High School Business Club Receives $100,000 To Invest

Just as tens of millions of Americans play fantasy football each year, millions of students participate in the Stock Market Game. But instead of forming a hypothetical team of favorite players throughout the NFL, the students invest a hypothetical $100,000 in an online portfolio, competing to achieve the highest return. What would happen, however, if fantasy portfolios—or football teams, for that matter—weren’t hypothetical? One group of high-school students is about to find out. They won’t be forming a team of real football stars. Instead, they’ve been given 100,000 real dollars to invest as they see fit.

Clint Golman, who graduated from Dallas’ Greenhill School in 2012, discovered that many colleges allow student investment clubs to manage real money. He approached Greenhill’s administration and requested the school allow its investment club, for which Golman served as president for two years, to “manage a small portion of the school’s investments.”

“We thought that would provide a better learning experience than a game that was all about taking the biggest risk to win,” Golman told CNN.

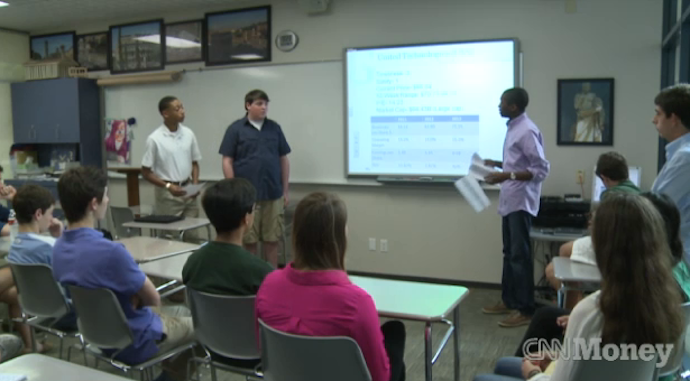

Little came from his request, but after he graduated the club made a formal presentation to the school’s Board of Trustees investment committee. Business Club leaders asked the committee for between $30,000 and $50,000 of Greenhill’s $30 million endowment.

Although several committee members thought the responsibility of investing real money would benefit the students’ own future investments, some were concerned that Greenhill’s benefactors would be upset if students were managing any of the school’s funds. Still, committee member Clint Carlson, also father to one of the club’s leaders, was convinced the activity would be worthwhile. Therefore, he convinced committee members to donate their own money to the cause, ultimately raising $100,000.

Money in hand, club members outlined their investment policy and decided to buy shares of 12 companies across six popular sectors: financial, health care, industrial, technology, real estate and utilities. They limited their investments to companies worth at least $1 billion, and no company can encompass more than 15 percent of their portfolio.

So far, the students have lost about $2,500, but are learning an important lesson in patience.

“It’s definitely scary, but we know we can’t be reactionary in this kind of climate,” Lewis Carlson, who will be a senior in the fall, told CNN. “The students admit they can be a bit obsessive about checking on the portfolio’s performance multiple times a day, but who wouldn’t be? The students also plan to rebalance the portfolio every six months to a year.”

Ultimately, Greenhill students hope their investments not only out-earn Greenhill’s endowment fund, but also profit enough to give back to their alma mater.

“We’d love to beat someone at their own job,” Lewis said. “Ultimately we’d like to take our earnings form the year and put it into scholarships for other students to come to Greenhill and experience this club and all the learning that goes on here.”