Feds Affect On Stocks Could Be Short-Lived

Hints from the Federal Reserve that it may begin modifying its cheap money policy have sent the stock market down almost 3 percent over the past week. Are we in for a long bear market as the Fed slowly changes course on its monetary policy?

The initial movement of the market is no surprise. Wall Street has long been poised to act on even the slightest change in fiscal policy. The sudden downturn in stock prices should have been no surprise. But unless the Fed makes some drastic moves in the weeks or months ahead—and there is no indication that that is going to happen—the stock market should stabilize.

One factor going against the market, however, is that stock levels have reached all-time highs. Whenever the market begins to get overheated, it doesn’t take much to spur a sell-off. Frankly, with stock prices at this level, there is little reason to expect significant growth in stock prices in the near term.

But the long-term outlook for the market should be fairly positive for the same reason the Fed is finally considering modifying its fiscal policy—certain signs in the economy are finally beginning to look a little more promising.

According to the Fed report on June 19,

Economic activity has been expanding at a moderate pace. Labor market conditions have shown further improvement in recent months on balance, but the unemployment rate remains elevated. Household spending and business fixed investment advanced, and the housing sector has strengthened further, but fiscal policy is restraining economic growth.”

The Fed also noted that inflation has remained relatively tame.

Partly reflecting transitory influences, inflation has been running below the Committee’s longer-run objective, but longer-term inflation expectations remain stable…. The committee also anticipates that inflation over the medium term will likely run at or below its 2 percent objective.”

While the Fed hinted that it may adjust its policy at some point, the Committee offered no indication that it was in any hurry to restrict monetary policy or push up interest rates.

The Committee will continue its purchases of Treasury and agency mortgage-backed securities, and employ its other policy tools as appropriate.”

As for future action, its report said:

The Committee is prepared to increase or reduce the pace of its purchases to maintain appropriate policy accommodation as the outlook for the labor market or inflation changes.”

In other words, if the Fed sees enough progress in employment and the economy, it might take some action to tighten monetary policy. If not, things really aren’t likely to change very much.

The Fed claimed that its primary goal is to continue a monetary policy designed to “support continued progress toward maximum employment and price stability.” To that end, the Committee said that any significant change in their stance will probably be a long time in the making. “The Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens.”

The low cost of capital created by artificially low interest rates has been a major force in driving up earnings for companies, and pushing up the price of stocks. It’s little wonder than even the distant fear of cheap money drying up could have a dampening effect on the market.

As a result, hopeful signs for the economy can sometimes have a contrarian effect on stock prices. While you might expect brighter economic indicators to bolster stock prices, the fear that an improving economy will motivate the Fed to tighten money actually helps drive prices lower.

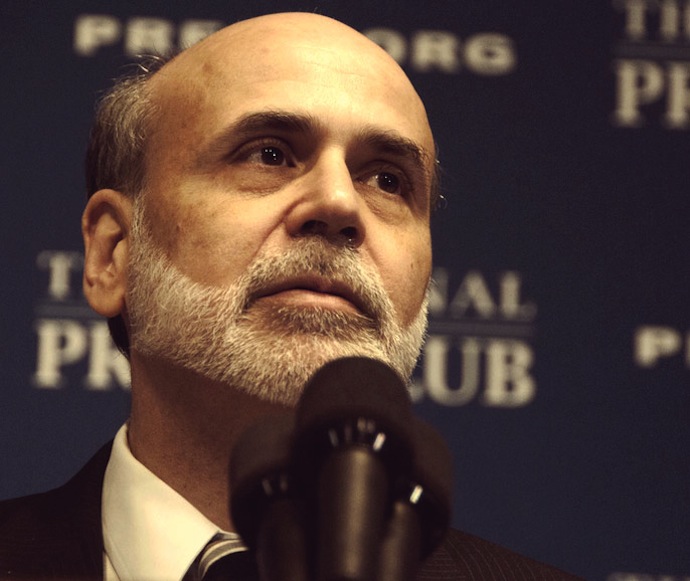

With Bernard Bernanke slated to step down as Fed Chairman as early as January, clearly he would like to see a legacy of responsible monetary management. He definitely does not want to see the economy spin back out of control just as he leaves his post.

So the Fed will continue to tread very carefully in modifying its policy. But as the economy and unemployment improve, there is no question the Fed will slowly move to tighten monetary policy. Dishing out billions of dollars at near zero percent interest is ultimately unsustainable for a stable economy.

You can expect a negative short-term reaction by the stock market every time the Fed modifies its policy—or even indicates that it is considering modifying it its policy. But the long-term prospects of the stock market should not be affected if the Fed moves slowly and methodically as the economy improves.