2 Moves That Might Help Get Rid Of Debt Quicker

It’s our mission to make money matters a little less insane. We provide financial editorial content free for all and are supported by affiliate partners included in this post which earns us a commission. We hope you enjoy our content and subscribe to our newsletter.

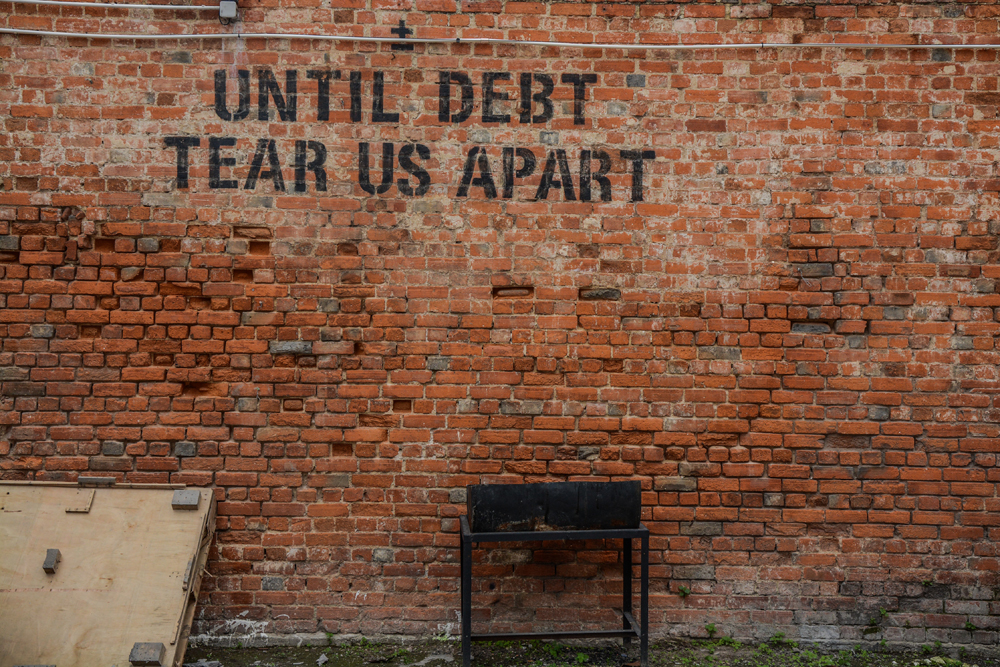

Debt is a vicious cycle. Sometimes once you have some debt it could quickly spiral into more and more debt due to interest charges.

That’s why in any economy it’s best for yourself financially as well as mentally to get out of debt as quickly as possible. These 2 companies might be a big help, find out what they could do for you!

1. If You Have Debt, Try This To Get Out Of It Faster

If you have debt, you know the ridiculous interest rates are like robbery.

And the truth is, companies you owe money too don’t really care. They are just getting rich by ripping you off with high interest rates — some with interest rates up to 36%.

If you have more than $10,000 in debt from credit cards, medical bills, collections, or personal loans, National Debt Relief could be a huge help. Their representatives might be able to assist you in consolidating your debt into one low monthly payment and help you lower your payments by up to 50%.

Since 2009, National Debt Relief has successfully helped more than 550,000 people get out of debt. And you have nothing to lose by letting National Debt Relief tell you how they can help you.

There are zero fees until your debt is resolved, you might be debt free sooner than you expected. Just answer a few short questions to find out if you qualify. It only takes 30 seconds right here.

2. Get Up To $50,000 To Pay Off Your Credit Card Debt

Credit card companies make lots of money charging their customers high interest, you do not need to be one of them.

Did you know you could get out of this debt spiral by using a personal loan to pay off your credit card debt? That’s because personal loans typically have a lower interest rate than a credit card.

2. Get Up To $50,000 To Pay Off Your Credit Card Debt

Credit card companies make lots of money charging their customers high interest, you do not need to be one of them.

Did you know you could get out of this debt spiral by using a personal loan to pay off your credit card debt? That’s because personal loans typically have a lower interest rate than a credit card.

LendingTree makes it super easy to see multiple options in one place, and apply for a personal loan in minutes online. Personal loans with LendingTree start at 6.99% APY, that could be a huge saving versus what credit card interest rates charge you. You’ll then be able to choose which personal loan is right for you, you can then get your credit card debt paid off as early as one business day.

It’s common that someone takes out a personal loan to pay off their credit card debt, and then begins paying off the lower interest personal loan.

You can also use a personal loan to pay off other types of debt, fund a vacation, or really anything you want.