28 Financial Hacks Anyone Can Do To Improve Their Finances

We work hard to bring you awesome editorial content. Some links on this page are from our affiliate partners which earn us a commission and help make this possible.

Let’s be totally honest: gaining control of your personal finances is hard.

There are so many variables to consider, numbers to crunch, cards to deal with, and due dates to juggle. Who has time to deal with that?

Fueled by technological advancements, globalization, and changing consumer behavior, the financial world has grown to be more and more complicated with each passing year.

Luckily, with that evolution has come another phenomenon: financial hacks.

These days, there are a ton of easy financial hacks that can quickly improve your financial situation with little effort.

Continue reading and dive into our in-depth list of the best financial hacks that you can start implementing today!

1. Know your credit (for free).

Shutterstock

Being informed about your credit is always a good idea. Once you know where you stand, you can start to take appropriate actions, whether that means working to improve your score or taking advantage of a good score by applying for a better credit card or refinancing your mortgage for a lower rate.

The best part about checking your score is that it doesn’t have to cost you anything. Sign up for Credit Sesame for free, and get an updated score each month. You’ll also get daily alerts to let you know if anything has changed.

You’ll be able to manage all your finances in one place, which makes it easier to tackle debt and stick to a budget. In addition, you can track your accounts over time and take advantage of Credit Sesame’s free identity theft protection. It’s like having your own financial advisor that you don’t have to pay. It doesn’t get much better than that.

Get your free credit report from Credit Sesame.

2. Pick up driving gigs ($1,000 in 30 days guaranteed from Lyft).

Abdiel Ibarra on Unsplash

Lyft allows drivers to pick up paying passengers when they choose to do so. It operates on the same model as Uber, giving drivers the freedom to make their own schedule. Lyft says median earnings are $29.47 per hour, nationwide. In Lyft’s top 25 markets, that’s $31.18 per hour. Some of its drivers make more than $800 by only working on Friday nights and weekends.

Sign up to be Lyft driver and make $1,000 in 30 days guaranteed.

Your other ride-sharing financial hack option is well known on-demand transportation company Uber. You’ve probably been driven around town by an Uber driver-partner, but you may not have ever considered becoming an Uber driver-partner. However, doing so can bring in a sizeable amount of extra cash. Think about it this way – you already own a car. You already drive. Why not pick up some extra money as you do it? You can opt to drive occasionally, or make it your main gig. You’re always in control, making your own schedule and choosing which riders to pick up.

Sign up to drive with Uber while you’re signing up for Lyft.

3. … And food delivery gigs.

Tim Mossholder on Unsplash

Sometimes a cozy night on the couch with Chinese takeout and Netflix is just what the doctor ordered. But those lovely evenings are only made possible by delivery drivers who bring food straight to your door. And one of our easy financial hacks is making extra cash by being one of those drivers.

Uber Eats allows delivery partners to make their own schedules, delivering food to hungry customers whenever is convenient. The concept is incredibly simple – customers order food from a restaurant via the Uber Eats app, and a delivery partner picks up the order from the restaurant and delivers it to the person’s home or office.

DoorDash operates on a similar model, allowing delivery drivers to become “dashers” for the company. Many drivers have great things to say about their jobs, including the perk of getting paid to learn about new eateries in their city.

Earning potential is up to how much time you put in, which is totally up to you. These are both good side hustles.

We recommend signing up for both Uber Eats and DoorDash, if they are available in your area.

4. … Or Grocery Shopping Gigs.

Gratisography on Pexels

Earn extra income in your spare time being a shopper for Instacart. Instacart connects customers with shoppers to deliver fresh groceries to their door. You can choose hours that work for you. Take time off whenever you want, or work extra hours when you feel like it. You have the option of being a full-service shopper (includes delivering) or an in-store shopper.

Sign up to be an Instacart Shopper.

5. List a room in your house.

Gabriel Beaudry on Unsplash

A recent analysis by Smart Asset found that $20,619 is the average expected annual profit of Airbnb hosts who list a full two-bedroom apartment or house in 15 major cities.

If you have extra space in your home that sits empty or acts as a storage room, you could be missing out on one of the best financial hacks. Listing a room or section of your house has never been easier, thanks to Airbnb. All you have to do is visit the Airbnb website, and the service will walk you through every single step. You’ll be a host in no time, welcoming guests from all over the world and enjoying extra cash.

