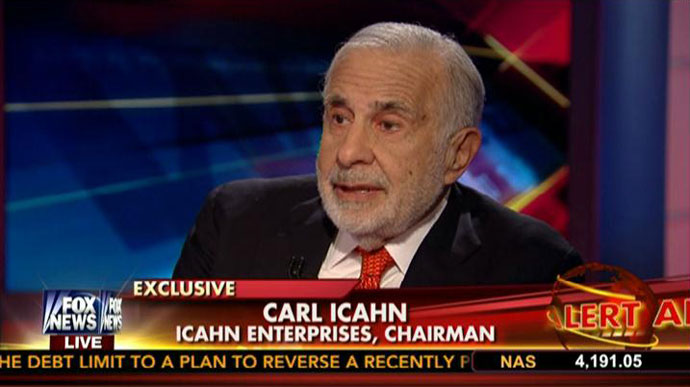

Carl Icahn: No Intention Of Selling Apple, Banks Should Go Back To Glass-Steagall

A day after Carl Icahn abandoned his efforts to push Apple to pay out more money to shareholders, the billionaire investor appeared on Fox Business Network’s “Cavuto,” where he explained he has no intention of selling his shares in the Cupertino, Calif.-based tech giant.

I think Apple is one of the cheapest stocks around,” Icahn told host Neil Cavuto. “We like the management there. It’s a little unique for us because we usually don’t like the manager.”

Icahn’s persistence that Apple is holding on to too many profits apparently hasn’t harmed his reputation with CEO Tim Cook. In fact, Icahn told Cavuto he planned to call Cook following the interview. He and Cook agree, he explained, that Apple’s stock is extremely undervalued – and a solid investment.

I think, you know, sometimes you make money when you look at things and you can see it on the back of an envelope and make it simple, a no-brainer,” Icahn said. “Netflix was one. Chesapeake was one. A lot of these that we do, Apple is exactly one. It’s just extremely cheap.”

Some other highlights from Icahn’s interview with Cavuto:

I think the Volcker Rule is fine,” Icahn said. “I think what they should do is go back to Glass-Steagall…a lot of my friends at these investment banks are going to be real mad at me for saying it, but I really think that was one of the problems in ‘08.”

Apparently Icahn does not, however, support New York City Mayor Bill de Blasio. Simply put, “I’m not a fan of the mayor,” Icahn told Cavuto.

Also from Icahn’s “Cavuto” interview:

On whether Apple at $530 is still cheap:

“Yes, I think, you know, sometimes you make money when you look at things and you can see it on the back of an envelope and make it simple, a no-brainer. Netflix was one. Chesapeake was one. A lot of these that we do, Apple is exactly one. It’s just extremely cheap.”

On Apple’s management:

“We like the management there. It is a little unique for us because usually we don’t like the manager, usually, but in this case we do like the management. You know why it’s simple for the last five years Apple has spent over $18 billion in research and development, now where is it. Now some of it is in the products they are making they build the product up they go from iPhone 5 to iPhone 6 is coming out, but a lot of that has not been seen by the shareholders.”

On Apple CEO Tim Cook:

“Tim and I we get along pretty well. I plan to talk to him this evening…I think, I mean I am hoping to speak to him this evening. We called and missed each other.”

On whether he has any intention to sell any of his Apple shares:

“I absolutely have no intention of selling them.”

On JPMorgan Chase CEO Jamie Dimon being awarded a $20 million package:

“I don’t really want to get into any area, I’m not going to talk about any specific companies… I personally think banks in general, and I am good friends with a lot of bankers may hate me for this, but I think the Volcker Rule is fine. I think what they should do is go back to Glass-Steagall… and a lot of my friends at these investment banks are going to be real mad at me for saying it, but I really think that was one of the problems in ‘08.”

On the possibility that New York City Mayor Bill de Blasio might raise taxes:

“It doesn’t bother me at all.”

On New York City Mayor Bill de Blasio:

“I’m not a fan of the mayor but that’s for different reasons. We do a lot in charter schools, when you get away from bureaucracy in education, it’s amazing what those charter schools have accomplished, treat ‘em like a business almost and we have eight charter schools. It costs me money obviously, but I think it’s well spent and those kids – the middle of the Bronx- read as well as the kids in Scarsdale on all the tests. Down the road, the city school, same thing, same environment, same block they can’t read or write. That’s what we should have, more charter schools.”

On whether he doesn’t trust Republicans or Democrats:

“It’s not don’t trust, I think the Republicans muffed the whole election race, I’ve never seen anything muffed worse than what happened in the election where you go to the middle class guy and the Republicans go and start telling him hey we gotta pay back the deficit, we gotta take away your entitlements, we gotta worry about the rich guy cause he’s good for you. It’s like in the middle ages, they would tell the peasants it’s good we can hang your children, it’s good for you. God wants us to do it.”

On whether the rich should do more:

“Yeah, but it’s not so much they should do more. I really do believe in a meritocracy, if someone really takes risk and invests money, what the heck he should get the fruits of it. I mean I have taken a lot of risk in my life, we’ve made a lot of money and by the way they keep saying I am greedy and trying to make money, all the money I have is going to the Giving Pledge and it’s going back to society for the most part.”

On whether his children know he is giving money to the Giving Pledge:

“They always knew that, they always knew how I felt. I don’t believe in this huge inheritance because money can also be bad for kids. I have seen friends of mine giving money to their kids. My kids are going to be well off and my son has already made a great deal by buying Netflix, he and his partner bought Netflix.”

