one of your recent purchases is now cheaper.

With Paribus, users have already gotten refunded $29 million, and they didn’t even have to do anything other than sign up – and that includes savings on hotel rooms! Getting back money you’ve already spent is one of the best ways to save money.

Get automatic, free refunds with Paribus.

Paribus compensates us when you sign up for Paribus using the links provided.

21. Unlock Exclusive Deals

When it comes to finding deals online with almost no effort, Voiced Market is a hotspot where you can find bargains of up to 95% off — from both top brands and up-and-coming retailers that you haven’t even heard of yet. Voiced Market users get to discover brands that they didn’t even know they wanted to try. Anything can pop up on the deal site.

Bargain hunters love Voiced Market because a portion of the site’s profits go toward education and feeding those in need. You can check out awesome deals on the site, or get access to even better, exclusive deals by signing up for their free newsletter.

Voiced Market, especially its newsletter, is one of the best-kept secrets, and is still sort of a top-secret society of smart shoppers who only have to check their emails for deals they might like.

Sign up for the Voiced Market newsletter.

22. Earn Free Cash by Watching Videos & Reading Emails

Buro Millennial on pexels

→ Swagbucks offers a $5 signup bonus and keeps on giving, handing out 7,000 gift cards every day to its users. You’re able to earn free gift cards or cash by shopping online as you normally would, watching entertaining videos, searching the web, and answering surveys.

→ Inbox Dollars offers a $5 signup bonus and more money by participating in a number of activities. Brands pay InboxDollars for consumer input, they then recruit users like you to do things like take surveys or watch videos, and in return pay you cash for your time.

→ MyPoints offers a $10 Amazon gift card sign up bonus and the opportunity to make more money by watching videos, taking surveys, shopping at their favorite retailers, and even playing online games. 10 million users have already earned themselves $236 million in free rewards – delivered via PayPal cash or gift cards.

Pro Tip: If you sign up for all 3 sites above, you can take advantage of $20 in free sign up bonus cash.

23. Let Nielsen Track Your Devices

Nielsen

Nielsen Research is a renowned organization that gathers and analyzes tons of consumer internet behavior. By paying attention to what everyday internet users are doing, Nielsen channels that information to help companies improve consumers’ favorite products and services.

Did you know that you, too, can profit from this research? By giving Nielsen access to your internet-enabled devices and letting them track your normal internet usage, you earn free rewards – and it doesn’t slow down or affect your internet in any way. You start earning the moment you download the app, and you just have to use the internet as you normally would.

Earn money with your devices by signing up with Nielsen.

More Easy Ways To Save Money

These days, there are so many cool, unique companies out there that have developed incredibly useful solutions that can help consumers save money in their day-to-day lives. From optimizing your 401k to switching up your mobile phone service, there are plenty of other avenues you can take that provide easy ways to save money.

24. Choose A Credit Card That Can Reward and Serve You Better (Plus $150 bonus)

Shutterstock

If you’re going to use a credit card, you might as well be getting the most rewards and savings possible. From cash back to 0% balance transfer credit cards, get the card that is the most beneficial to you. Make sure to pay your credit card bill on time so that you don’t get hit with any interest charges while taking advantage of the perks offered.

The ABOC Platinum Rewards Credit Card offers cardholders cash back and 0% APR on purchases for 12 months. That means you won’t pay a dime in interest for a full year, including if you transfer debt from a high-interest card.

There’s zero annual fee, and cardholders score a $150 sign-up bonus if they rack up $1,200 in purchases within the first three months of opening the account.

The ABOC Platinum Rewards Credit Card also offers a generous rewards program, with cardholders earning 5x points on popular categories that rotate quaterly like travel, automotive, dining, and groceries. The points never expire, and there are so many possibilities when it comes to how you can spend them.

Apply for the ABOC Platinum Rewards Credit Card now.

25. Pay Way Less on Your Mobile Phone Plan

@Matthew_T_Rader on Unsplash

Many of us are paying much more than we need to be just to use our beloved smartphones, but we don’t have to keep getting overcharged by the massive telecoms corporations – we can save a good amount of money by switching to Mint Mobile.

This 4G LTE phone plan works nationwide, and new users can even keep their current phone numbers. Mint Mobile is the fastest way to save money on your monthly phone bill, and their plans start at just $15 per month – and that includes unlimited talk and text with 2 GB of mobile data.

Mint Mobile can provide you with a new phone, or you can simply keep your current phone and insert the free SIM card they provide. They even have a free, 7-day risk-free trial, just so you can test out their great service plans before fully committing. It’s one of the most straightforward and easy ways to save money!

Save a ton on your phone bill with Mint Mobile.

26. Drastically Reduce Your Cable Bill

JESHOOTS.com on Pexels

If you join the growing number of cord-cutters who are no longer paying for cable TV, you are free from the unfair and predatory practices that giant cable corporations are known for – but you are then only faced with a limited number of options for online streaming services. The most popular streaming services don’t offer many of our favorite shows, so it can leave us wanting more.

Luckily, Sling TV gives us the best of both worlds: the cable tv channels we love without the ridiculous packages that traditional cable providers offer. With Sling TV, users can easily design their own personalized package by selecting only the channels they actually want to watch.

It’s an easy-to-use live cable service that’s streamed over the internet, so you don’t have to concern yourself with skipping a day of work to stay home and wait for a technician to install anything. Sling TV just requires any screen, be it your smart tv or tablet, and you can get 30 channels for just $20! It’s one of the most entertaining ways to save money!

Try a week of Sling TV for free and save money on cable.

27. Get a Pro to Help Fix Your Credit

Shutterstock

One of the biggest obstacles to saving money is less-than-perfect credit history, which often means that we can’t get low-interest rates, making us pay much more in the long run for many of our monthly expenses. That’s why fixing your credit is one of the best ways to save money. Thankfully, there are steps you can take to start fixing your credit score – and Lexington Law is one of the best solutions around.

Lexington Law is a great organization that’s dedicated to improving its customers’ credit scores. For nearly three decades, it has helped countless people fix their credit scores, and their success is proven: the company claims past clients have seen 24% of their credit report negatives wiped clean from their credit history thanks to Lexington Law.

Collectively, Lexington Law’s credit experts have successfully gotten 9 million negative items taken off of their clients’ credit reports. Anyone who’s curious can schedule a free consultation, so you can see exactly how Lexington can potentially help boost your credit score without any cost or commitment.