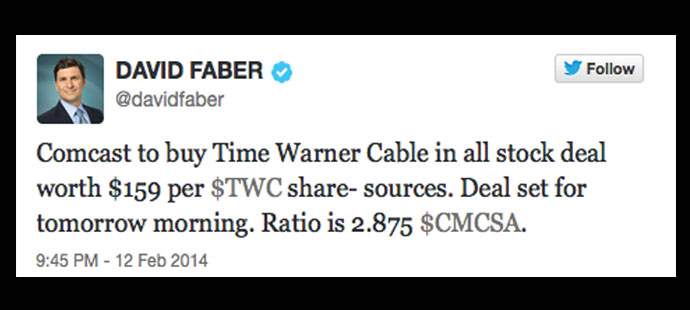

CNBC Scoops Time Warner-Comcast Merger… Or Did It?

The media has been buzzing all day with news that Comcast will acquire Time Warner Cable in a $45 billion deal. CNBC’s David Faber has been credited with breaking the story. However, a critical detail about this “scoop” has been conveniently omitted: Comcast owns NBC, and is, therefore, Faber’s boss. Was there, then, ever any doubt its in-house business channel CNBC wouldn’t be first to report the news? Hardly a journalistic coup here, further evidenced by reports that this news was actually embargoed and Faber simply broke the embargo…. Scoop? Not so much. Easiest story ever to break? Definitely.

In fact, Reuter’s editor Soyoung Kim called CNBC out on Twitter:

Know M&A is competitive, but how are you supposed to break news you get on embargo? Sad to see people don't have same journalism ethics.

— Soyoung Kim (@SoyoungSays) February 13, 2014

Although Faber “broke” the story Wednesday evening, other journalists were not invited to a teleconference announcement of the merger until Thursday morning. By that time, they were, of course, well aware of the news thanks to CNBC’s “scoop.” Reuter’s, in fact, had been reporting the possibility of a merger for months. Kim, no doubt, was seeing green when a fellow journalist broke the embargo to run the story during Wednesday night’s “Squawk Box.”

What is the world of journalism coming to? As more media outlets merge to form major conglomerates, we’re likely to see more of this. It’s only one of many reasons the Comcast-Time Warner Cable deal is likely to face major scrutiny from regulatory agencies. While many are already calling the deal “too big to fail,” others note it’s certainly not “too big to sail” through the FCC’s review process.

I don’t know if the deal is too big to fail to be approved but it is definitely too big to sail through either the Department of Justice or the FCC without serious, serious examination,” former FCC Chairman Reed Hundt told Reuters. “If approved, (it) would tilt the balance of power at every negotiating table in media and content and broadband and equipment industries.”

Think about it: Comcast is already the biggest U.S. cable provider with 23 million subscribers. At 12 million subscribers, Time Warner is the second largest. The merger will create, by far, the largest pay-TV business, swallowing DirecTV’s 20 million customer-base. That doesn’t even count subsidiaries like NBC Universal and the possibility – or promise – of even more broken embargoes in the world of journalism. Even Faber agreed that the deal will face a tough FCC review:

Comcast deal for $TWC does not face ownership cap restrictions, but sure to get tough review from FCC.$CMCSA wants to avoid consent decree.

— David Faber (@davidfaber) February 13, 2014

Experts in the field tend to agree. Los Angeles Valley College journalism professor William Dauber tweeted what we can expect from such mergers:

@davidfaber

the unchallenged provider of everything — all data, all information, all entertainment — flowing over the wires in its markets— Prof Dauber (@ProfDauber) February 13, 2014

Will there be an end to the media mergers? Unlikely, if the FCC, as predicted, approves the deal. And what will happen to the world of journalism when pay-TV providers eventually own all the news networks? Will the FCC consider Comcast’s evergrowing reach? Or will it simply allow a “too big to fail” deal to slide through?

Read this morning’s full press release announcement below:

Time Warner Cable to Merge with Comcast Corporation to Create a World-Class Technology and Media Company

PHILADELPHIA & NEW YORK–(BUSINESS WIRE)–

Comcast Corporation (CMCSA)(CMCSK) and Time Warner Cable (TWC) today announced that their Boards of Directors have approved a definitive agreement for Time Warner Cable to merge with Comcast. The agreement is a friendly, stock-for-stock transaction in which Comcast will acquire 100 percent of Time Warner Cable’s 284.9 million shares outstanding for shares of CMCSA amounting to approximately $45.2 billion in equity value. Each Time Warner Cable share will be exchanged for 2.875 shares of CMCSA, equal to Time Warner Cable shareholders owning approximately 23 percent of Comcast’s common stock, with a value to Time Warner Cable shareholders of approximately $158.82 per share based on the last closing price of Comcast shares. The transaction will generate approximately $1.5 billion in operating efficiencies and will be accretive to Comcast’s free cash flow per share while preserving balance sheet strength. The merger will also be tax free to Time Warner Cable shareholders.

