11 Money Habits of Mentally Strong People

It’s our mission to make money matters a little less insane. We provide financial editorial content free for all and are supported by affiliate partners included in this post which earns us a commission. We hope you enjoy our content and subscribe to our newsletter.

It should come as no surprise that some of the wealthiest people have one very important attribute in common — mental strength.

When it comes to money, so many people get buried under the weight of financial stress and are ultimately unable to make forward progress.

To become like the mentally strong person — the person who is able to continuously move forward and reach their financial goals — it’s critical that you forge the following money habits:

- Remain optimistic about your finances.

- Keep other financially and mentally strong people in your circle.

- Become a lifelong student of finance.

- Remove emotion from your financial decision-making process.

- Always live below your means.

- Remember to pay yourself first.

11 Quick Ways to Get Financially and Mentally Strong Today

Ready to put your mental toughness into action? Here are some quick ways to financially flex your mental muscles.

1. You Could Leave Your Family with $1.5 Million (Bestow)

Brooke Cagle on Unsplash

One of the smartest money moves you can make is to protect your family’s financial future. Many people underestimate how much money is needed to provide for their families after they die. This is why life insurance is a must. Make sure your family’s future is secure.

The older you are, the more expensive life insurance becomes. And because today is the youngest you’ll ever be, there’s no better time than today to get a life insurance policy.

Plus, with a company like Bestow, you can actually lock in your rate. As you age and your health declines, you’ll get to keep paying that same low premium.

Bestow’s policies start from as little as $16 a month, and you can get a quote in minutes — without providing a medical exam or filling out paperwork!

And with coverage of up to $1.5 million, you can leave your family with a significant amount of money after you pass.

Get your free quote from Bestow today

2. Invest in the Stock Market and Get a Free $5 Bonus

William Iven on Unsplash

Think you need to be wealthy or a financial expert to invest in the stock market? Think again. Today, it’s easy to invest, and with almost any amount — even $5!

That’s all it takes with Stash. This app was built for beginner investing and allows you to invest in fractional shares if you’d like, so you can buy small pieces of your favorite companies — Apple, Amazon, Tesla, you name it — with as little as five bucks.

By creating a portfolio and funding it, Stash will even deposit a $5 welcome bonus right into your new account.

Stash provides tools and more for all levels of investing needs.

3. Save Hundreds Right Now On Your Car Insurance

Hannes Egler on Unsplash

While auto insurance is a necessity, it can also be pretty expensive. But it doesn’t have to be — you might be able to save hundreds on your auto insurance this year.

Let EverQuote tell you in two minutes if this is possible. This site will return multiple auto insurance quotes for you to compare in one place.

That’s a lot of time you’ll save. Just fill out a quick questionnaire.

If you find cheaper insurance than you currently have, EverQuote can help make the switch super easy.

It might save you hundreds of dollars a year.

4. Diversify Your Investments By Investing in Fine Art

Vlad Kutepov on Unsplash

For years, blue-chip artwork was an area that only the super-rich could get involved in. But Masterworks has made it so that anyone can get started investing in top-tier pieces!

Investing in blue-chip artwork — which, according to Artprice, has outperformed the S&P by more than 250% from 2000 – 2018 — might be a good way to diversify your investments and safeguard your money in a fluctuating economy.

Here’s how it works. On the platform, you can invest in a portfolio of iconic works that have been carefully crafted by Masterworks’ team of research professionals. You can wait for Masterworks to sell the artwork at some point during the next 3-10 years, or you have the option to sell your shares to other investors on Masterworks’ secondary market.

You’ll only need to pay a small management fee, and in return, you’ll get all administrative costs covered, professional storage, insurance, regulatory filings, and annual appraisals.

Request an invite for membership today (bypass the 25,000 person waitlist)!

5. Potentially Save Thousands on Your House With This Simple Move

Pixabay on Pexels

Your house is probably your biggest investment, which means it’s also one of your greatest opportunities to save money.

By refinancing, you could potentially save thousands of dollars on your house. Here’s how it works — you find a new home loan that, ideally, has a lower interest rate and better terms, and then use it to replace your current home loan. Sounds simple enough, right?

Because it is. And with Figure, you can check your mortgage refinance rates in just a few clicks without even impacting your credit score!

Find a loan with a lower interest rate and apply with Figure’s 100% online application. Once you’re approved, Figure will help you close out your new loan quickly so that you can start enjoying your new savings as soon as possible.

Check your mortgage refinance rates with Figure today.

Figure Mortgage Refinance is only available in the following states: AK, AL, AR, AZ, CA, DE, FL, GA, IA, ID, IN, KS, LA, MA, MI, MO, MS, MT, NC, ND, NE, NH, NJ, NM, NV, OH, OK, OR, PA, SD, TN, WA, WI, WV.

6. Get an Affordable Pet Insurance Policy to Keep Your Pet Healthy and Happy

Wade Austin Ellis on Unsplash

You’re not only responsible for your property and your family but also your pet. Unfortunately, bills from the vet can really pile up and hurt your bank account.

But with Embrace, you could get an affordable pet insurance policy that keeps your pet in great health. Started by real pet parents, this company covered over 93% of all of their claims in 2019.

As plans are tailored for dogs or cats, you can choose the plan you need and get coverage for illnesses and injuries, emergency care, hospitalizations, and more.

And get this — for every year in which you don’t receive a claim payment, Embrace will actually reduce your deductible by $50.

