6 Powerful Retirement Moves People Over 55 Could Make Today

It’s our mission to make money matters a little less insane. We provide financial editorial content free for all and are supported by affiliate partners included in this post which earns us a commission. We hope you enjoy our content and subscribe to our newsletter.

Making smarter decisions today can really payoff big.

If you’re 55 or older. There’s no better time than today. Stop procrastinating, and makes some moves to set yourself up for the best retirement possible! There are 6 on this list.

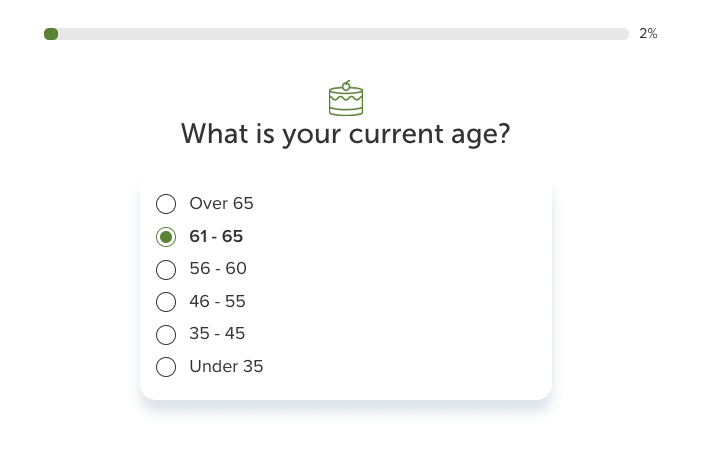

1. Prepare For Life After Work – Take The Retirement Quiz

You’ve worked hard. And for what? Likely to enjoy a bright future and retirement. You don’t need to be old to retire. It’s important to prepare today.

A study published by the research center CIRANO found that households that engaged with financial advisors for a period of 15 years or longer accumulated 290% more assets than those who didn’t consult with financial advisors.

The smartest thing to do for your future and retirement is plan. Starting now could lead to an amazing outcome. Take the retirement quiz right here and get matched with an advisor for free.

A company named SmartAsset works with a robust network of financial advisors all across the U.S., including individual advisors and large investment firms to cater to anyone’s financial situation. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Check out the free service from SmartAsset. Start by taking the retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 2 minutes. Smart Asset is now matching over 50,000 people a month.

Take the retirement quiz right here.

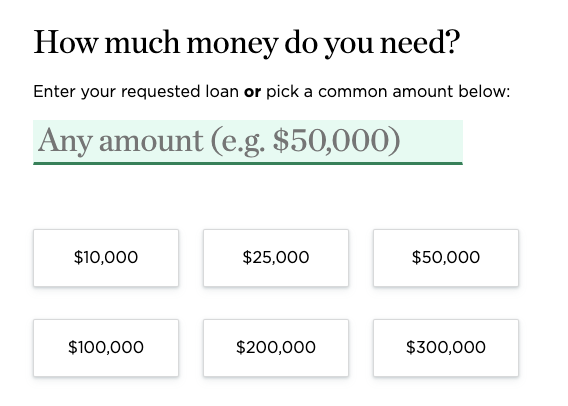

2. Business Owners: Get Funding Of Up To $5,000,000 To Use To Grow Your Company And Increase It’s Value (Must have at least $50,000 in annual revenue)

If your company is incorporated as a corporation or is an LLC with over $50,000 in yearly revenue and has been in business for at least 1 year, you’ve got a great chance of getting funding. The free service from Fundera by NerdWallet will show you up to 20 funding options in just 2 minutes, so you can take your business to the next level.

It’s free to use, there’s no obligation, and won’t effect your credit. Just answer a few questions about your business and find out how much you qualify for right here on the Fundera website.

Most businesses can make use of extra cash to hire new employees, expansion, working capital, equipment, make an acquisition, invest in research and development, or something else.

Over 85,000 companies have secured more than $2.5 billion through Fundera.

Find out right now how much funding Fundera might get your business.

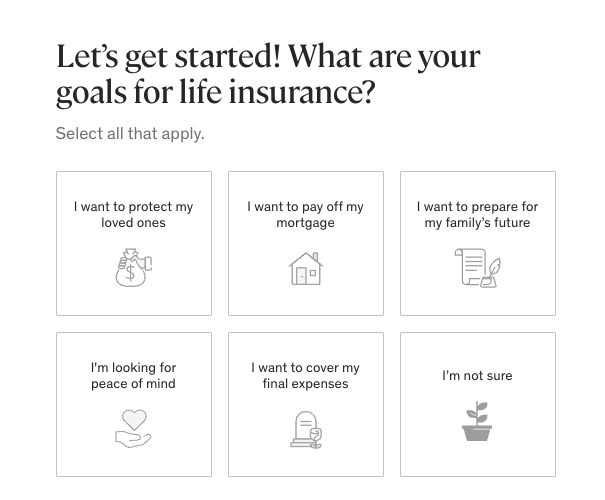

3. Protect Your Family With An Extra $2,000,000 Life Insurance Policy

We hate to think about it, but who would support your family if something were to happen to you? An extra $2,000,000 could go a very long way for anyone.

It takes just a few minutes with Ethos to get a free life insurance quote and check your rates. $500,000 in coverage starts at just $1 a day.