Airbnb even suggests a market rate for your space, so you don’t have to worry about guessing how much it’s worth. Of course, you still have the freedom to charge anything you like. It’s your space, after all. You remain in control the entire time, choosing which bookings you want to take and when you want to take them. Sign up to become a host.

6. Side Job: Become A Stylist.

James Gillespie on Unsplash

Do you love fashion? Become a “stylist” by being an independent seller of Stella & Dot merchandise.

The women’s fashion company allows you to sell their products in person and online for a 25%-35% commission. Start a Facebook page, share photos of your pieces on Instagram, or host a Stella & Dot party with all your friends. How you earn is totally up to you. You also get a 25%-50% discount when you buy a product from the company.

The average Stella & Dot stylist makes $1,400 a year, which is a decent chunk of change. However, some exceptional stylists have been known to make around $43,800 based on 2017 data. As with most easy financial hacks, you get what you put in. You can begin with as little as a $199 investment for the Stella & Dot starter kit.

Sign up to become a stylist with Stella & Dot.

7. Make Money off Your Car.

Kaique Rocha on Pexels

Owning a car isn’t cheap, so seizing the opportunity to make money from your vehicle is a smart thing to do. This is made possible with Getaround. You can turn your car into another paycheck with no driving necessary, listing your car for free and choosing how and when to rent your car. There are car owners who have pocketed over $30,000 using Getaround.

If you’re worried about someone else driving your car, every trip includes $1,000,000 insurance and 24/7 roadside assistance. Drivers are screened to ensure they have a safe driving record. That’s why this is one of the best financial hacks – security!

Get around is currently available in San Francisco, Los Angeles, Boston, Washington D.C., Chicago, Seattle, Portland, Philadelphia, Miami, New Jersey, San Diego and Denver.

If Getaround is available in your city, sign up to list your car here.

If Getaround is not available in your city (or even if is it), you can list your car on Turo.

Turo allows you to list your car as a rental as well. You’ll find car owners renting their cars for anywhere from $30 to $1,000 a day. Sign up to list your car on Turo.

8. Be smart when it comes to auto insurance.

Photo by Matthew Henry from Burst

If you’re like most Americans, you drive less than 200 miles per week. However, you’re still stuck paying the same amount for car insurance as those who are always behind the wheel. Doesn’t sound fair, does it? That’s because it isn’t.

Metromile has changed the entire car insurance game, offering a pay-per-mile service to drivers in California, Illinois, New Jersey, Oregon, Pennsylvania, Virginia, and Washington (with more states to come). All you do is pay a base rate of $29, then pay pennies per mile. On average, a typical driver who switches to Metromile saves $500 per year by doing so.

Don’t worry about the odd day when you find yourself driving a lot. You won’t pay for anything you drive past 250 miles (or 150 miles if you live in New Jersey). Your miles are all tracked using a simple device called Pulse, which plugs into the OBD port of your car. Just keep it plugged in, and Metromile takes it from there.

Other Metromile perks include the app, which even has a car locator so you never have to wander aimlessly around a parking lot ever again. It can also let you know if you’re in a zone where you shouldn’t be parked (a feature which can save you lots of money in parking tickets).

Get a free MetroMile auto quote.

If You Don’t Live In A State Where MetroMile Is Currently Available…

… or want to shop around a little more, get a free auto quote from Liberty Mutual. Drivers who switched saved an average of $509. Benefits that come standard are a 12-month rate guarantee, 24/7 customer service, and lifetime repair guarantee.

Get a free Liberty Mutual auto quote.

9. Stop Overpaying For Renters & Home Owner Insurance

NeONBRAND on Unsplash

As another one of our best financial hacks, check out Lemonade for renters and home insurance. Renters insurance starts at just $5 a month, and homeowners insurance at just $25 per month. Even if you’re currently insured, Lemonade will handle the switching hassle for you. You can get insured in 90 seconds, seriously.

Lemonade’s mission is to transform insurance from a necessary evil into a social good. Unlike any other insurance company, they take a flat fee from your premium, use the rest to pay claims, and give back what’s left to causes you care about. They gain nothing by delaying or denying claims, so they handle them quickly and fairly.

This means:

- You get some great insurance, while making a mark on a cause you care about.

- There’s no conflict of interest between you and them, because they always earn a flat fee.

