Market Turbulence As US Prepares For Possible Strike Against Syria

Image via Flickr/ James Gordon

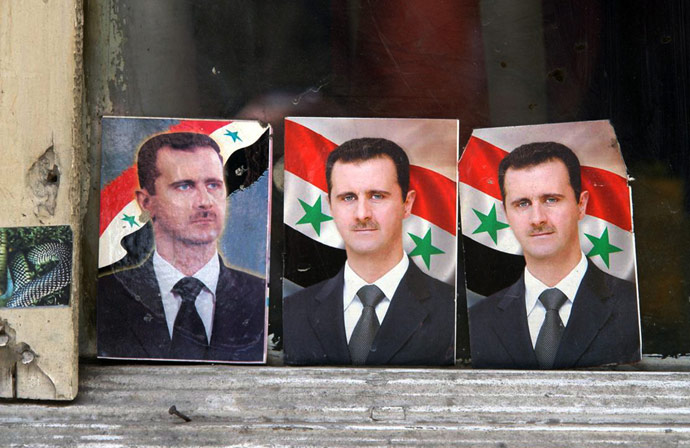

The world was shaken early Tuesday morning as Syria made headlines once again. Rumors have emerged, and some have speculated over the past week that chemical weapons have been used to wipe out citizens challenging the government. Secretary of State John Kerry said on Monday that the use of chemical weapons during attacks in Syria last week was confirmed, and the Obama administration will hold the Syrian government accountable for its actions.

Senior U.S. officials responded quickly Tuesday morning, stating missile strikes against Syria could be launched “as early as Thursday.” The White House has intensified its push toward an international response to the suspected use of chemical weapons, a war tactic unimaginable to most. U.S. officials expanded on those statements,adding that attacks would be pinpointed at certain targets. Instead of a broad strike, the attacks would focus on degrading Syria’s President Bashar Assad’s military capabilities and hopefully reduce violence in the region. Defense Secretary Chuck Hagel said the U.S. military was “ready to go” with any action directed by President Obama.

The United States isn’t the only country looking to get some skin in the game, either. British Prime Minister David Cameron recalled his country’s Parliament from vacation on Tuesday for a Thursday vote on a proposal for action. As a result of the fear and rough headlines, global markets were sent spinning on Tuesday. Global equity markets felt great pain with the Dow Jones Industrial Average down more than 100 points early in the session. However, Europe led the declines with the DAX and CAC 40 both down more than 2 percent on the day.

Alternatively, the commodity space caught a bid as investors and traders alike searched for hard asset exposure. Oil prices roared higher by more than 3 percent on the day to $109 a barrel, while Brent prices followed to $114. This move to the upside set in six-week highs for the sweet stuff, as some traders believe this trend could carry momentum throughout the week. Precious metals soared as demand rose, and the dollar saw minor weakness. Silver is higher by more than 2 percent to $24.50 per ounce. Gold is higher by 1.79 percent to $1418 per ounce. Both metals have performed exceptionally poor this year, and it is too soon to tell if the Syrian crisis will have a significant impact on prices in the near future. For the long-term investor, market turbulence may offer the opportunity to increase equity exposure. For the short-term trader, good luck, headline risk will prove challenging during the remainder of the month.