4 Coronavirus Money Moves To Make During The Pandemic

Macau Photo Agency on Unsplash

The coronavirus (COVID-19) is driving us all crazy one way or the other, and has had an impact on everyones wallet.

If you’re impacted by the coronavirus in any way — whether you’re falling ill, being sent home from work, or self-quarantining for the time being — you might find yourself in an odd financial position.

Maybe you’re not able to rely on consistent income. Maybe you just have more time on your hands than you usually would!

Whatever the case may be, here are 4 top money moves you can make while you’re waiting for the dust to settle.

1. Help Protect Your Your Family By Leaving Them Up To $8,000,000

Sai De Silva on Unsplash

We hate to think about it, but who would make the mortgage payments if something were to happen to you? One of the smartest moves you can make is to help protect your family’s financial future. Many people underestimate how much money is needed to provide for their families after they die. This is why life insurance is very important.

The older you are, the more expensive life insurance becomes. And because today is the youngest you’ll ever be, there’s no better time than today to get a life insurance policy.

Plus, with Ladder, you can actually lock in your rate. As you age and your health declines, you’ll get to keep paying that same low premium.

Ladder offer’s term life insurance policies starting from as little as $4.95 a month, and you can complete the company’s application in 5 minutes. Ladder is 100% digital for coverage up to $3 million which means no medical exams or filling out paperwork! You’ll simply have to answer a few health questions as part of the online application.

Get your free quote from Ladder today and help ensure your family’s financial future is secure.

$4.95/month pricing is based on 20-year-old female, preferred plus rating with a 10 year term and $100,000 in coverage.

Ladder Insurance Services, LLC (CA license # OK22568; AR license # 3000140372) distributes term life insurance products issued by multiple insurers – for further details see ladderlife.com. All insurance products are governed by the terms set forth in the applicable insurance policy. Each insurer has financial responsibility for its own products.

2.

3. Take Care Of Your Health Affordably (Stop Worrying About The Cost)

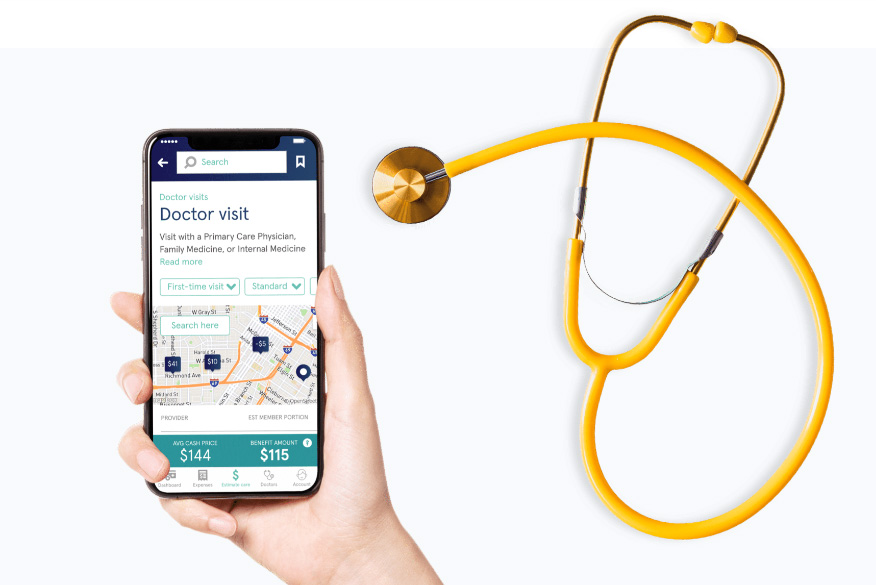

Sidecar Health

What is more important than your health?! But sadly many people neglect their health due to cost, not going to a doctor for preventative care or even when they’re sick.

Sidecar Health is trying to change healthcare for Americans by bringing them a new affordable way to do health insurance. The company allows you to completely customize your health insurance plan.

With Sidecar Health, you can see any licensed doctor you want, their service isn’t bound by a network. And you will pay your provider directly using the optional Sidecar Health VISA benefit card.

By paying with the Sidecar Health VISA benefit card, doctors get paid directly which usually translates to lower costs. This is because doctors generally charge discounted “cash” or “self-pay” prices because they don’t need to chase down reimbursements from insurance companies. Plans from Sidecar Health take advantage of these generally lower prices and can ultimately save you up to 40% or more on your health care costs..

Sidecar Health makes getting and paying for care easy, simply follow these steps:

1. Know your benefits – Use our website or app to find the exact Benefit Amount your plan pays for any procedure, test, or drug you need.**

2. Choose your provider – See any doctor you want; compare prices between doctors to find the best provider price. Goodbye, networks!

3. Use your Sidecar Health VISA benefit card – This convenient card allows you to access your benefits and pay for medical services on the spot.

4. Submit your claim – Ask your provider for the itemized bill. Upload the bill and check the status of your claim on the app.

Get a free quote from Sidecar Health now and see if they can offer you more affordable health insurance.

Sidecar Health offers and administers a variety of plans including ACA compliant major medical plans, employer group plans, and excepted benefit plans. Coverage and plan options vary and may not be available in all states.

*Savings estimate based on a study of more than 1 billion claims comparing self-pay (or cash pay) prices of a frequency-weighted market basket of procedures to insurer-negotiated

rates for the same. Claims were collected between July 2017 and July 2019. R. Lawrence Van Horn, Arthur Laffer, Robert L. Metcalf. 2019. The Transformative Potential for Price

Transparency in Healthcare: Benefits for Consumers and Providers. Health Management Policy and Innovation, Volume 4, Issue 3.

** Subject to policy terms and conditions.

3. Diversify Your Investments By Investing In Blue-Chip Artwork (without needing lots of money)

Vlad Kutepov on Unsplash

For years, blue-chip artwork was an area that only the super-rich could get involved in. But Masterworks has made it so that anyone can get started investing in top-tier pieces!

Investing in blue-chip artwork — which, according to Artprice, has outperformed the S&P by more than 250% from 2000 – 2018 — might be a good way to diversify your investments and safeguard your money in a fluctuating economy.

Here’s how it works. On the platform, you can invest in a portfolio of iconic works that have been carefully crafted by Masterworks’ team of research professionals. You can wait for Masterworks to sell the artwork at some point during the next 3-10 years, or you have the option to sell your shares to other investors on Masterworks’ secondary market.

You’ll only need to pay a small management fee, and in return, you’ll get all administrative costs covered, professional storage, insurance, regulatory filings, and annual appraisals.

To start investing, simply request an invite for membership today!

4. Find Out How Much You Might Get For Your Home In 3 Minutes

Pixabay on Pexels

Did you know there’s a way you could receive a cash offer within 24 hours without any broker, or any showings? Offerpad makes selling your home super easy.

Offerpad will carefully evaluate your home with local market expertise, and could give you a competitive cash offer within 24 hours. All you need to do is fill out a short 3-minute questionnaire.

If you choose to accept your offer, Offerpad will also provide you with free local moving to your next place. You can also pick your closing day, which could be in as little as 24 hours, or choose to extend your stay to live in your current home a little longer.

Find out what your home’s cash offer is in 3 minutes right now.

Don’t Let the Coronavirus Infect Your Bank Account!

While the coronavirus is having a direct impact on the economy, it doesn’t have to keep you from making smart money moves and great financial decisions.

If you find yourself at home with a little extra time on your hands, now is the time to stay on top of your finances and get ahead. When this pandemic has passed, you’ll be thankful that you took action!