- Social good is baked into the core of their business model. That’s why they’re a Public Benefit Corporation and a Certified B-Corp.

Get a free renters or home insurance quote from lemonade.

10. Cut monthly bills without lifting a finger.

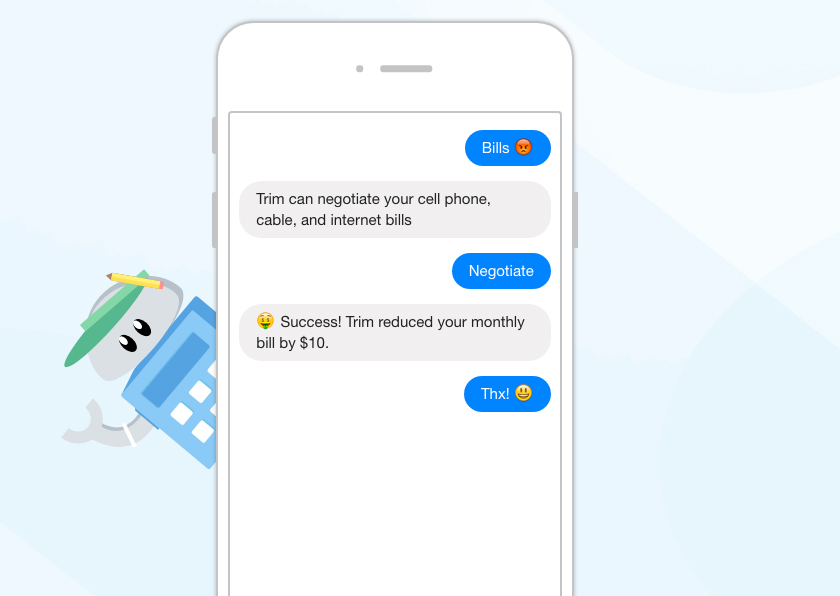

Trim

Even though you’re probably a lovely person with great financial aspirations, you likely aren’t saving as much money as you could be each month. Automating your savings is a great way to ensure you meet your goals, and Trim is designed to do just that. Trim has saved its users $1,000,000 just in the last 30 days. It literally cuts your bills automatically.

Once you’ve given it permission to do so, Trim analyzes your bills and subscriptions for free, determining how you can save money. It can cancel subscriptions you aren’t using, negotiate with your cable company, or find you better car insurance. Trim also tracks your spending, so if you’re ever wondering how much money you gave to Amazon in a given month, you can just pick up your phone and ask Trim for an answer.

Almost everyone can benefit from this financial hack, whether it’s someone who didn’t realize they were still being charged for a subscription, or someone who wrongly thought they were already paying the lowest rate possible to their internet company. And don’t forget about the countless hours saved by not having to be placed on hold with customer support – that’s priceless.

Sign up for the Trim App.

11. Unlock amazing discounts.

Markus Spiske on Unsplash

When it comes to shopping, everyone loves a bargain – and we all love easy financial hacks. Voiced Market allows you to save up to 95% on products and services from brands big and small. You’ll find exclusive deals from brands you know, and brands you’ll want to try. You never know what just might show up, but you can bet it’ll be good. You can feel even better because purchases help to better our world, a percentage of Voiced Market profits go toward educating and feeding those in need.

Many deals are listed on the site, but some of the best offers can be found by signing up to Voiced Market’s newsletter. Think of it has a top-secret society of smart shopping, with details delivered straight to your inbox. The only thing you have to do is try to contain your excitement when you see the incredible savings.

As a consumer, you have a lot of choices when it comes to shopping. But why not make the smartest choice and check out Voiced Market? Your bank account will be happy about it, and so will you.

Sign up for Voiced Market’s free newsletter today.

12. Earn the most interest you can.

Vladimir Solomyani on Unsplash

You’d never pass up free money if you found it on the sidewalk, so why would you pass up free money in your bank account? That’s exactly what you’re doing if you’re not opting for an account with a high-interest rate.

If you don’t open a CIT Bank account you’re just lazy. It offers a higher than the national average interest rate. The best financial hacks generate the best returns, don’t they!

CIT Bank offers some of the best interest rates out there. It’s currently offering a decent interest rate on an online savings account. The best part is that you only need $100 to open an account with the bank.

