14 Money Mistakes To Avoid In Your 20s

We work hard to bring you awesome editorial content. In full transparency, some of the links on this page are from our affiliate partners which earn us a commission and help make this possible.

Being a 20-something means seeking new opportunities, figuring out who you are and what you want, and most of all, hustling. Often, though, your 20s also mean partying it up, spending money you don’t have, accumulating debt, and making money mistakes you’ll come to regret by 30. But you don’t have to be that broke 30-year-old with the crappy job who moves back in with their parents! Here are 14 money mistakes to avoid in your 20s.

1. Not keeping track of your finances.

Bruce Mars on Pexels

This is potentially the #1 most important mistake to avoid, and the #1 most common mistake. To take control of your finances, you have to keep track of them. It’s that simple.

In our tech and mobile app-saturated world, keeping track of your finances is easy and free. You’ve got no excuse not to do it. Head to Credit Sesame to get your credit score, financial profile, and ongoing reports and tracking for free online and via the mobile app.

Credit Sesame gets your free credit report by pulling credit information from TransUnion’s VantageScore. But this isn’t a one-time service. Credit Sesame notifies you of how your credit score changes every month, and if you’re especially vigilant, you can also sign up to receive real-time, daily, or weekly monitoring alerts as well.

Credit Sesame also advises you on how you can adjust your spending habits to improve your score. Advanced analyticals give customized recommendations for which cards or loans will help you save.

You can also keep track of loans, credit cards, and market options for when you’re ready for your seriously adult purchases, like your next car or home. Trending charts make changes in your financial situation easy to understand and review.

Your free Credit Sesame account also provides Identity Theft Protection at no charge, along with fraud resolution assistance. If you’re ever a victim of identity theft, you’re protected by Credit Sesame just by getting an account. Sign up now to get serious about your finances.

2. Not building your credit.

Shutterstock

It’s one thing to know your credit score. But if you’re walking around with an embarrassingly low credit score, just knowing about it doesn’t mean much. The next step is to find a way to build your credit.

Head to Self Lender to create a credit builder account. Credit builder accounts help you establish your credit history (not all of us have been paying with plastic for forever) and save money responsibly. Instead of racking up debt on a credit card, you can create a small loan with Self Lender which earns interest as you pay it off and build your credit.

Self Lender’s credit builder account is a small loan that’s held in a certificate of deposit account for 12 months. It’s FDIC insured, in your name, and earns you interest. As you pay the account, your payment history is reported to all 3 credit bureaus. In one year, you’ve established your credit history, and the money in your account unlocks with interest. Literally, you’re building credit while you save.

Credit builder accounts are easy to get started. You pay an administrative fee ($9-$12 based on your monthly commitment), and then choose a monthly payment (these range from as low as $25 a month to $150). At the end of your payment plan, you will have built credit and earned interest. After 24 months, $25 a month earns you $525. After 12 months, $150 a month earns you $1700.

Learn more and sign up here.

3. Not getting rewarded for the money you spend.

Burst

We talk a lot about smart savers, but what about smart buyers? Yes, that is a thing. Here’s how to be one: Get rewards every time you shop.

Ibotta is the mobile app shopping assistant you didn’t know you could afford. It links you up with the best offers available and redeems your account with cashback bonuses. If you buy groceries (you know, if you’re a human), you should sign up for Ibotta. If you’re a loyal shopper, you can also link your Loyalty Card for even more savings.

Once you’ve joined Ibotta, using the app is simple. First, you choose the offers you know you want. Ibotta’s catalog allows you to search and browse by product, category, or store, based on your location. Ibotta covers Sam’s Club, multiple grocery stores, pharmacies, pet stores, and even liquor stores. Once you’ve chosen the offers you want, you buy the products you selected at participating stores, just as you would have anyway. Then, you redeem your offers by taking a picture of the receipt, and within 48 hours, you get the cash.

You can sign up for Ibotta here. Use our promo code WSI to get a $10 bonus.

Here’s another way to make the most of your spending habits: Swagbucks.

Swagbucks pays you to do what you’d be doing anyway — shopping online. When you sign up with Swagbucks, you gain access to exclusive deals, coupons, and cashback with over 1,500 online retailers.

Swagbucks also gives you cash for wasting time online (you know, more of the things you’d be doing anyway). You can earn SB points (which add up to cashback) when you answer surveys and polls, watch entertaining video playlists, use the Yahoo! search engine, or even make in-game purchases at GSN, an online game platform.

After you’ve earned points with online activities, you can redeem your points for free gift cards to great retailers like Amazon and Walmart, or just get cash back at PayPal.

Sign up for Swagbucks here. They’ll thank you for getting started with a $5 bonus.