On his legacy:

“What I am doing actually here and I know it sounds corny to you but I think if my legacy could be to change what goes on in corporate America, to change this reprehensible system that we have that only enriches some of these lawyers and that the poison pill is killing the little guy and I’ll tell you why, what’s gonna happen is if you have this pill and you keep invading with the pill and saying oh we don’t like these bad raiders, whatever they call them, which is nonsense because look at the record we have and look at what we’ve accomplished…a lot of these pension funds are beginning to understand hey we have to do something, we are underfunded and here’s what happens, we do get calls, it’s coming around where some of these mutual funds, hedge funds say ‘you ought to take a look at this one Carl’ and we can’t come out. It’s like in the House of Cards, you could say that but we can’t so you could go do it. I am like the guy that you go to in the schoolyard, go beat up the bully, we’ll stand behind you, we’ll hold your books for you…I don’t mind beating up the bully.”

On how he wants to be remembered:

“If I could be remembered, as somebody who changed the rules of corporate governance to make management accountable. And if they are accountable, you will see that, companies will flourish….it’s like if you inherited a vineyard and the guy that runs the wine was out there playing golf all day, I’d say well why do you keep him?”

On whether he doesn’t want the label of being a corporate raider:

“I don’t know what raider means…the word raider, it means that we take money from companies. We built up companies. Look I could show you company after company that we’ve made a fortune for the shareholders and built them up.”

On whether the conduct of AOL CEO Tim Armstrong would hurt investors:

“I’m not going to get into that because I don’t really know the company that well and I don’t want to get into anything I don’t know well…I don’t know the situation. I mean I read about it in the newspapers.. I think you don’t fix a company that is doing well. We don’t micromanage, I’m not going to get into personal situations.”

On whether this is a market that loves goodies:

“I think that you shouldn’t be all that sanguine I mean look I’m happy when the market goes up, right now though all the numbers point out to me that at 17, 18 times earnings you’re paying a hefty price. I’m better off if it goes up but we keep everything pretty well hedged because I think, our returns by the way were 35% for five years, annualized they would have been a lot higher if I didn’t keep a big short position on it.”

On whether he believes statements that last year’s heady advances were built on air:

“Yes I do. I think that a lot of the heady advances, it’s like having a patient and you’re giving a patient a new kind of medicine and nobody, including, and I think Bernanke did a great job by the way I’m not faulting Bernanke, I think he saved the country. But right now I think this whole injection of capital is like giving somebody sort of like a heroin and you don’t know what it’s going to do to them. I mean it’s a new medicine, think of it maybe not heroin, but it’s a new medicine. There’s so much money being pushed in and it all relates to one thing I think the credibility of the American dollar. I mean you think about it a dollar is a piece of paper, people give you food all over the world for it, people give you clothing, people give you technology for it. What happens if they start wondering how good is a dollar. And you can’t just keep printing forever you can’t do it. Obviously when interest rates are 3% or 3.5%, I’m a businessman I look for everywhere to invest. I look to borrow money. Money is a commodity and I’m buying money very cheaply when I buy at 3, 3.5, 4, or even 5%. I mean if I can make returns of 28% annualized well of course I’m going to do it, I’m going to invest but the trouble is that is a false type of investment possibly and especially when you have mediocre managements in a lot of companies taking this money and everybody says let them alone, let them alone, let those guys invest.”

On managers who think they’re geniuses:

“Yes, a lot of them start believing it because they are the CEO they are accountable to nobody in many cases and therefore the guys on the board it’s sort of a fraternity.”

On whether he worries about macro stuff like the debt:

“I worry about it to the extent I can do something about it and what I can do about it I put on different credit spreads I mean this is something a little arcane and I worry about it for that purpose and that’s the reason I’ve done well in bad markets as well as good generally except ’08, nobody did well in ’08.”

On whether he pays attention to Washington:

“Well I do pay a lot of attention to it but it doesn’t do me much good. You can pay attention to it but there are so many variables that are going on that anybody picking what the markets going to do next month even next year is foolish, its too many variables.”

On the possibility that the government might shut down again:

“You’ve got a myriad of problems that could come up from left field that could shake the market up and you have to be ready for that.”

On his opinion of the way President Obama has been shepherding the economy:

“You know I will tell you that I will say that I think Obama could have done a lot more. I think he could have done a lot more in investing, in going in and really putting money out there. I think he stressed Obamacare too much.”

On whether he likes the healthcare law:

“I don’t necessarily, I’m not one of those guys that hates it, I think that Obama had to do something like that. I don’t think it’s that bad. I’m no expert on it but I don’t think businesses should be a medical provider. Look the CEO has enough trouble with his own business they’re not doing so well with it, what the hell is he a medical provider for?”

On businesses saying that Obamacare is costly:

“I’d like to understand what they’re saying; I think it’s just another excuse if they’re not having good earnings. I really think, my opinion, I’ll go back to my basic opinion which is a no brainer. Here’s a no brainer, I can make and I am no genius at managing companies, I can go into a company, almost any company that we go into and save 30% make that company turn it around which I’ve done over and over and over again and I’m not a managing genius, it tells you one simple thing, at companies, many of them are terribly run and there is no accountability. And here is why the little guy is going to get hurt I know it sounds corny as hell and I’m going to say it to you I know this sounds corny, I’m a kid from Queens, I grew up on the streets, only in this country, this great country, only in here could I have done what I have done. I could never have done it in any other stratified society and I hate to see us lose our hegemony it bothers me.”

On what it means for us to lose our hegemony:

“We are now the foremost country in the world but as you have seen in The Wealth of Nations, you read Paul Kennedy’s book, the downfall of why these major economies fail and you see that they go for 300 years or 200 years and then something happens to the meritocracy. A country does great when you have a meritocracy like in this country; the right guy gets to the top. We don’t have that now. Right now our corporate leaders are not the right guy. They are the right guy for the fraternity house. Not every one of them but many of them. They are the guy that was the president of the fraternity, knows how to get along, and then starts believing he’s a genius which he’s not.”