You can do everything online – it just takes a few minutes to fill out some information. Open an account today, and start raking in those interest payments.

13. Be Student Loan Debt Free Sooner

Shutterstock

Financial hacks like refinancing your student loans could save you thousands, even tens of thousands of dollars. Penfed could help you do this with ease by answering 4 easy questions and finding your rate. Variable rates as low as 2.85% and fixed rates as low as 3.25%. Established in 1935, PenFed is one of the country’s strongest and most stable financial institutions with over 1.6 million members and over $24 billion in assets.

Student loan refinancing is the process of taking one or more student loans and consolidating them into one new loan. The refinanced loan will often include new terms, such as a lower interest rate, a different monthly payment and a new repayment term length.

When the federal government extends loans to students to attend college, the government does not check credit and everybody receives the same rate. This is a great program for most students who need help with their tuition but are unlikely to be able to borrow at a good rate from private lenders. But as the years pass, the government does not offer to refinance these loans at lower interest rates… even if market interest rates have dropped and graduates have steady jobs and good credit. As a result, many graduates end up paying higher rates than they could get from a private lender by refinancing their federal loans.

Find your rate here and see what you could be saving with this financial hack!

14. Build your credit.

Shutterstock

No one achieves a fabulous credit score overnight, and everyone has to start somewhere. If you don’t have a credit history, it’s time to build one. After all, you’ll need good credit when it comes time to rent an apartment, apply for an auto loan, or get a mortgage. However, it’s absolutely vital that you do this in a responsible way.

Thankfully, one of our easy financial hacks can help.

Self Lender is a great way to build credit while saving, instead of spending. The concept revolves around a credit builder account, which is a small loan held in a CD account for 12 months. As you pay into the account, your payment history is reported to all three credit bureaus. At the end of the year, you’ll have a credit history and a CD which unlocks with interest.

In other words, you have a choice. You can build credit while spending money and paying the credit card company interest, or you can build credit while saving money and earning interest. It’s a no-brainer.

Get started with Self Lender.

15. Make the most out of your 401k.

Fabian Blank on Unsplash

If your employer offers a 401k, you should always opt-in. But that’s not all you need to do. You need to diversify and make sure you aren’t being charged hidden fees. You need to monitor it. You need to make sure your money is working as hard as it can for you. That’s where Blooom comes in and why you’ll want to take advantage of it’s free 401k analysis.

The team at Blooom knows what they’re doing. In fact, the company’s founders used to manage money for millionaires. Now they spend their time offering unbiased advice to any 401k holder that chooses to hire them. They eliminate anything that doesn’t make sense for your retirement goals and use their algorithm to select ideal investments for you. Those results are then double checked and cross-referenced. Once all that is done, Blooom monitors your account for any changes, and deals with rebalancing when the time comes. You’ll also have access to a certified financial planner who can answer any questions along the way.

These guys really know what they’re doing, and they’re well worth the investment. Just think of how much richer you’ll be when you retire if you start making smart choices now with this financial hack.

Sign up and get a free 401k analysis from Blooom.

16. Save on your prescriptions.

Joshua Coleman on Unsplash

Even with insurance, prescriptions can be costly. However, there are ways to lower your costs. The next time you need to pick up a prescription, head over to singlecare.com to get a better deal. It’s super simple to use. Just put in the prescription name and your zip code. It’ll then find a few discount offers for you. Then just print it out or have it emailed or texted to you, and present it to the pharmacist when you pick up your medication. It’s such an easy way to save, it’s a crime not to use it. They even offer a free SingleCare card you can present instead.

Sign up for the free SingleCare pharmacy card (no insurance needed).

Another prescription saving option is BlinkHealth…

Blink Health offers more than 15,000 drugs which are marked down by as much as 95%. That’s huge, and can mean everything to someone who is struggling to pay for their medications each month.

The company was founded by two brothers, in an effort to bypass insurance companies. Blink Health goes straight to drug makers, cutting out the insurance middleman. You go to the website, click on the drug that your doctor prescribed, pay online, and print out a receipt to take to one of 60,000 participating pharmacies – including major ones like Walmart and Kroger. You don’t pay anything at the pharmacy, because you’ve already paid online.

This tactic is often much cheaper than a person’s insurance co-pay, and makes a lot of sense for people who have extremely high insurance deductibles. At the very least, you have nothing to lose. The next time you get prescribed a medication, visit Blink Health and see how much they can save you.