4. Not getting rewarded for the money you save.

Vladimir Solomyani on Unsplash

Banking seems simple enough, but there are a lot of traditional banks that provide next to nothing in regards to interest on your account. If you’re not getting rewarded for the money you save, you’re making a simple but all too common money mistake.

To fix this problem, check out CIT Bank. Depending on your needs, CIT Bank offers a number of different accounts, including a 1.75% APY Money Market Account and a 1.55% APY Premier High Yield Savings Account.

Creating an account takes less than 15 minutes. The minimum initial deposit for a savings account is only $100, and there are no continuous fees to keep the account. With CIT Bank, you’re FDIC-insured and you’re earning above the national average in interest rates. Checking up on your account is easy with the mobile app.

Why not get started?

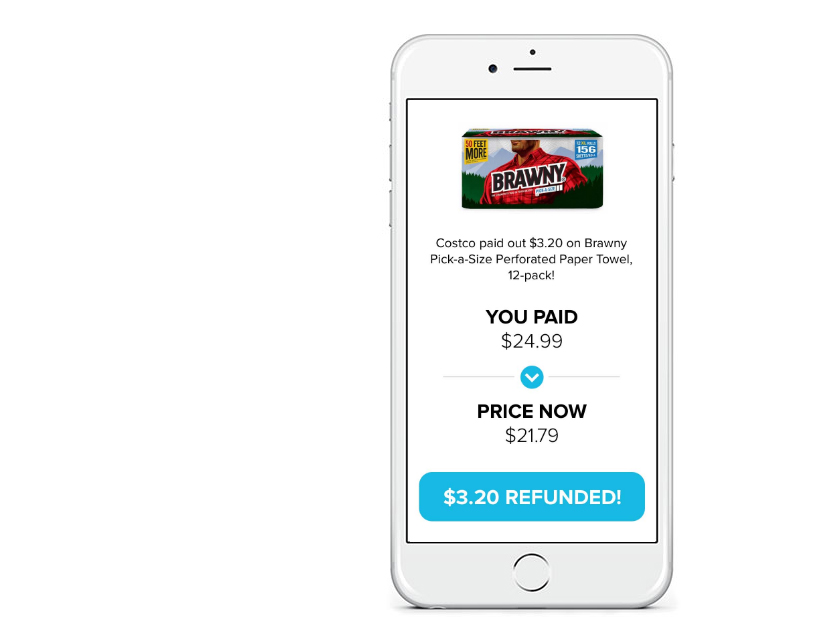

5. Not getting the refunds you deserve.

Paribus

Isn’t it the worst when you buy a laptop or a phone and then a week later the price magically decreases for everyone else?

Not if you have Paribus. Meet the app you never knew you needed, but will want to get it right now.

Paribus is a free app that tracks price drops at stores with price adjustment policies for you. Stores covered by Paribus range from L.L. Bean and J. Crew to Walmart and Costco to Target and Office Depot to Wayfair and Anthropologie. Even Home Depot is covered!

When prices drop, you’re eligible a refund. Most of us don’t keep track of our receipts and price drops at all, though. Paribus keeps track of both, so when price drops come along for items you’ve already purchased, you get money. <

When you sign up for Paribus, your mailbox is connected to the Paribus Receipt Fetcher. As you shop, Paribus logs your purchases. Whenever you’re eligible for a price adjustment claim, Paribus files the claim on your behalf. Once the claim has gone through, you earn 100% of the savings.

Paribus compensates us when you sign up for Paribus using the links provided.

6. Not taking care of your student loans.

Brad Neathery on Unsplash

It’s tempting to just pretend they’re not there, but you know they are, and they are racking up the interest while you avoid paying for them. Freaked out? Don’t know what to do? Don’t make the mistake so many other 20-somethings make. Face your student loans like an adult.

If you feel like you got screwed or you can’t make it work, you can take a sigh of relief thanks to Upstart. Upstart helps you pay off student loans (and credit card debt and all other types of debt) with personal loans catered to your strengths (like that expensive education) and your needs.

To get started with Upstart, you fill out a few questions to check your rate. These include basics like the amount you want to borrow and your address, as well as your primary source of income and highest level of education. You can check your rate here (and no, it won’t hurt your credit score). People who use Upstart save 24% compared to people who deal with credit card rates.

After you’ve filled out your information, Upstart sends you a loan offer to review. Loans range from $1,000 to $50,000. Once you’ve accepted, you can set up easy automatic monthly payments, and there are no penalties if you pay it off faster than you expected to.

7. Racking up credit card debt.

Shutterstock

Student loans are one thing, but we could talk about credit card debt all day. Chances are your parents and your grandparents and your favorite uncle all warned you, but you still went and got one. Or two. Or three. Or ten. Pay them off. And if you can’t, we refer you once more to your new best friend, Upstart.