This transaction will create a leading technology and innovation company, differentiated by its ability to deliver ground-breaking products on a superior network while leveraging a national platform to create operating efficiencies and economies of scale.

“The combination of Time Warner Cable and Comcast creates an exciting opportunity for our company, for our customers, and for our shareholders,” said Brian L. Roberts, Chairman and Chief Executive Officer, Comcast Corporation. “In addition to creating a world-class company, this is a compelling financial and strategic transaction for our shareholders. Also, it is our intention to expand our buyback program by an additional $10 billion at the close of the transaction. We believe there are meaningful operational efficiencies and the adjusted purchase multiple is approximately 6.7x Operating Cash Flow. This transaction will be accretive and will yield many synergies and benefits in the years ahead. Rob Marcus and his team have created a pure-play cable company that, combined with Comcast, has the foundation for future growth. We are looking forward to working with his team as we bring our companies together to deliver the most innovative products and services and a superior customer experience within the highly competitive and dynamic marketplace in which we operate.”

“This combination creates a company that delivers maximum value for our shareholders, enormous opportunities for our employees and a superior experience for our customers,” said Robert D. Marcus, Chairman and CEO of Time Warner Cable. “Comcast and Time Warner Cable have been the leaders in all of the industry’s most important innovations of the last 25 years and this merger will accelerate the pace of that innovation. Brian Roberts, Neil Smit, Michael Angelakis and the Comcast management team have built an industry-leading platform and innovative products and services, and we’re excited to be part of delivering all of the possibilities of cable’s superior broadband networks to more American consumers.”

The new cable company, which will be led by President and CEO Neil Smit, will generate multiple pro-consumer and pro-competitive benefits, including an accelerated deployment of existing and new innovative products and services for millions of customers. Comcast’s subscribers today have access to the most comprehensive video experience, including the cloud-based X1 Entertainment Operating System, plus 50,000 video on demand choices on television, 300,000 plus streaming choices on XfinityTV.com, Xfinity TV mobile apps that offer 35 live streaming channels plus the ability to download to watch offline later, and the newly launched X1 cloud DVR. Comcast is also a technology leader in broadband and has increased Internet speeds 12 times in the past 12 years across its entire footprint.

Time Warner Cable owns cable systems located in key geographic areas, including New York City, Southern California, Texas, the Carolinas, Ohio, and Wisconsin. Time Warner Cable will combine its unique products and services with Comcast’s, including StartOver, which allows customers to restart a live program in progress to the beginning, and LookBack, which allows customers to watch programs up to three days after they air live, all without a DVR. Time Warner Cable also has been a leader in the deployment of community Wi-Fi, and will combine its more than 30,000 hotspots, primarily in Los Angeles and New York City, and its in-home management system, IntelligentHome, with Comcast’s offerings.

Through this merger, more American consumers will benefit from technological innovations, including a superior video experience, higher broadband speeds, and the fastest in-home Wi-Fi. The transaction also will generate significant cost savings and other efficiencies. American businesses will benefit from a broader platform, and the Company will be better able to offer advanced services like high-performance point-to-point and multi-point Ethernet services and cloud-based managed services to enterprises. Additionally, the transaction will combine complementary advertising platforms and channels and allow Comcast to offer broader and more valuable packages to national advertisers.

Through the merger, Comcast will acquire Time Warner Cable’s approximately 11 million managed subscribers. In order to reduce competitive concerns, Comcast is prepared to divest systems serving approximately 3 million managed subscribers. As such, Comcast will, through the acquisition and management of Time Warner Cable systems, net approximately 8 million managed subscribers in this transaction. This will bring Comcast’s managed subscriber total to approximately 30 million. Following the transaction, Comcast’s share of managed subscribers will remain below 30 percent of the total number of MVPD subscribers in the U.S. and will be essentially equivalent to Comcast Cable’s subscriber share after its completion of both the 2002 AT&T Broadband transaction and the 2006 Adelphia transaction.

The companies said the merger agreement between Comcast and Time Warner Cable is subject to shareholder approval at both companies and regulatory review and other customary conditions and is expected to close by the end of 2014.

J.P. Morgan, Paul J. Taubman, and Barclays Plc acted as financial advisors to Comcast and Davis Polk & Wardwell LLP and Willkie Farr & Gallagher LLP are its legal advisors. Morgan Stanley, Allen & Company, Citigroup and Centerview Partners are financial advisors to Time Warner Cable and its Board of Directors, and Paul, Weiss, Rifkind, Wharton & Garrison LLP and Skadden, Arps, Slate, Meagher & Flom LLP are legal advisors.