17. Reduce Your large Wireless Bill.

Rohit Tandon on Unsplash

We all love using our mobile devices, but hate the big bill every month. Mint Mobile claims they have taken everything wrong with wireless and made it right. They may just be correct about that, with wireless plans starting at just $15 per month and nationwide 4G LTE. The $15 a month plan has 2GB of data and unlimited talk and text. There is a risk-free 7-day money back guarantee, available on all of its plans.

You can buy a phone from Mint Mobile or bring your own unlocked GSM phone and keep your current number. Just switch out the SIM card and presto. You can check here if your existing phone will work with Mint Mobile.

Mint Mobile is all digital which means they have no buildings to maintain or storefronts to drive up the cost. They pass all the savings on to you. That’s what you call an easy financial hack.

View available Mint Mobile plans.

18. Use A Home Equity Loan To Get A Better Rate.

Jesse Roberts on Unsplash

If you want to consolidate debt, make a home improvement or make a major purchase, you can use Figure for a loan between $15,000 and $100,000 to make that happen. With a Figure Home Equity Loan, you can tap into your home equity to get a better rate.

Figure offers same-day approvals, funding in 5 days, no ongoing fees, and fixed monthly payments.

19. Hire freelancers for less.

Manny Pantoja on Unsplash

At some point, you’ll probably find that you need to hire someone. Maybe you need a writer to create great copy for your website, or a graphic designer to make that site look pretty. Or maybe you’ve finally decided to take up guitar, and you need a teacher. Look no further than Fiverr.

The website is full of freelancers who offer tons of services, from translations to custom artwork. They list what they have to offer, and the amount they are willing to take for that service. You browse through profiles and hire the person you think will do the best job at a good rate.

This is a great way to be presented with tons of freelancers and get to know a little bit about each person before you decide who to hire. It also tends to be a lot cheaper than hiring a traditional freelancer. It’s a really cool platform that embraces everyone from email marketers to creative souls.

20. Hire taskers on TaskRabbit.

rawpixel on Unsplash

TaskRabbit is the convenient affordable way to get things done around the home. Choose from over 140,000 vetted Taskers for help without breaking the bank.

Whether you need help with moving or packing, furniture assembly, home improvement, a general handyman, or something totally different, TaskRabbit can help.

Just describe the task, get matched with fully vetted taskers, and get started.

21. Earn cash for just using the internet ($5 bonus).

Swagbucks is a great way to make money doing the things you already do online. You rack up Swagbucks when you shop online, watch videos, play games, or answer surveys. Every 100 Swagbucks equals $1. Once you’ve accumulated 300 points (they add up fast), turn those points into gift cards or get cash back through Paypal.

Signing up is incredibly easy, and you earn four Swagbucks just for doing it. You get a $5 sign-up bonus just for confirming your email address. Sound too good to be true? It’s not. It’s entirely legit.

Just remember to always go through a retailer’s link on the Swagbucks site, rather than heading straight to the site itself. This is the only way you’ll see your points grow.

22. Earn free gift cards for shopping in-store and online.

Shopkick

Shopkick could be one of the best financial hacks: an app that rewards you for shopping in-store and online. Earn reward points (they call them kicks), then redeem for a wide selection of free gift cards!

Have fun earning rewards points (kicks) when you walk into partner store, scan select products, or make purchases. You also can earn kicks when you visit our online partners from Shopkick, view select offers, or make online purchases.

Shop kick users have earned $78 million in free gift cards!

23. Earn Even More Shopping Online.

Earn free gift cards with MyPoints when you shop online at 1900+ top retailers like Walmart, eBay & Amazon.

You’ll earn a free $10 Amazon gift card with your first purchase.

10 million MyPoints members have been awarded $236 million in gift cards and PayPal cash!

24. Slash your cable bill.

Tim Mossholder on Unsplash

Are you up for a challenge? If so, try to find someone you know who is satisfied with their cable provider. You probably won’t find many (or any) because cable companies seem to be universally disliked due to their pricing, service packages, and the fact that they make you block off an entire day for a visit to your home which may or may not actually happen.

If that sounds familiar, it’s time to ditch your traditional cable provider and try something new. Sling TV allows you to create a custom television plan for yourself. You choose the channels you want, which means you don’t have to pay for 20 sports channels if you hate sports. Cool, right?