A personal loan can be a smart way to consolidate your credit card payments at one fixed and potentially lower rate.

8. Driving uninsured.

Abdiel Ibarra on Unsplash

We get it. You want to save money. And auto insurance is crazy expensive. And you don’t even drive that much!

If this sounds like you, we have a simple message for you: get car insurance for people who only want to pay for the miles they drive. AKA: Metromile. Metromile is designed for people who drive less than 200 miles a week (as in, 65% of Americans).

Metromile is pay-per-mile insurance, which is just what it sounds like — you pay a flat monthly base rate (rates start at $29), plus a few cents for every mile you drive. Rates depend on factors typical to car insurance: age, vehicle, driving history.

If you’re stuck in a dead-end plan, you don’t have to wait for it to end. Get a free, no-risk quote from Metromile now.

If you’re worried about the occasional long driving day, don’t — Metromile factors that in. If you drive over 250 miles a day, you won’t be charged for any additional miles. After 250, the rest are free.

A device called Pulse, which easily plugs into the OBD port of your car, measures your miles and reports them back to Metromile’s billing department. Pulse is free and connected to the ever-helpful Metromile app, which can tell you when it’s time to move your car to avoid getting a ticket, or where your car is if you parked so long ago you’ve forgotten.

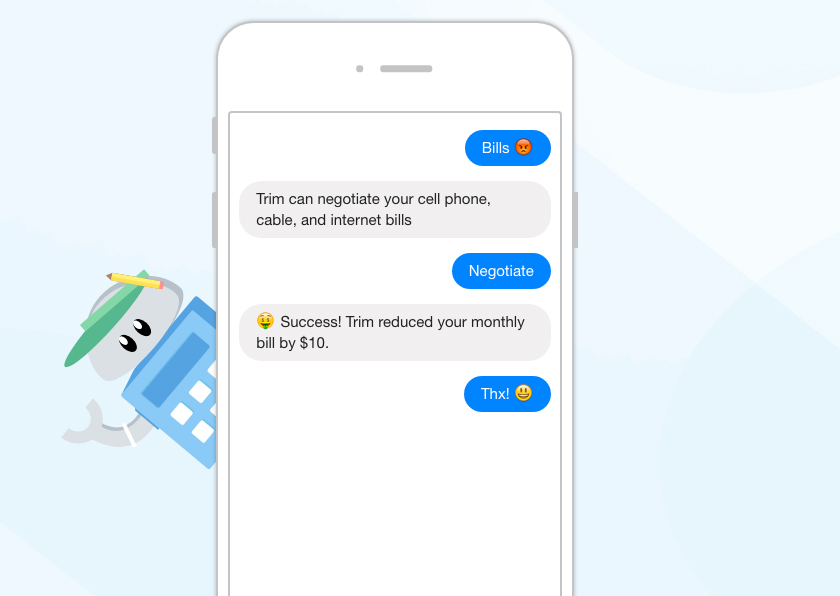

9. Not keeping track of your subscriptions.

Trim

One of the most glorious parts of being a 20-something is the subscription. To Netflix, to Hulu, to that gourmet pet treat delivery service, to that gourmet meal delivery service, to your favorite magazines, to all of the other subscription services you’ve already forgotten about…

Yeah, we said it.

When you’ve got an automatic payment plan set up, it is really easy to forget where you’re funneling your hard-earned cash. Don’t make this mistake.

Instead, get an automated financial planner. Yeah, you can totally afford that! Because it’s free. Trim is a free money-saving assistant that tracks your spending habits, suggests spending cuts for things you don’t really need or use, and even negotiates your cable and internet bills.

When you sign up for free with Trim, Trim scans your financial history to show you all of your subscriptions and helps cancel anything you don’t want to pay for anymore.

After that, Trim moves into full-on financial planner mode. It communicates you via your Facebook Messenger account or phone number with spending and balance alerts. Once it’s been linked to your card, it can also automatically apply coupons and special savings — at no cost to you.

Trim is constantly adding new features to help you out with financial planning and saving. The latest tool is the Bill Negotiator, which automatically negotiates your Comcast bill for you. This is the one place where Trim takes a cut — if they help lower your bill, they take 25% of the savings the first month. After that, though, your savings are all yours.

Ready to sign up? Connect with Trim here.

10. Overpaying for cable.

JESHOOTS.com on Unsplash

Instead of paying an arm and a leg for hundreds of channels just so you can watch your favorite one or two, customize your cable plan with Sling TV. Sling TV is free of everything you hate about other cable companies — there are no lengthy and convoluted contracts or hidden fees, and it’s easy to stream on any and all of your devices.

