The Billion Dollar Market For E-Cigarettes

The market for e-cigarettes is booming. Estimates indicate that sales in the United States could surpass $1 billion in 2013, piggy-backing on strong sales of $600 million in 2012. This is still a small portion of the $100 billion overall tobacco market, but tobacco companies are looking for opportunities for growth as smoking rates decline due to higher per-pack taxes and negative publicity. One analyst for Wells Fargo even predicted that ecig consumption could take over that of traditional cigarettes one day. As such, tobacco companies are keen to get in on the action too, and have acquired e-cigarette companies or are putting out there own version of ecigs. Investors wishing to gain exposure to this growing market have a few different options as investment vehicles.

Lorillard, Inc. (NYSE: LO) is a traditional cigarette manufacturer, and distributes tobacco products under the brand names of Newport, Kent, True, Maverick and Old Gold. Lorillard acquired Blu Ecigs for $135 million in April of 2012. Lorillard’s revenue is heavily dependent on the sale of menthol cigarettes under its Newport brand, and the FDA is giving greater scrutiny to menthol flavored products. As such, Lorillard is one of the first traditional tobacco companies to release an ecig. Lorillard has a market cap of $16.97 billion, and a healthy dividend yield of 4.91 percent. The Company reported that first quarter net revenue for 2013 increased 3.3 percent to $1.577 billion. First quarter GAAP diluted earnings rose 50.9 percent to $.86 per share. Blu eCigs had net sales of $57 million in the first quarter, with an approximate 40 percent share of the ecig market. Lorillard’s board has approved up to $500 million for a share repurchase program, which will help to prop up the stock price. Technically, the Company’s share price has been in a strong upward trend since early March. The price has risen 15.86 percent in the last six months, but may encounter longer term resistance around $47. The stock is currently trading around $44.71, well above its 50-day and 200-day SMA on generally decreasing volume over the past two weeks.

Altria Group, Inc. (NYSE: MO) is another large tobacco company seeking to enter the ecig market. It announced plans earlier this year to release an electronic cigarette called the MarkTen through its Numark subsidiary. Altria is better known as the owner of Phillip Morris, the manufacturer of the Marlboro brand of cigarettes. Marlboro products account for 43 percent of all cigarettes sold. Despite this impressive number, the Company will be releasing the MarkTen in Indiana this August. Altria has a current market cap of $72.16 billion with a dividend yield of 4.88 percent. The Company issued slightly revised guidance for the 2013 fiscal year raising an initial estimate of diluted EPS from a range of $2.49 to $2.55, up to a range of $2.50 to $2.56. In addition, Reynolds American Inc. (NYSE: RAI) also announced recently that it is releasing its new version of the Vuse brand electronic cigarette in Colorado in July, with plans to expand nationally thereafter. Reynolds’ share price is up over 22% year to date. Similar to other tobacco companies, Reynolds has a dividend yield of 5.11 percent.

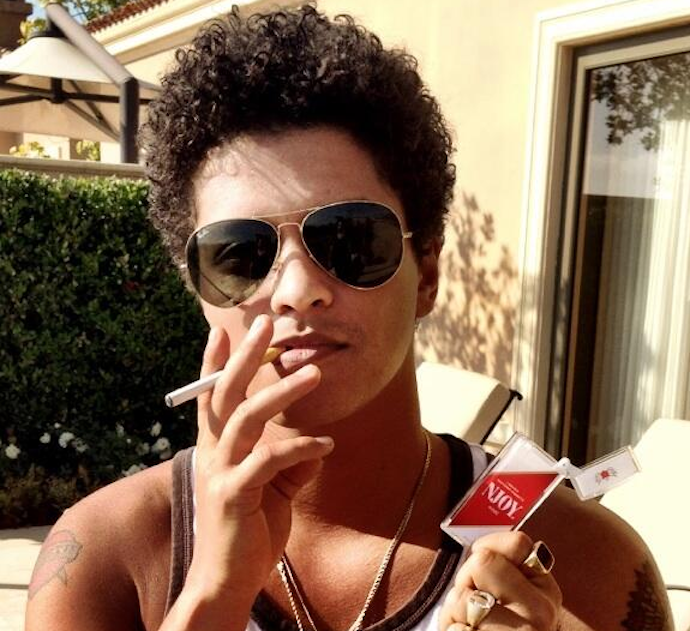

Some celebrities are even getting in on the ecig revolution. Popular singer Bruno Mars recently invested in NJOY, a privately held ecig manufacturer, after beginning to use the Company’s product in an attempt to stop smoking. It had been rumored that NJOY was a takeover target, possibly for Altria, but nothing has come of those rumors. NJOY has over 60,000 retail locations across the United States, with estimates stating the Company has 40 percent of the ecig market. It would appear that Njoy is still a takeover target, but there is no way to invest since it is privately traded.

https://twitter.com/BrunoMars/statuses/333705897098498048

There are a number of players in the ecig marketplace, and it is still unclear which technology and style consumers will gravitate towards. Altria and Reynolds American are trying to fine tune the formula by initially releasing in limited markets. Lorillard, as an early adopter with high market penetration, will likely see the most near term revenue gain from ecigs. Still, a takeover of Njoy by another player could provide a fast-track to a significant market share. At any rate, those investors not deterred by investing in the tobacco sector are benefited by the practice of companies paying high dividends. Still, it has yet to be seen whether the growth in ecigs can totally offset dwindling numbers of smokers, as traditional tobacco companies still have a myriad of legal and regulation issues to face.

Disclosure: The author has no position in any of the companies mentioned, and does not intend to initiate a position in the next 72 hours.