9 Ways To Boost Your Bank Account By Next Friday

It’s our mission to make money matters a little less insane. We provide financial editorial content free for all and are supported by affiliate partners included in this post which earns us a commission. We hope you enjoy our content and subscribe to our newsletter.

We’d all love to wake up and see a bigger number in our bank accounts.

Unfortunately, making extra money can take time. In a world where you can get access to most things much faster than ever before, it can still be difficult to get your hands on cash quickly.

Here are 9 ways for you to give your bank account a welcome boost by next Friday!

1. Invest in the Stock Market and Get a Free $5 Bonus

Ishant Mishra on Unsplash

Think you need to be wealthy to invest in the stock market? Think again. Today, you can invest with almost any amount — even $5!

That’s all it takes with Stash. This company allows you to invest in fractional shares, so you can buy small pieces of your favorite companies — Apple, Amazon, Tesla, you name it — with as little as five bucks.

By creating a portfolio and funding it, Stash will even deposit a $5 welcome bonus right into your new account.

With a Stash bank account and Stock-Back card, you’ll earn even more stock for your portfolio when you swipe your card.

To get started, sign up for Stash today and make your first deposit!

2. Save Hundreds By Letting This Site Find You a Cheaper Auto Insurance Policy in 2 Minutes

Evgeny Tchebotarev on Unsplash

Auto insurance is a necessary expense but probably one that you’re paying too much for. When you switch to a cheaper policy, not only will you save on your very next bill but you might also get a partial refund on your old policy.

Hate shopping for car insurance? Leave it to EverQuote. This insurance comparison site does all of the shopping for you, gathering multiple quotes from various companies—sometimes from ones you’ve never thought to check out!

The best part? The service is free to use and you can find new options in minutes. Potentially save hundreds of dollars on car insurance each year with very little effort.

Check out your rates with EverQuote today and see how much you could be saving on car insurance right away!

3. See if This Company to Help You Save Thousands on Your Mortgage As Soon As Possible

Ross Joyner on Unsplash

Your mortgage is probably your largest expense each month and it could be your biggest opportunity to save money right away.

By refinancing your mortgage — that is, replacing your current loan with a new loan that, ideally, has a lower interest rate — you could potentially save thousands of dollars in interest fees and start making lower payments as soon as your very next bill!

And with Figure, refinancing is made easy. In only a few clicks, this lender will let you check your rates without any impact to your credit score.

What’s more, Figure offers a 100% online application form. This allows you to apply quickly and get a speedy approval — all without filling out stacks of paperwork or being hassled over the phone.

The first step is to check your rates with Figure today. See how much you could start saving on your home!

Note that Figure is only available in the following states: AK, AL, AR, AZ, CA, DE, FL, GA, IA, ID, IN, KS, LA, MA, MI, MO, MS, MT, NC, ND, NE, NH, NJ, NM, NV, OH, OK, OR, PA, SD, TN, WA, WI, and WV.

4. Swap Out Your Homeowners Insurance Policy for a Cheaper One in Minutes

Your monthly mortgage payment isn’t the only expense related to your home. There’s homeowners insurance as well, which allows you to safeguard your property and possessions.

But for a service that you hope you’ll never need to use, homeowners insurance can be pretty expensive, too. Instead, find out if you could be paying less for your policy in minutes with EverQuote.

This insurance comparison site might help you save hundreds on your homeowners insurance policy — all you have to do is provide a few details about your home and they will hunt down multiple rates for you to compare in one place.

Get your free quote from EverQuote today and potentially find a better policy in minutes!

5. Use a Personal Loan of Up to $100K to Pay Off Your Credit Card Debt and More

Daniel Thomas on Unsplash

One of the fastest ways to put a large sum of money in your bank account is to get a personal loan.

Credible is a marketplace that allows you to check out multiple personalized rates from top lenders in minutes. Loans up to $200,000.

