8 Money Hacks Perfect for a New Year’s Resolution

It’s our mission to make money matters a little less insane. We provide financial editorial content free for all and are supported by affiliate partners included in this post which earns us a commission. We hope you enjoy our content and subscribe to our newsletter.

Is there a better way to kick off 2021 than with a handful of money hacks to help you get your finances in order?

As people are planning to eat healthier and writing new bucket lists, consider how taking control of your finances could make 2021 a year for you to remember.

Here are 8 money hacks that could set you up for a successful 2021!

1. Save Up to $1,000 Quickly with This App

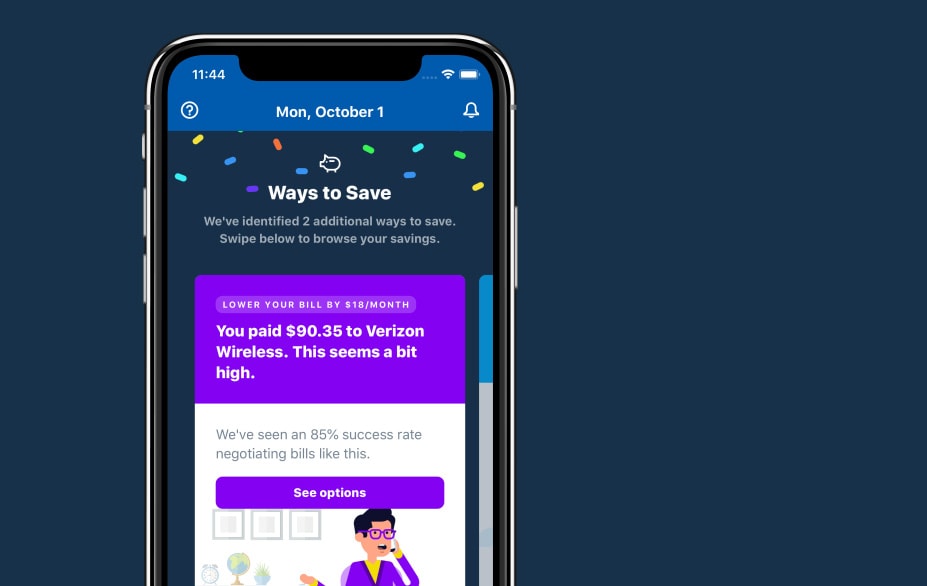

Truebill

Many people struggle to keep track of what’s coming out of their checking accounts each month.

Truebill can help. This app gives you a rundown of all of your subscriptions, bills, and other expenses in one place.

Don’t need a certain subscription? With your permission, Truebill will cancel it for you!

Hate arguing with cable, phone, and other companies over your bills? Sit back, relax, and leave the negotiating to Truebill. They will actually try to get you better rates so that you’re paying less each month—saving you both time and money in the process.

Allowing Truebill to help you with these simple tweaks could easily save you up to $1,000 a year.

Download the Truebill app and start chipping away at your expenses today!

2. Give Your Family $1 Million

Sai De Silva on Unsplash

Most people figure that their savings accounts will leave their families with enough money after they pass. But in reality, your savings account probably only covers a fraction of what is needed, making life insurance an absolute must.

And Bestow is a company that makes it both easy and affordable. The younger you are, the lower your rate usually will be. And since you’ll never be younger than you are today, there’s no better time to lock in your rate than right now. Don’t put it off!

With Bestow, coverage ranges from $50,000 to $1,000,000 and policies start from $16 per month. You can get a quote in just 60 seconds and if approved, a new policy in minutes, as Bestow doesn’t even require medical exams or stacks of paperwork

Get your quote today without even leaving your couch!

3. Diversify Your Investments with Art

Timon Klauser

on Unsplash

It used to be that only the super-rich could invest in things like blue-chip artwork — a market that has outperformed the S&P by over 250% from 2000 – 2018, according to ArtPrice.

But in 2021, you can invest in valuable art pieces, too — all thanks to Masterworks.

Sign up with Masterworks and you’ll be able to invest in a portfolio that has been carefully curated by research professionals. All administrative costs, insurance, professional storage, and more are covered under a small management fee.

All you have to do to start is request an invite to free membership with Masterworks today!

4. Get Rid of Your Car Insurance

Peter Broomfield on Unsplash

Auto insurance is an area where many people can save money this year.

And with EverQuote, shopping for better rates is made easy. In just a few minutes, this site could help you save hundreds each year!

Just provide a few details about your vehicle and EverQuote will immediately go to work for you — hunting down multiple rates and putting them all in one place for you to compare their findings.

What’s better? You can ask one of EverQuote’s licensed agents for help along the way.

Ready to see your potential savings? Get your free quote from EverQuote today!

5. Add to Your Credit Score

Mika Baumeister on Unsplash

What do your big milestones look like in 2021? Looking to buy a new car? Get a mortgage for a new home? Generally speaking, the more money you need to borrow, the higher the credit score you’ll need.