Sling TV’s go-to plans include $20 a month for 25+ channels, $25 for 40+ channels, and $40 for 50+ channels. If you’ve got a specific TV addiction like news, comedy, or sports, you can add on a handful of channels for just $5 a month as well.

Sling TV links to all of your favorite devices, too. You can watch TV on your phone, XBOX, computer, and TV.

Check out Sling TV’s industry-leading offers here. Sign up here (Did we mention the first 7 days are a free trial?).

11. Overpaying to eat healthily.

Anna Pelzer on Unsplash

Taking care of your body means you’re doing better than the vast majority of 20-somethings. Chances are, though, you’ve noticed something: eating healthy is damn expensive. Don’t give up your health to save a buck. Instead, stick to organic but on the cheap with Thrive Market.

Thrive Market curates the best of high quality, organic, non-GMO products and delivers them to you (for free) at wholesale prices (think, 25-50% cheaper than in-store). They’ve got food for you, food for your pets, and even eco-friendly, safe beauty and cleaning products.

At Thrive Market, you can even shop by diet (vegans and paleos, they got you!).

While shipping and handling can get pricey when you get your food delivered, with Thrive Market, any order over $49 comes with free shipping. An annual membership is a mere $5 a month, and you can try out Thrive Market for free for your first month. For each paid membership, Thrive Market provides a free membership to a family in need, teacher, veteran, or first responder.

Becoming a member is as easy as checking out with your first order. Sign up now for an extra 25% of your first order. Once you’ve fallen in love with Thrive, you also get rewarded for spreading the word. For every friend you recommend Thrive Market to, you get $25 in Thrive Cash.

Start shopping and saving at Thrive Market here.

12. Not making bank on your old stuff.

Nick Hillier on Unsplash

It’s easy to toss your stuff on the side of the road or auction it off on Craigslist or at a yard sale for way too cheap. It’s also a great way to throw away money you could be making on Decluttr.

Decluttr is a free app that spins your old and unwanted CDs, DVDs, cell phones, and clutter (including LEGO for you boyhood collectors out there) into cash. All you have to do is scan the barcode and Decluttr will make an offer. You send your stuff to them (they even pay for shipping), and you get cash the next day by check or direct deposit.

Say goodbye to yard sales and awkward Craigslist transactions. Sell your stuff here.

13. Not making bank on that extra room in your apartment.

Mary Whitney on Pexels

If you’ve got extra space and you’re wasting it rather than listing it out, clean it up and make use of it! Earn money as an Airbnb host.

With Airbnb, you really are in charge of your own mini bed and breakfast. You get to decide when you’re available, what the prices are, what house rules you require, and how you interact with guests (or don’t). You’re even in charge of check-in and check-out times.

After you create a listing and approve of guests, you’re paid automatically after check-in, minus a 3% service fee. You can be paid in whatever way you’re comfortable with, from PayPal to direct deposit to international money wire, if need be.

Listing out a part of your place out can seem intimidating, but not when you know Airbnb has your back 24/7 with host support. Their Host Guarantee also provides up to $1 million in coverage for property damage, just in case a bad guest makes a mess of the place. Of course, according to Airbnb, issues like this are rare.

Sign up with Airbnb to turn that home office or storage room into a money-maker.

14. Not making use of your free time to earn extra money.

Adolfo Félix on Unsplash

The gig economy is alive and well, and if you’re not taking advantage of it in your free time, you’re saying no to a whole lot of extra cash.

If you ever use Lyft or Uber, you may have noticed that multiple drivers make cash driving for both apps. Culture varies — generally, Lyft emphasizes friendliness and care, whereas Uber emphasizes professionality and poise. With both, you can make a pretty penny.

When you sign up to drive with Lyft, tips from riders are 100% yours, and you can make extra bank during Prime Time pricing during peak hours (read: weekend). You get paid for every trip per minute and mile. Money’s deposited into your account each week, or automatically if you opt for Express Pay.

As long as you’re 21, have access to a smartphone, and access to a good car, you’re ready to go. Because safety is a priority, you do have to undergo a background check and get your vehicle approved. After that, going to work is as simple as opening the app, turning on driver mode, and waiting for your passenger to call.

Driving with Uber is similar. Like Lyft, you need to undergo a thorough background check and get your car approved. The only major difference is that whereas Lyft checks your driving skills in person, Uber’s review process is primarily based on local and state laws. As soon as your activation is complete, it’s the same thing: turn on the app when you want to drive, and get going!

Sign up here to drive with Uber and here to drive with Lyft. (Lyft is now offering a $300 bonus by clicking here).

In conclusion

You’re in your 20s, and although money matters can seem boring and intimidating, they don’t have to be hard. Take advantage of the tools you have to avoid making these money mistakes. Your 30-year-old self will thank you.