Once you apply for a loan you like and are approved, your funds will be deposited right into your bank account as soon as the very business day!

What’s great about a personal loan is that you can use it for just about anything. If you’re drowning in credit card debt and heavy interest fees, you can use a personal loan to pay off your debt completely—potentially saving you thousands of dollars in the process.

Don’t have credit card debt? Use a personal loan to make additions to your home, pay medical bills, plan your next family vacation, or something else. The possibilities are virtually endless.

Look at your personal loan rates with Credible today and get money deposited into your bank account in as little as one business day!

6. Save Up To $2,000 By Telling This App to Cut Unwanted Subscriptions and Negotiate Your Bills

Michael Walter on Unsplash

Most people have a few subscriptions that they no longer use or don’t use very often. Some of them might even be charged to your account soon! Canceling them would mean hanging onto some extra money before next Friday.

But amongst all of the different transactions on your account each month, they might still fly under the radar.

Not to fear — Truebill can find them and cancel them for you. This app will show you each of your bills in one place and cancel the ones you no longer want—with your permission, of course.

What’s more, Truebill can even negotiate your bills for you. Whether it’s your cable bill, phone bill, or another expense, Truebill will try to get you better rates so that you potentially pay less going forward.

Think about how much this could save you this week, this month, and over the next year. Download the Truebill app today to get started!

7. Get a $100 Welcome Bonus and a Cashback Debit Card from This Bank

Aspiration

One of the best ways to get more money in your bank account by next Friday is to get a better bank account.

Aspiration is an FDIC-insured bank that will give you a $100 welcome bonus after making a minimum deposit of $10 and spending $1,000 within 60 days (terms apply).

What’s more, they will give you a debit card that earns up to 5% cashback from socially responsible companies. These companies include TOMs, Blue Apron, Warby Parker, and more!

An Aspiration bank account also comes with no hidden fees and fee-free withdrawals at their network of over 55,000 ATMs.

And get this — if you upgrade to a paid plan for $7.99 a month, your debit card will start earning as much as 10% cashback and you’ll even earn up to 1.00% APY on your account balance.

Open an Aspiration bank account today and make your first deposit!

8. Make Up To $225 A Month Watching Videos

Kelly Sikkema on Unsplash

When you sign up to InboxDollars, you’ll get a $5 bonus! Once you’ve confirmed your account, you can see a list of videos to watch.

There are all kinds of videos, including movie previews, TV shows, news clips, health, cooking, and tech-related videos. You can see how much the videos earn before you start watching.

In order to earn money, you’ll be required to watch all of the videos in a playlist. You’ll be able to see how long the running time for each playlist is though before you start watching.

There are several other ways to earn money with InboxDollars, including doing internet searches, reading emails, taking surveys, shopping, and playing games.

Sign up for InboxDollars now to claim your free $5 and start earning today. You can earn up to $225 a month!

