Google Debit Card: Can Banking Change?

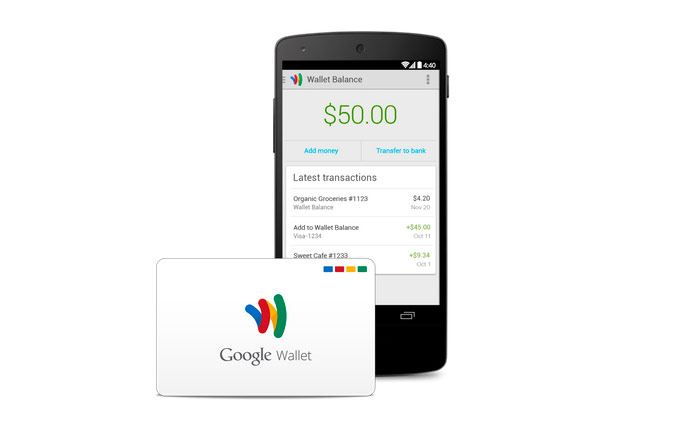

Google Inc (NASDAQ:GOOG) is one of the many internet companies trying to change the way payments are made. The company unveiled a debit card on Wednesday that will allow US customers to withdraw money from any ATM and pay at any location that accepts Mastercard. Google has tried to enter the payments sphere before, and bankers have never been worried. Perhaps it’s time for them to start.

Google says that the debit card will be free and users will not have to pay any fees to use it. Google Wallet is one of the many services that could take money out of the hands of consumer banks and put it into the hands of tech companies. Google may soon compete with JPMorgan and Citigroup.

Google Turns Banker

Tech companies tend to hold a lot of cash. There is another industry that holds more, however, and that’s banking. Google Inc (NASDAQ:GOOG) wants customers’ cash flowing through its debit card because it wants to collect information about what they’re purchasing. As with Android and many other Google services, the company is willing to offer it free in exchange for that data.

There are distinct generational advantages for Google in banking. Young people have a few attributes that make them more likely to choose Google over Bank of America. First of all they don’t trust banks in the wake of the 2008 crisis. Second they don’t mind giving away their information. Third they don’t know what it’s like to earn interest on a deposit account.

Google Is Not Ready For Banking

If Google wants to become a financing house, there’s two major things it needs: infrastructure and mass adoption. The first may be easier than the second. The Google debit card is a huge jump in infrastructure. Users are now able to withdraw money anywhere, and pay almost anywhere. A couple more pieces are needed to complete the puzzle however.

Customers need an easier way to put money into their Wallet account. At the moment they require a linked bank account or a transfer from another Google wallet account. Google needs to create a way for users to lodge cash into their Google Wallet accounts, and it needs a way to allow users to get paid into their Wallet accounts if they want to dislodge bankers.

There are barriers to surmount and Google may never be able to achieve the mass adoption it needs to really boost its ad efficacy. The company will not be able to offer services like loans or high interest accounts. Google needs mas adoption if the Google Wallet debit card is to be useful.

Google Inc (NASDAQ:GOOG) may turn itself into a banking powerhouse yet, but the company isn’t all that interested in doing so right now. Google banking might be coming, but it’s going to take the undivided attention of the company to dislodge JPMorgan. That’s not being given today.

Disclosure: Author represents that he has no position in any stocks mentioned in this article at the time this article was submitted.