Continuing Mergers And Acquisitions In The 3-D Printing Sector

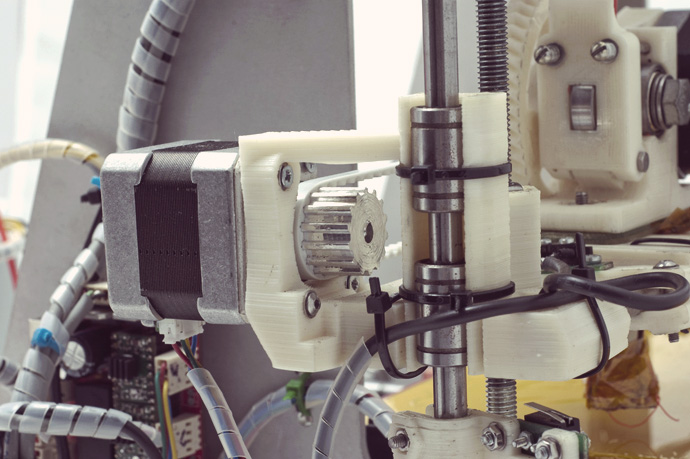

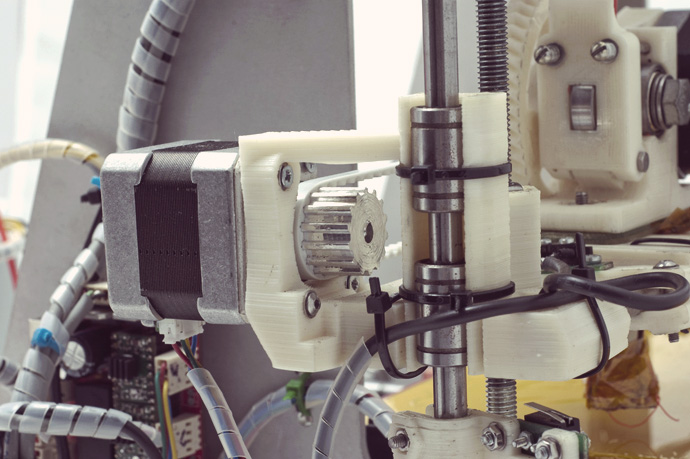

Deals in the 3-d printing sector are heating up, as there are further moves towards consolidation among companies. As the once speculative technology becomes more affordable for retail consumers, 3-d printing companies are scrambling to get a portion of the desktop 3-d printing market. The most recent example is the merger of Stratasys, LTD. (NASDAQ: SSYS) with Makerbot Industries, LLC, a private 3-d printing manufacturer. The 3-d printing market is still young. There are clear significant commercial applications for the technology, yet it is unclear how it will shake out for the consumer retail market.

Stratasys announced late last week that it was merging with Makerbot Industries, LLC. Makerbot is the manufacturer of the Replicator 2 desktop printing system, which has a current retail price of $2,199. The merger is valued at approximately $403 million based upon Stratasys’ recent stock price, as Stratasys will issue 4.76 million new shares to Makerbot. This represents 15.4% of the Stratasys share float. Makerbot had revenue of approximately $15.7 million for 2012, further supported with revenue of $11.5 million in Q1 of 2013. Makerbot has sold 22,000 3-d printers since 2009. The merger gives Stratasys a presence in the desktop printing market, in order to compete with the desktop Cube printer offered by 3D Systems Corp., Inc. (NYSE: DDD).

Stratasys has a market cap of $3.1 billion, and completed a large merger with Object in December of 2012. The Company reported $98.2 million for the first quarter of 2013 which represents an 18% increase over the $83.0 million revenue recorded for the same period last year. The Company has had a wide price range over the past year, with a low of around $42 in June of 2012, and reaching a high of $94.9 in mid May. The share price has been volatile over the past month, as it moved down 7.84%, with a current monthly volatility of 4.63%. However, the stock is up over 80% in the past year. Stratasys further has a high short float of 11.86%, with 3.18 million shares shorted as of the end of May. The stock just broke below its 50-day SMA, and is slightly above its 200-day SMA. The MACD indicates that the price is moving sideways, and there is no current strong directional trend.

Stratasys is not the only 3-d printing company in acquisition mode. 3D Systems recently announced that it was acquiring 80% of Phenix Systems, a French company. Phenix Systems manufactures and sells metal 3-d printers that can print dense metal and ceramic parts. The parts are used for aerospace, automotive, and medical applications. Once the anticipated deal closes in July, 3D Systems plans to acquire the remaining 20% of Phenix Systems on the French stock market.

3D Systems is the largest player in the 3-d printing sector with a market cap of $4.26 billion. The Company recently reported solid earnings with revenue for Q1 of 2013 growing 31% to $102.1 million from the prior year quarter. Revenue from 3D printers and other products increased from $15.0 million to $39.7 million. 3D Systems completed a 3 for 2 stock split in February of this year in order to increase liquidity and raise funds for more acquisitions. Additionally, the Company sold 6.2 million shares, including 1.3 million shares sold by corporate insiders. 3D Systems said it planned to use the proceeds from the offering to finance future acquisitions and for working capital. The Phenix Systems acquisition was as a result of these moves.

3D Systems’ share price is trading around $44.42, and recently bounced off its 50-day SMA. The price is well above the 200-day SMA, but has generally been range bound since mid-May. The stock is up over 117% on the year, but is down around 7% in the past week. The Company has a very high short float of 23%, with 23.4 million shares sold short as of the end of May. The stock looks technically strong, but is flirting with moving below its 50-day SMA, which can be a bearish signal.

The major players in the 3-d printing sector are hungry for acquisitions. Since the nascent market is so young, it is difficult to tell how these acquisitions will play out. For example, 3D Systems is attempting to maintain a presence in both the consumer and commercial printing sectors, and it is unclear how sustainable this business model ultimately is. Further, 3-d printing stocks have run up over the past year on the hype associated with the futuristic technology, and the share prices are possibly a bit frothy. Any investor jumping into the sector needs to be ready for the volatile price swings, as well as the influence of very high short interests. While 3-d printing has the potential to totally revolutionize a portion of the retail and commercial manufacturing market, it is unclear which companies in the sector will be most successful.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.