Credit Sesame is a site that will help you improve your credit score with a handful of important tools — including credit score monitoring, a credit report card, product recommendations, ID theft protection, and so much more. And guess what? It’s free!

Credit Sesame user Alex O’Brien was able to raise his score from the 500s to over 800 — simply by learning more about credit, making smart adjustments, and using Credit Sesame’s free tools to monitor his credit, check his credit usage, and keep an eye on hard inquiries.

Sign up for Credit Sesame today and join over 8 million users who are working to improve their credit scores — it takes just 90 seconds to create your account!

6. See If You Can Get More Money from This Company

Aspiration

Most banks don’t hand out money for swiping your debit card.

But Aspiration does. With an account from this FDIC-insured bank, you’ll get a debit card that earns up to 5% cashback on everyday purchases from socially responsible companies, such as TOMs, Warby Parker, and Blue Apron, to name only a few.

The bank has no hidden fees and even offers fee-free withdrawals at over 55,000 ATMs. For just $15 a month, you can upgrade to a paid plan that earns up to 1.00% APY on your monthly balance, as well as up to 10% on socially responsible purchases.

Sign up for an Aspiration account today with a minimum deposit of just $100!

7. Use Your Home as a Source of Fast Cash for Whatever You’ve Been Wanting to Do

todd kent on Unsplash

As a homeowner, you could be using that status to get fast cash for whatever you need — making a new addition to your home, paying off debt, or funding your next family vacation!

Figure is an online lender that offers HELOCs (home equity line of credit) — a low-interest loan that uses the equity in your home as collateral. In just 5 minutes, you can apply for a HELOC through Figure and potentially borrow up to $250,000 against the equity in your home.

And get this — the application is 100% online and you could receive funds in as few as 5 days! Check out Figure today to learn more.

8. Invest in the Stock Market and Get Up to 4 Free Stocks to Start

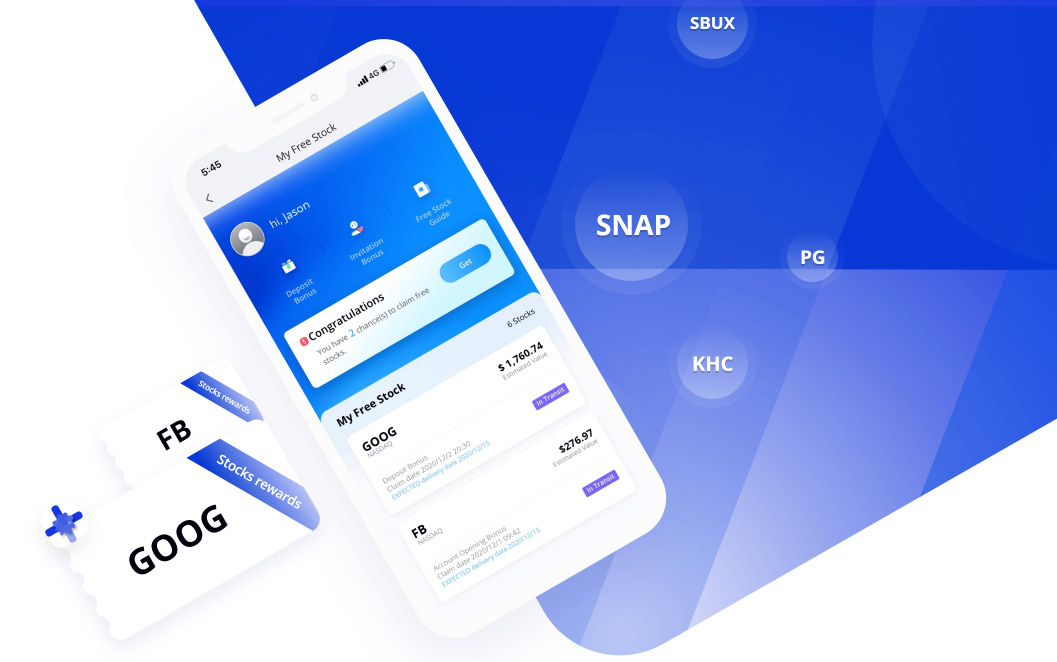

WeBull

Make 2021 the year when you finally invest in the stock market. Although the stock market can be volatile, historically, those who diversify their investments and keep their money in the market for the long run tend to see strong returns.

With Webull, you can open your very own investment account for free, and with no deposit minimums! All you’ll need is a few documents to verify your identity. With your new brokerage account, you’ll have access to all sorts of tools to help you make smarter investments.

What’s more, the company takes zero commissions on trades and even gives you up to 4 free stocks after opening and funding your new account — stocks from big companies like Snapchat, Google, New York Times, and others!

You’ll have a chance to earn even more free stocks as you refer friends and family. Open your Webull account today and make smarter investments in 2021!

Start 2021 Off on the Right Foot

Like most people, you probably had no idea of what 2020 had in store before it unfolded. Make sure you’re prepared for whatever 2021 might hold by taking better care of your money this year.

With these 8 money hacks, there’s no reason why you can’t start 2021 the right way and take control of your finances!