Tesla Motors Investors Should Stop Looking At Charts

Tesla Motors Inc (NASDAQ:TSLA) stock is on the rise once again. The company’s future is looking brighter on news of positive production dynamics, and an easing of Model S ire pressure. That doesn’t mean everything is rosy for investors in Tesla, however, challenges lie ahead, and investors should be ready for them.

Stock in Tesla lost one third of its value between the end of September and the ends of November. The two month decline began to slacken at the end of the eleventh month, but the loss in value still hurt investors. Those who have held the stock for months worried that their entire investment might be erased. Those that bought in to play the momentum probably did lose a good deal of their initial investment. There is a lesson to be learned, and it has nothing to do with the stock’s recent recovery.

Tesla Is Not For Day-Trading

If you want to buy and sell stocks every day, you had better be doing it with another person’s money. Stock brokers and other members of market infrastructure should be getting in and out because they’re only looking to make cents on every transaction. Retail investors who are paying commission on every transaction need to stay away from day trading, and day-trading Tesla Motors Inc (NASDAQ:TSLA) stock is a good way to burn money.

Investors who are interested in the market have plenty to be doing that doesn’t involve actual trading. Warren Buffett doesn’t spend his days buying and selling companies, he spends them doing research and making sure he’s onto the correct strategy. Warren Buffett doesn’t invest in Tesla Motors Inc (NASDAQ:TSLA) either, so there might be a lesson to be learned there.

For those looking to get rich off of Tesla Motors Inc (NASDAQ:TSLA), the stock market is lottery. There is no guarantee of success out of Tesla, and the company is incredibly risky and frighteningly expensive to buy shares in. That said, there is nothing wrong with investing in Tesla, if a person goes about it in the right way.

Tesla Is Not A Horse Race

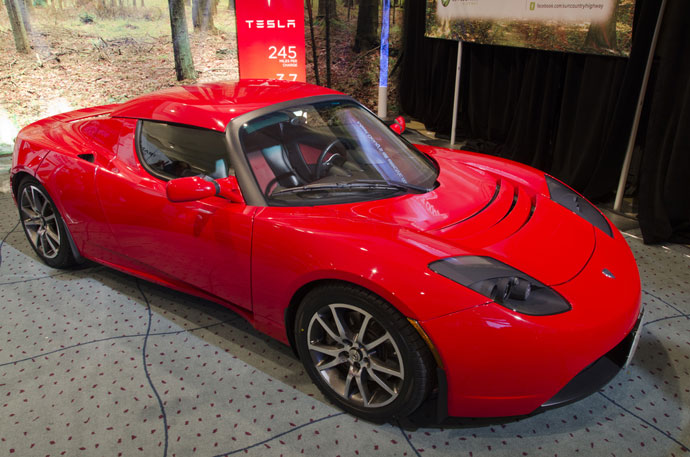

Tesla Motors Inc (NASDAQ:TSLA) should be seen as a company first and a stock second. Investor in the firm should stop looking at charts and attempting to guess the direction the firm’s shares are likely to move next time around. They should invest in the success of the company’s electric car. If they have faith in the success of the product, leaving charts behind should free up time for some actual research.

If the investor in question is not able to leave the charts behind, there’s a good chance that their belief in the company isn’t all that strong, and their research leaves them with little confidence in their investment. Investors like that should rethink their entire investment philosophy. Confidence is important, but so is research. Stay away from the Tesla Motors Inc (NASDAQ:TSLA) chart and open up the company’s K-10.

Disclosure: Author has no position in any stocks mentioned, nor does he plan to initiate one in the next 48 hours.