It’s a live cable service that’s delivered through the internet, so you also don’t have to worry about paying for equipment or having a serviceman come to your house to install a bunch of wires. You get to watch your favorite TV shows at home or on the go, using your laptop, phone, or tablet. There’s no long-term contract, no high monthly bills, and no hidden fees. It’s amazing when financial hacks are flexible.

You pay just $20 a month for the basic package, which gives you 30 channels. For $5 more per month, you get 45 channels. Take that, traditional cable company.

You can try out Sling TV for free, for seven days, by clicking here.

25. Improve your credit.

Shutterstock

If your credit score isn’t what you want it to be, there are steps you can take to start improving it. One of those is to head over to CreditRepair.com to take advantage of their team of experts. They’ll speak to the credit bureaus on your behalf, working to dispute any errors or negative marks on your credit report. Basically, they’ll work as your advocates and use their knowledge of industry rules to protect you and get the best possible outcome. Once credit card companies agree to make changes, CreditRepair.com will check up on them to make sure they actually follow through.

Click here to receive a free personalized credit consultation.

Lexington Law is another great service which focuses on credit repair. It’s been helping consumers for more than 27 years, and it has the stats to back up its claims. For example, past clients have seen an average of 10.2 items, or 24% of their credit report negatives, removed within four months. In 2016 alone, Lexington Law’s experts managed to collectively get nine million negative items removed from credit reports. Every prospective client is offered a free consultation, so you have nothing to lose by getting in touch.

Click here to speak to the experts at Lexington Law and receive your free consultation.

26. Pay off Credit Card Debt Faster.

Shutterstock

The first step to financial wellness is taking control of your credit card debt, which you can do as an easy financial hack. What better way to pay off your credit card debt than with a company called Payoff. The Payoff Loan gives you the power to reduce multiple high-interest payments into one low-rate monthly payment.

Paying off your credit cards is one of the best investments you can make. The Payoff Loan is a personal loan between $5,000 and $35,000 designed to eliminate or lower your credit card balances. The Payoff Loan is designed to allow you to take control of your finances and pay your credit cards off faster.

There are no application fees or commitments, and it does not impact your credit score. A team member from Payoff’s California office is always ready to help you.

Based on a study of Payoff Members between August 2017 and February 2018. Payoff Members, who paid off at least $5,000 in credit card balances, saw an average increase in their FICO® Score of 40 points within four months of receiving the Payoff Loan. Individual results may vary.

Find out how much you could be saving with a Payoff Loan.

27. … Use A Personal Loan To Consolidate Debt.

Anete Lūsiņa on Unsplash

PersonalLoans.com is a website that works with a network of lenders. Those lenders offer three types of loans – personal installment loans, bank personal loans, and peer-to-peer loans. As a potential borrower, all you need to do is head to the website and fill out a fast and quick loan request. After that, you’ll be connected to lenders who meet your needs. If you accept an offer, you can have the cash in as little as one business day.

Whether it be for consolidating debt, an emergency, home improvement, or even a family vacation – a low-interest personal loan can be a safe and reliable way to meet your financial needs.

There are different requirements for the loans, depending on which kind you’re seeking. Those with low salaries and low credit scores should aim for a personal installment loan, as borrowers only need a monthly income of $2,000 and a minimum credit score of 580. Bank personal loans require the same minimum credit score, but a higher monthly salary of $3,000. Peer-to-peer loans usually require borrowers to have a minimum score of 600 and a monthly income of $2,000.

Submit your online request at PersonalLoans.com

28. Save on Life Insurance.

rawpixel.com on Unsplash

Ladder offers term life insurance that’s easy to get and easy to change. There are no brokers, which means no upselling. Ladder offers a quick three-step process — get a quote, complete the application in five minutes and get an instant decision on coverage. Ladder makes it super simple for policyholders to decrease or apply to increase their coverage in a matter of clicks, for free. There are no policy fees, and you’ll benefit from a price lock guarantee. You can also cancel your policy whenever you want.

Get an instant life insurance quote from Ladder.

Ladder Insurance Services, LLC (CA license # OK22568; AR license # 3000140372) distributes term life insurance products issued by multiple insurers – for further details see ladderlife.com. All insurance products are governed by the terms set forth in the applicable insurance policy. Each insurer has financial responsibility for its own products.