Kodiak Oil & Gas: Follow The Hedge Funds?

Kodiak Oil & Gas, Inc. (KOG) has found some well-heeled suitors in the market as of late. A couple of prominent hedge fund managers substantially increased their positions in Kodiak during the second quarter. John Paulson of Paulson & Co. initiated a position in the Company of 14.95 million shares with a market value of $132.98 million. Citadel Investment Group, headed by Ken Griffith, increased its position in Kodiak by 5.25 million shares during the second quarter, for a total of 16.31 million shares with a market value of $145 million. Further, Kodiak has benefited with the jump in oil prices due to the Syria uncertainty.

Kodiak is seeking to grow by expanding its operations in the Bakken oil region. The Company reported in July it acquired approximately 42,000 net leasehold acres and net production of approximately 5,600 barrels of oil equivalent per day in McKenzie and Williams Counties, N.D. Kodiak now has total lease holdings in the Williston Basin of around 196,000 acres. The leasehold interests were acquired for $660 million. In 2012, the Company spent around $810 million in capital expenditures for drilling and completing new wells, including surface facilities and pipeline connections. Overall, Kodiak had estimated total proved reserves at the end of 2012 of approximately 94.8 million barrels of oil, compared with 39.8 barrels at the end of 2011. The discounted future cash flows for the reserves are $1.9 billion, versus $850.7 million for 2011.

Kodiak is showing solid revenue growth, which may be one factor influencing the hedge funds. In the second quarter, the Company had revenues of $173.5 million. This was an increase of 102% from $85.8 million for the prior year quarter and up 5 percent from $165.1 million for the first quarter of 2013. The Company further reported adjusted EDITDA income of $131.1 million, versus $67.7 million in the prior year quarter for a 94% increase. However, net income was $44.3 million, down from $93.1 million for the prior year quarter. The Company pointed out that this number includes an unrealized gain of $20.9 million from mark to market derivatives used for commodities hedging operations. Kodiak recently completed a private offering of $400 million in aggregate principal amount of senior notes due 2022. The Company has a current market cap of $2.83 billion, with a P/E ratio of 28.84 and a forward P/E of 10.70. The Company has a debt to equity ratio of 1.38, with a debt-to-capital ratio of 56.6 percent. Thus, Kodiak is incurring a substantial amount of debt in the expansion of its operations and leaseholds.

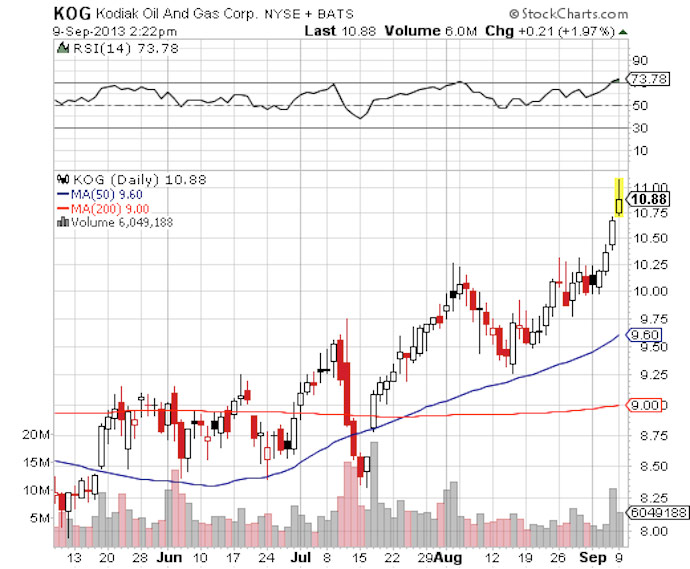

The issue is whether individual investors can profit by following Paulson and Citadel and mimicking their investments in the Company. The stock is up over 19 percent year to date, spiking 4.92 percent in the last week. The price broke through its 20-day SMA in late August, and is well above its 50 and 200-day SMAs, which are bullish indicators. Volume had generally been trending downward since mid-July, with an average daily volume of 6.27 million shares, but has spiked over the last couple trading days. The stock had 40 million shares being sold short as of August 15th, for a moderate short float of 15.4 percent and a short ratio of 6.89.

Kodiak has a competitor in Sandridge Energy, Inc. (SD). Sandridge has a similarly sized market cap of $2.66 billion, but its stock has fallen over 14 percent year to date. The stock is trading around $5.59. The Company has gotten a lot of flack for its management by ousted CEO Tom Ward. Ward was replaced in June by CFO James Bennett. Bennett is seeking to streamline capital expenditures and reduce costs. Some have suggested Sandridge might be an acquisition target. Yet, it is still too early to determine whether Bennett will be successful in his attempts to turn Sandridge around.

Kodiak’s stock may be on the way up since there are a number of bullish signs. It appears to be on more stable footing than Sandridge right now. As noted herein, hedge funds have taken large positions in the Company. Although debt levels have increased to fund the expansion of leaseholds and production, revenues are concurrently showing strong growth. Further, continued uncertainty in the Middle-East could send the sector. Kodiak may be a favorable growth stock opportunity.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.