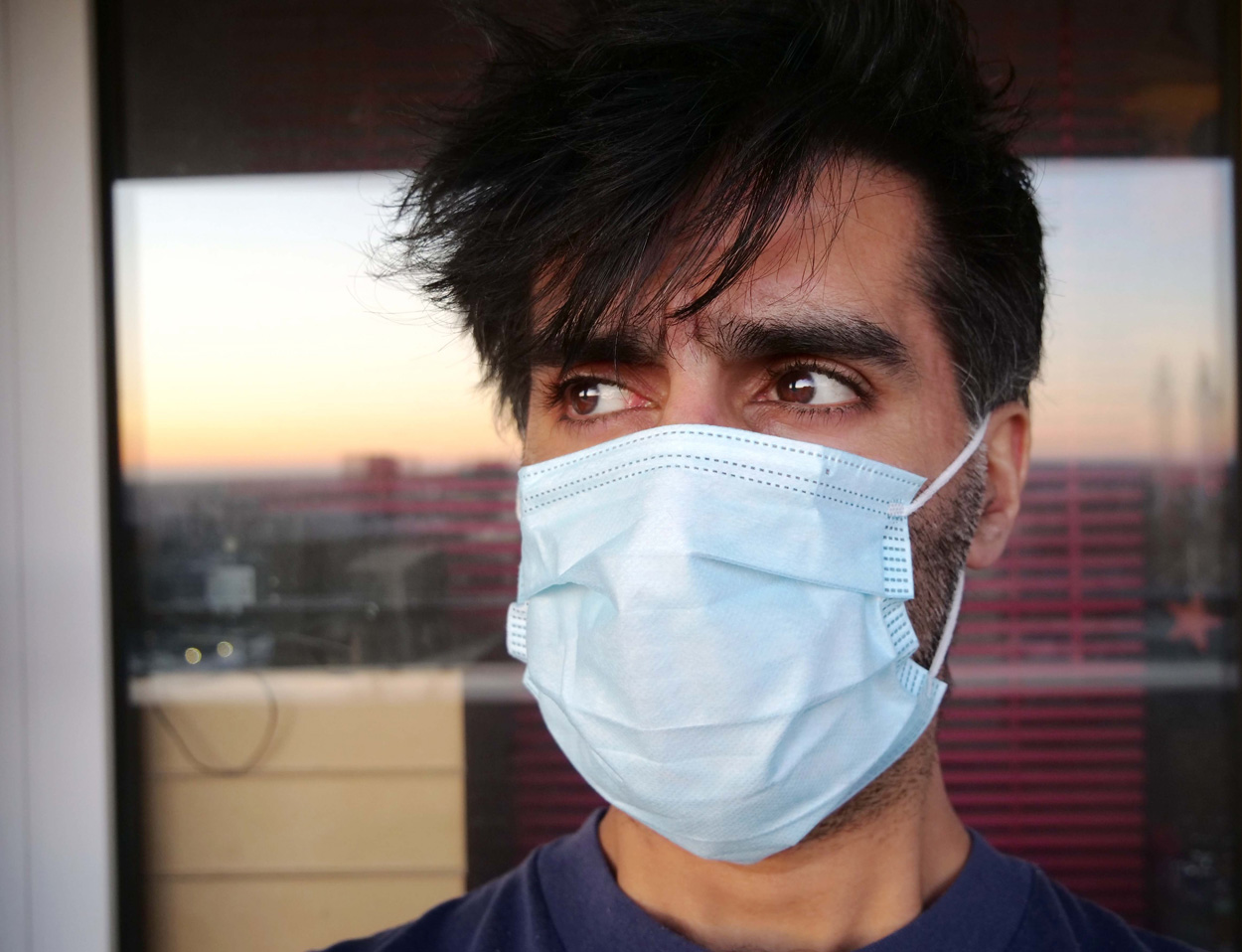

10 Pandemic Money Mistakes (And How To Correct Them Quickly)

It’s our mission to make money matters a little less insane. We provide financial editorial content free for all and are supported by some of our affiliate partners included in this post which earns us a commission. We hope you enjoy our content and subscribe to our newsletter.

