6 Companies That Could Put Cash In The Hands Of People In Florida

It’s our mission to make money matters a little less insane. We provide financial editorial content free for all and are supported by affiliate partners included in this post which earns us a commission. We hope you enjoy our content and subscribe to our newsletter.

Are you ready to unlock the financial potential you never knew existed? In a world filled with opportunities, there are 6 remarkable companies that might be ready to put cash in your hands and change your financial game.

Whether you’re looking to escape the shackles of credit card debt, transform your home into a financial powerhouse, or better your financial situation, these companies might the keys to unlock your financial dreams. Join us on a journey to discover the hidden treasures of these 6 companies that could give you the cash or help you need.

1. Get A Top Financial Advisor To Help You Reach Your Money Goals (This Is Not Just For Wealthy People)

Unsplash+

There is no better time to plan for your financial future than today.

And a professional money manager/advisor could do wonders for your financial and retirement future. Getting a second opinion from a pro certainly can’t hurt. A financial advisor could help you create long-term strategies for building wealth and managing risk.

If you have a portfolio size of over $50,000 (it could be a combination of cash, stocks, bonds or other assets), there are no-cost online services that make it easier than ever to find trustworthy financial advisers in your area. For example, WiserAdvisor. You fill out a short questionnaire and are instantly matched with up to three local fiduciary financial advisers, all legally bound to work in your best interests.

The process only takes about a minute, and you’ll be offered a free consultation. WiserAdvisor is an independent matching service that helps individuals find the best financial advisor for their unique needs. They have successfully helped over 100,000+ individuals like you find their ideal financial advisor since 1998.

The best advisors will work with you, as a partner, to make a game plan that puts you on track to achieve your financial goals and retirement dreams.

This has the potential to be hugely beneficial: Take a minute to fill out the short questionnaire now.

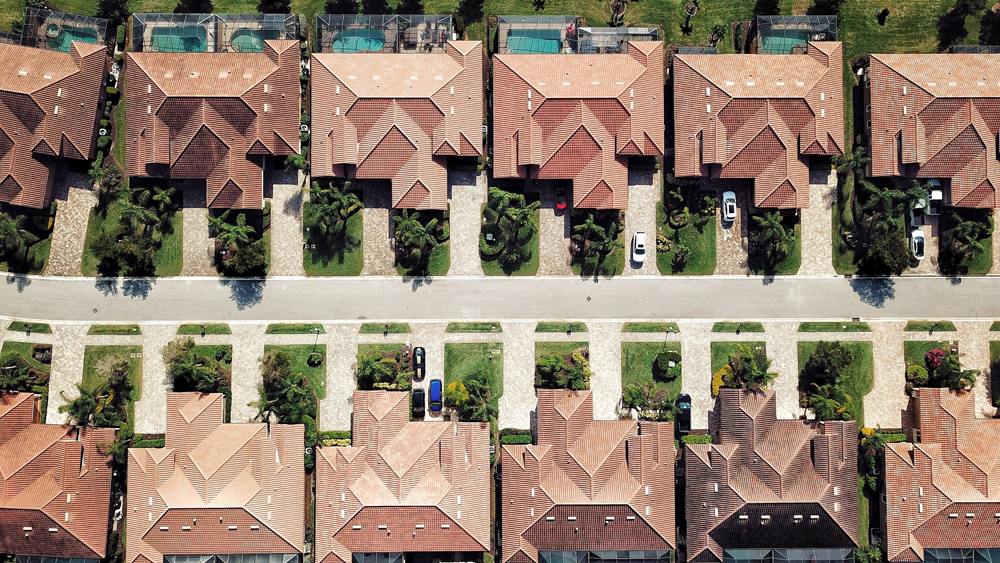

2. Get A Cash Offer For Your Home Online Now (No Real Estate Agent Needed)

Tessa Wilson on Unsplash

Have you been thinking about upgrading or downsizing or maybe cashing out? Maybe you’re just curious about how much money you can get for your home or want to move. Whatever the reason, did you know there’s a way you could receive a no obligation cash offer within 24 hours without any broker/agent, or any showings (and it takes just 3 minutes of your time)?

There is no obligation to sell and it’s completely free to check what your offer is: Offerpad could give you a competitive cash offer right now.

All you need to do is fill in a 3-minute questionnaire. Just fill in some info and Offerpad will carefully evaluate your home with local market expertise.