Get a free quote from Embrace today in minutes

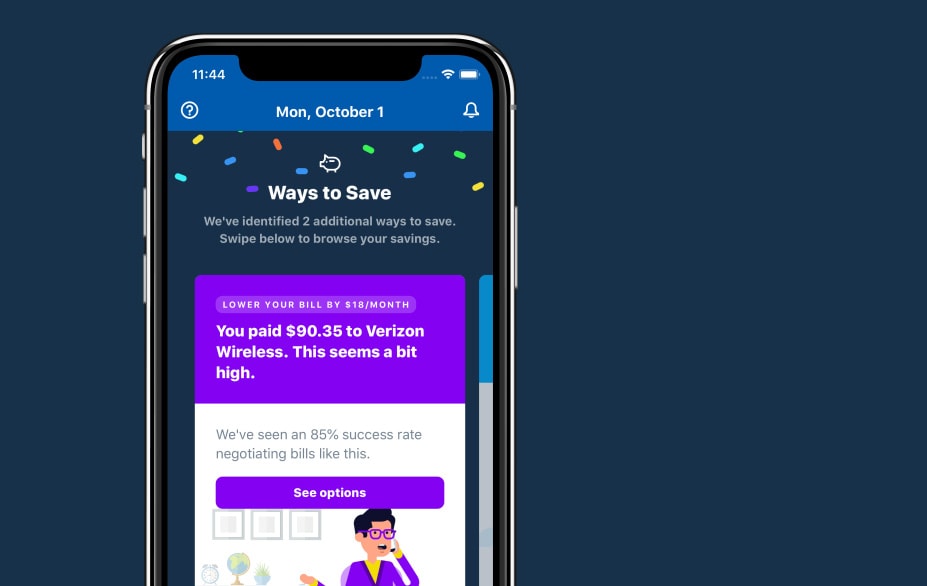

7. Save Potentially Thousands By Telling This App to Cut Unwanted Subscriptions and to Negotiate Your Bills

Truebill

Most people have a few subscriptions that they no longer use or don’t use very often. Some of them might even be charged to your account soon! Canceling them would mean hanging onto some extra money before next Friday.

But amongst all of the different transactions on your account each month, they might still fly under the radar.

Not to fear — Truebill can find them and cancel them for you. This app will show you each of your bills in one place and cancel the ones you no longer want—with your permission, of course.

What’s more, Truebill can even negotiate your bills for you. Whether it’s your cable bill, phone bill, or another expense, Truebill will try to get you better rates so that you potentially pay less going forward.

Think about how much this could save you this week, this month, and over the next year.

Download the free Truebill app today to get started!

8. Get the Best Extended Warranty for Your Car

Evgeny Tchebotarev on Unsplash

You’re only ever one breakdown from having to fork out hundreds of dollars (thousands, in some cases) to get your car back on the road!

Well, with Olive, you can get an extended warranty for your car for an affordable price each month.

Olive allows you to tailor a plan to coverage needs and monthly budget, and your rate is fixed for the life of your term. You can also cancel at any time without penalty!

What’s more, there’s no waiting period. After your first payment, your coverage will start at midnight. You’ll be covered up to 185,000 miles, with no annual mileage restrictions.

And filing a claim is easy. Use Olive’s RepairPal tool to find a repair shop near you and Olive will pay your bill directly so that you don’t have to wait for reimbursement.

Finally, Olive invests a portion of your premium in renewable energy, sustainable infrastructure, social services, and other community programs at no extra cost to you.

Get a free instant quote from Olive now

9. Get Rid Of Credit Card Debt

Avery Evans on Unsplash

Credit cards often come with extremely high interest rates that keep users trapped in debt.

If you have credit card debt, you could eliminate it today by getting a personal loan through Credible.

By getting a personal loan that has a lower interest rate and using it to wipe out your credit card debt, you’ll be left with lower payments going forward.

This marketplace will find you multiple offers on personal loans without any impact to your credit score. Run a search, compare all your options conveniently in one place, and find personal loan options that range from $1,000 to $100,000.

All it takes is two minutes to check out your rates with Credible and potentially find a loan that wipes out your credit card debt and saves you thousands.

10. Invest With Intelligent Automation for Free

M1 Finance

You work hard, shouldn’t your money do the same for you?

M1 Smart Money Management gives you the freedom to build, invest, and optimize your money — the way you want.

You can create your own portfolio with any stock and/or ETF, for free. Borrow money at one of the lowest rates in the market, and access spending of your money with an M1 checking and debit card.

Best of all, you can enjoy M1 Finance for free. Fund your account within 14 days of opening with at least $1,000 to get a $30 bonus.

11. Build the Health Insurance Policy You Need (and Can Afford!)

Let’s face it — health insurance is really expensive. Plus, options are limited, so you don’t always get the coverage you need or the deductible you want.

Fortunately, there’s a new way to do health insurance — Sidecar Health. This company allows you to completely customize your health insurance plan!

With your plan, Sidecar Health will send you a payment card, which you’ll use to access your benefits for medical services. After a visit, you’ll be charged 20% as the “estimated expense” and the remaining 80% will be charged to your Sidecar Health payment card as the “estimated benefit.”

Sidecar Health is currently available in AL, AR, AZ, FL, GA, IN, KY, MD, MS, NC, OH, OK, SC, TN, TX, and UT.

Take a photo of your bill and submit it through the app; your account will then be credited or debited accordingly, depending on what your plan covers. As a member, you can also wave goodbye to out-of-network fees, as your plan will work with any doctor!

Through Sidecar Health, members are able to save 40% or more on the cost of care.