9. Tell This App to Help You Add $1,000 or More Quickly

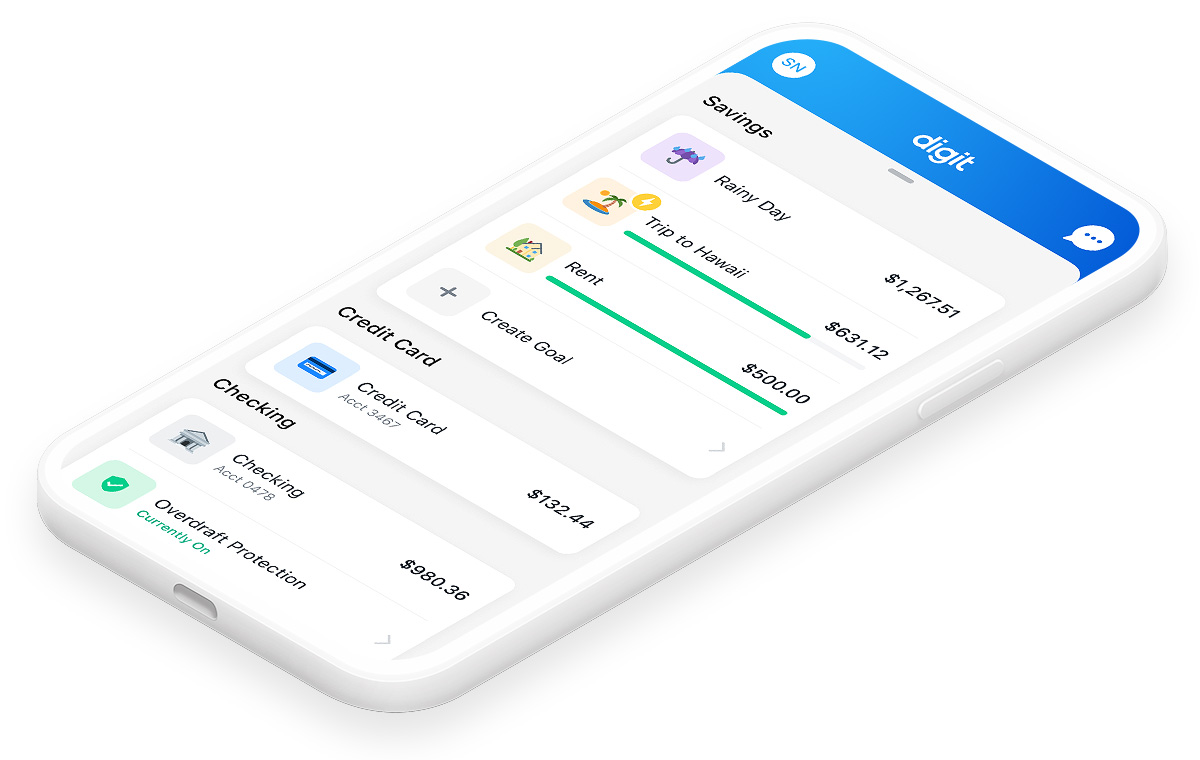

Digit

There are probably all sorts of areas where you could be saving more money right away, boosting your bank account as a result. But you might not know where to look.

Digit can help. This personal budgeting app is designed to help you achieve your financial goals — whether it’s saving, investing, paying off debt, or preventing overdrafts to your bank account.

All you have to do is sign up, download the app, and tell Digit what your financial goals are! The app will then analyze your spending and automate your saving for you so that you don’t have to think twice about being frugal and growing your money.

What’s more, the company offers a 30-day free trial. Sign up with Digit today and see how easy it can be to take back control of your finances!

Don’t Wait Another Week to Bolster Your Bank Account

When it comes to making extra money, we’re often taught to play the waiting game — that it takes time to grow your bank account balance.

But you don’t always have to wait weeks, months, or years to boost your bank account. Make these simple adjustments to have some extra money deposited into your account by next Friday!

* Wall Street Insanity is a paid affiliate/partner of Stash. Promotion is subject to Terms and Conditions. To be eligible to participate in this Promotion and receive the bonus, you must complete the following steps: (i) click through the link above, (ii) successfully open a Stash Invest Account (otherwise known as your personal portfolio) in good standing, (iii) link a funding account (e.g. an external bank account) to your new Stash Invest Account, AND (iv) initiate and complete a deposit of at least five dollars ($5.00) into your Stash Invest Account.

(*1)Bank Account Services provided by Green Dot Bank, Member FDIC

(*2)Stash banking account opening is subject to identity verification by Green Dot Bank. In order for a user to be eligible for a Stash banking account, they must also have opened a taxable brokerage account on Stash. Bank Account Services provided by Green Dot Bank and Stash Visa Debit card (Stock-Back® Card) issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Visa is a registered trademark of Visa International Service Association. Investment products and services provided by Stash Investments LLC, not Green Dot Bank, and are Not FDIC Insured, Not Bank Guaranteed, and May Lose Value.