The COVID-19 pandemic has compromised the finances of many. Now more than ever it’s important to be smart with your money.

Perhaps you’ve been laid off or your work hours have been cut. Maybe you’re looking to add an extra cushion of savings during the global economic impact. It might be that your business is struggling.

Whatever the case, now is the time to take action. Here are 10 of the most common pandemic money mistakes, paired with solutions that can help you get back on top of your finances!

1. Not Making Sure Your Family is Protected with up to $5,000,000

Kelli McClintock on Unsplash

The coronavirus pandemic has reminded everyone of his or her own mortality. If you were to pass unexpectedly, do you have enough money in savings for your family to carry on? Many of us don’t have millions sitting in the bank.

If you want to give your family up to $5,000,000, get life insurance.

Rather than waiting to purchase life insurance, purchasing it while you’re younger can help you lock in a low rate!

Life insurance is made fast, easy, and affordable with Fabric, a company that lets you apply online in minutes without leaving your couch and get personalized term life insurance offers based on your family’s needs. Coverage ranges from $100,000 – $5,000,000 and may cost as little as the price of a few coffees each month.

Get your free quote today and let Fabric’s licensed team help you navigate any questions you might have!

2. Not Getting Rid of Your Old Mortgage

Jacques Bopp on Unsplash

It’s possible that you’re throwing away money by paying your old mortgage, as interest rates have hit all-time lows.

LendingTree is a marketplace through which you might be able to refinance your mortgage and potentially save a whole lot of money! The process of refinancing is simple. Essentially, you replace your old home loan with a new loan that, ideally, has better terms and a lower interest rate.

Whether you have a single-family home or condominium, LendingTree will find you all sorts of refinancing options based on your financial goals — lowering your monthly payment, paying off your mortgage faster, you name it!

As long as you don’t live in Kentucky or New York, where LendingTree is not available, find out what you could be saving on your home. Fill out LendingTree’s short questionnaire and check out your refinancing options!

3. Paying Way Too Much for Auto Insurance

Erik Mclean on Unsplash

Due to the COVID-19 pandemic, many auto insurance companies rolled out stay-at-home savings to reward customers during lockdown. But by this point, most of those offers have run out and it’s likely that you’re back to paying full price for auto insurance.

You don’t have to settle for that expensive policy. Instead, check out Gabi.

This is a company that allows you to compare up 40 options in two minutes. When you find a policy you like, the company will even help you switch over quickly. And get this — it’s free!

On average, drivers save $825 on auto insurance each year by using Gabi. Fill out Gabi’s short questionnaire and you could join the club!

If you live in Arizona, California, Illinois, New Jersey, Oregon, Pennsylvania, Virginia, or Washington you can also try Metromile. This auto insurance company lets you pay by the mile for the miles you actually drive. Rates start at just $29, and you can get a quote now in a couple of minutes online.

4. Not Having a Good Credit Score

Shutterstock

You might want to get a car, house, or a credit card at some point, and if you’re looking for a loan, a good credit score will save you a lot of money.

A good credit score means cheaper interest rates. It’s important today, to get on top of your credit score for your future.

That’s where Credit Sesame can help. This service will give you your free credit score, free credit report card, and free credit monitoring.

It’ll let you know where it sees ways for you to better your credit. They even give you free ID protection.

Sign up now for free to Credit Sesame.

5. Wasting Money on High-Interest Credit Card Debt (This Could Get Rid of Your Bill)

Andrea Piacquadio on Unsplash

Your credit card is a source of a lot of thrown out money, in the form of interest fees.

If you’re wasting money on your high-interest credit card debt, consider getting a personal loan through Fiona to pay it off.

This simple move could get rid of this month’s credit card bill and save you thousands.