If you choose to accept your offer, Offerpad will also provide you with free local moving to your next place. You can also pick your closing day, which could be in as little as 24 hours, or choose to extend your stay to live in your current home a little longer.

Find out what your home’s cash offer is in 3 minutes right now.

3. Use Your Home To Avoid Sky High Interest Rates

Ameer Basheer on Unsplash

If you want cash to do something like pay off debt, make a home improvement or borrow up to $500,000 for something else, you could use your home to take out a lower interest home equity loan instead of using a high interest credit card or other higher interest loan. You could use the cash for virtually anything you want and potentially save lots of money in interest payments.

Check your rates now right here with LendingTree in under 2 minutes by answering a few questions and find out how much cash you might be able to get.

A home equity loan allows you to borrow money using the equity in your home as collateral. Because you’re using your home as collateral you usually can get much better interest rates than other loans or using a credit card. You receive the money from a home equity loan as a lump sum, and you pay back the loan in monthly payments.

LendingTree is an online marketplace that could help you get a large sum of cash against the equity in your home quickly. It has been finding top loan options for Americans for more than 20 years.

4. Leave Your Family With Up To $8,000,000 With Affordable Life Insurance Coverage

Unsplash+

We hate to think about it, but who would make the mortgage or rent payments if something were to happen to you? One of the smartest moves you can make is to help protect your family’s financial future. Many people underestimate how much money is needed to provide for their families after they die. This is why life insurance is very important.

The older you are, the more expensive life insurance becomes. And because today is the youngest you’ll ever be, there’s no better time than today to get a life insurance policy.

If you’re looking for life insurance coverage, coverage ranges from $100,000 to $8,000,000 and you can apply online in 5 minutes with Ladder. Ladder is a company where you can actually lock in your rate. As you age and your health may decline, you’ll get to keep paying that same low premium. Ladder lets you apply online in minutes without leaving your couch and get personalized term life insurance offers based on your needs.

Ladder is 100% digital for coverage up to $3 million in coverage which means no medical exams or filling out paperwork! You’ll simply answer a few health questions as part of the online application. Ladder has has provided over $65 billion in coverage.

Term life insurance policies go higher or lower depending on factors like age, health and coverage amount.

Get your free quote from Ladder today and help ensure your family’s financial future is secure.

Ladder Insurance Services, LLC (CA license # OK22568; AR license # 3000140372) distributes term life insurance products issued by multiple insurers – for further details see ladderlife.com. All insurance products are governed by the terms set forth in the applicable insurance policy. Each insurer has financial responsibility for its own products.

5. Diversify Your Retirement Investments with Gold & Real Estate No Matter The Income Level

Unsplash+

Not planning for the future could literally be asking to fail. And nowadays there’s no excuse not to plan ahead with the internet making it easier than ever.

Gold and real estate are some of the best ways to diversify a portfolio, but so many people are missing out because traditional retirements accounts only let someone invest in stocks and bond. Also people make the mistake of thinking they need huge sums of money to invest in these assets. With a self directed Equity Trust IRA (IRA stands for Individual retirement account) anyone can now set up a retirement account that allows them to invest in gold, real estate, and more.

Equity Trust has been in business for more than 45 years, and has over $39 billion in retirement assets under custody and administration. They have over 400 client-focused associates that are there to provide dedicated, personalized service whenever someone needs it.

Simply start by requesting your free self-directed IRA success kit from Equity Trust, it contains useful information. Then (or whenever you’re ready), set up a free no obligation phone call with one of the Equity Trust associates that can help you set up your Equity Trust IRA account if you choose to do so.

6. Help Protect Your Dog Or Cat With Pet Insurance (Get Claims Paid Fast)

Wade Austin Ellis on Unsplash

We love our dogs and cats and want the best for them. We know that talking care of them can be expensive, and vet bills can add to that expense. Did you know that insurance company Lemonade now offers pet insurance for cats and dogs?

Lemonade offers a digital experience that allows users to get coverage in seconds and have their claims approved in minutes. Lemonade has a 4.9 star rating out of 5 stars in the App Store. The company also offers multiple discounts for policyholders, including a 10% bundle discount, 5% multi-pet discount, and a 5% discount for paying annually.

Coverage includes: wellness exams, diagnostics, procedures, medication, vaccines, blood tests, heartworm test, routine dental cleaning, fecal or internal parasite test, and flea/tick or heartworm medication.

Things like your pet’s age and breed (among other things) can affect the cost of pet insurance. Get a free pet insurance quote for your cat or dog now.