Life insurance is made fast, easy, and entirely online with the #1 online life insurance provider Ethos, a company that lets you apply in minutes (no medical exams, no blood tests) and get personalized term life insurance offers based on your family’s needs. Get up to $2,000,000 in coverage. Don’t put this off until tomorrow, because you might forget about it before it becomes too late.

With Ethos, you’ll simply answer a few health questions as part of the online application. Ethos has helped protect over 100,000 families and has provided over $34 billion in coverage.

Get your free quote from Ethos today and help ensure your family’s financial future is secure.

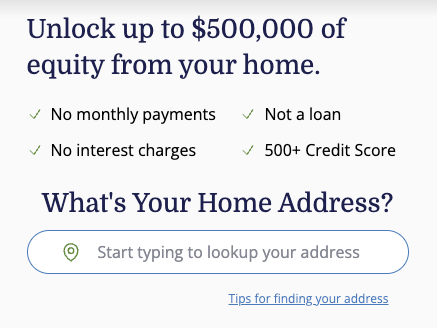

4. Get Up To $500k Cash From A Company That Wants To Invest In Your Home, Without Having To Move (This is not a loan and has no monthly payments!)

Your home is extremely valuable but it’s hard to access that value unless you sell. But depending on how you do it, it could also add extra debt while increasing your monthly payments or interest. Now there’s a way to get a large sum of cash from your home to fund whatever you want without moving.

Unlock Technologies might be the solution you’ve been looking for. Unlock can invest in your home, giving you cash today, in exchange for a percentage share in your home’s future value. If you qualify, Unlock will give you up to $500k of your home’s value for a percentage of your homes future value. Unlike a loan, there’s no interest, no monthly payments, and no added debt.

Get your no obligation cash offer estimate in 3 steps taking less than 60 seconds. Start by entering your address right here.

Unlock has helped over 10,000 homeowners, and has a 4.7 out of 5 TrustPilot score, and A+ rating with the BBB.

In exchange for its investment, Unlock will share in a portion of your homes future value. If you decide you want to stay longer than 10 years, you can settle the agreement at the end of the term without moving out.

Get an estimate of how much cash you could get now in just 60 seconds. Find out if you qualify right here. In most cases, you can use the money however you’d like.

5. Use Your Home To Access Cash At A Lower Interest Rate (Forget Those High Interest Credit Cards)

If you’re in need of cash to do something like pay off debt, make a home improvement or make any other kind of large purchase, you could use your home to take out a lower interest home equity loan instead of using a high interest credit card or other higher interest loan. You could use the cash for virtually anything you want and potentially save lots of money in interest payments.

Check your rates now right here with LendingTree in under 2 minutes by answering a few questions and find out how much cash you might be able to get.

A home equity loan allows you to borrow money using the equity in your home as collateral. Because you’re using your home as collateral you usually can get much better interest rates than other loans or using a credit card. You receive the money from a home equity loan as a lump sum, and you pay back the loan in monthly payments.

LendingTree is an online marketplace that could help you get a large sum of cash against the equity in your home quickly. It has been finding top loan options for Americans for more than 20 years.

6. Get Yourself A Top Financial Advisor With Ease

There is no better time to plan for your retirement future than now, and you don’t have to do it alone. A top financial advisor could help you make big money moves (from retirement planning, to investments, to tax planning, estate planning, social security, and more). Think about your financial advisor as your secret weapon to help you with whatever you need.

If you have a portfolio value of over $50,000 (it could be a combination of cash, stocks, bonds or other assets), answer the short questionnaire right here, and WiserAdvisor will instantly match you with up to three fiduciary financial advisers, all legally bound to work in your best interest.

You can even choose to have a free no obligation consultation. WiserAdvisor has successfully helped over 100,000+ individuals.

This has the potential to be hugely beneficial: It’s free to use the WiserAdvisor service if you have a portfolio over $50k, don’t let the opportunity pass you up. Answer the short questionnaire right here.

7. Here’s How You Could Potentially Save Big On Homeowners Insurance, Bundle With Auto Insurance To Potentially Save Even More

When was the last time you checked your homeowners or auto insurance rate? The rates have become insane! Insurance companies love when you’re lazy and don’t look for better prices. You could be saving money! For many people, there are cheaper rates floating around but they just don’t know where to look. It takes just 2 minutes to check.

With this company right here, you could be saving big money. Liberty Mutual is an insurance giant and they’ve got lots of ways to help you save, like customizing your insurance or bundling.

You could save even further with an online purchase discount and get rewarded for things like good driving behavior. There’s also a possible paperless policy discount and a pay-in-full discount.

Do yourself a favor because it only takes 2 minutes, get a quote right now.

8. A Cash-out Refinance Could Turn Some Of Your Home Equity Into Cash

If you have equity in your home, an option to get cash could be a Cash-Out Refinance. Use the cash for virtually anything you want like paying off higher interest debt.

A Cash-out refinance replaces your current home loan with a new bigger mortgage, allowing you to take advantage of the equity you’ve built up in your home and access the difference between the two mortgages (your current one and the new one) in cash. The cash you get can go toward virtually anything you want, such as home improvements, paying off debt or other purposes you have.

But be careful not to replace your current mortgage with a higher interest mortgage, unless you might have good reason to do so.

With New American Funding, you can check your mortgage Cash-Out refinance rates in just a few clicks!

New American Funding has funded $60 billions in home loans since 2010. You’ll need a credit score of 620 or higher to get approved with New American Funding.

Find out how much cash you might be able to get from New American Funding now right here!

New American Funding: NMLS#6606