Fiona is an online marketplace that allows you to shop loan offers based on your credit score, how much money you need to borrow, and the area where you live. With loans ranging from $1,000 to $100,000, you could potentially get a personal loan at a low rate and use that money to pay off your credit card debt. You could be left with a lower interest bill which means a lower payment.

Fiona doesn’t charge you a fee for using their service! If you have a credit score of roughly 580 or higher, go ahead and check your personal loan rates with Fiona today!

6. Paying Too Much for Homeowners Insurance (This Could Save $864)

Chris Ross Harris on Unsplash

The fallout from the COVID-19 pandemic might be causing you to revisit your monthly expenses and tighten up your budget wherever possible. Homeowners insurance is one area where you might be paying much more than you need to.

But check this out — you might be able to save big on your homeowners insurance policy with a company like Liberty Mutual, which allows customers to save an average of $864 by bundling their home insurance and auto insurance!

With Liberty Mutual, getting the protection you need at an affordable rate is fast and easy. Get a free quote online in seconds and see how much you could be saving!

7. Keeping Your Money in an Account Where It Can’t Grow (With Heavy Bank Fees)

Morning Brew on Unsplash

Not all bank accounts are created equal. Some of them will charge you expensive fees or impose heavy minimum balance requirements. Others don’t allow you to do all of your banking online. Not to mention, many bank accounts provide very little opportunity for you to grow your money.

Well, with Chime, you can wave goodbye to all of these issues. Chime has checking and savings accounts that have no monthly fees, minimum balance requirements, or foreign transaction fees. The company’s savings account even allows you to earn an APY of 1.00% — that’s over 16x the national average!

Chime also allows users to perform all of their banking online, while giving them access to a large network of over 38,000 fee-free ATMs. And if you have your paycheck direct deposited into your account, you’ll enjoy access to that money up to two days early!

Sign up for a Chime account today (it takes just 2 minutes) and stop paying those exorbitant bank fees!

8. Not Setting Up Your Business Online (And Getting New Customers)

Morning Brew on Unsplash

If your business wants to thrive during the pandemic and beyond, it needs to adapt. With more people staying at home and spending more time online, you need to pivot your focus to online channels in order to reach them.

And with a marketing platform like Constant Contact, you can do just that. Constant Contact allows you to build your own website or online store to sell physical or digital products with no coding skills needed.

Already have a website? Constant Contact is still for you. The platform allows you to deploy powerful email marketing campaigns easily, thanks to their many stunning templates and graphics. Track your campaign metrics through a user-friendly analytics tool and add new email subscribers by adding Constant Contact’s sign up forms directly to your website!

It only gets better — sign up with Constant Contact today and you’ll enjoy your first 60 days free!

9. Waiting to Get Funding for Your Business (Instead of Going After it)

Blake Wisz on Unsplash

If the pandemic has hurt business, you might need a little help. Today, there are ways to get funds for your business and make sure the lights stay on and your employees get paid.

Check out Fundera, an online marketplace that allows businesses to get the funds they need to not only survive but also thrive during tough times.

You start by filling out one easy application. Then, they will hunt down some of the top lending options that best fit your company’s financial needs.

To date, Fundera has helped over 85,000 small businesses get over $2.5 billion in total loans. Complete the company’s easy application and find out what funding options are available for your business!

10. Not Budgeting and Saving Money

Micheile Henderson on Unsplash

Saving and budgeting can be hard, but not when it’s on auto-pilot.

That’s where Digit, can help. It’s your very own personal savings and budget assistant.

Digit will automate and manage your savings to reach your goals, and so much more.

Get a free 30-day Digit trial and find out what it can do for you. Try it out risk-free now.

Don’t Keep Making These Same Pandemic Money Mistakes

Unfortunately, these pandemic money mistakes are anything but rare. People are making them without second thought.

The good news is that you can correct them in no time at all by employing some of the solutions we’ve discussed. Right the ship today and start saving money at a time when it’s most needed!