This App Saves You Money Automatically And Manages Your Finances — For Free

We partner with brands to bring you things we think you’ll like. We link to some of our affiliate partners on this page which earns us a commission.

In the old days, personal finance meant an awkward visit with a financial planner, during which you nodded a lot and pretended to understand a whole bunch of jargon. These days, though, there’s no need to report to a fancy office to gain control of your finances. Actually, there’s no need to even talk to anybody. Meet your new friend Trim.

Trim is the most adorable (and intelligent) personal finance assistant you’ll ever have.

And you can afford it. Because Trim is a free app.

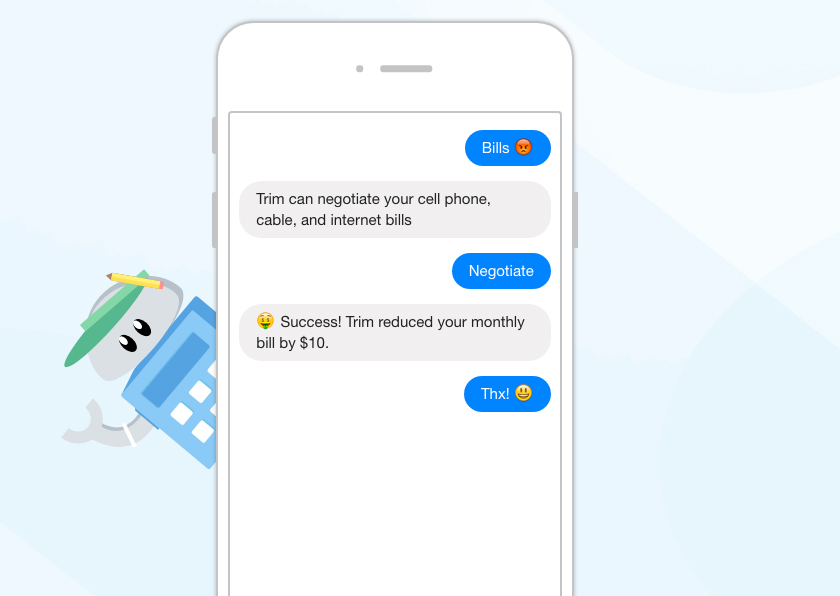

Trim is an adorable little bot who helps you track your spending habits, suggests tweaks to cut unnecessary spending, and even negotiates your cable and internet bills.

Trim can:

- Find and cancel old subscriptions

- Negotiate your Comcast bill

- Contest overdraft fees from your bank

- Send financial alerts for transactions, deposits, low balance, etc.

- Identify expenses you can reduce, like credit card interest payments

- Help you open an investment account to save for retirement

- Save regularly with automatically-added special cashback offers

Sounds pretty nifty, huh?

Here’s how it works.

When you sign up to use the app, Trim starts with the simple stuff, like subscriptions. It scans your financial history to show you all of the subscriptions and automatic billing payment plans you’ve set up. Then, it allows you to go through and cancel any you’ve forgotten about or don’t want to use anymore by simply texting “Cancel ____” to Trim. Trim contacts the biller for you and will even send certified mail to get you out of that tricky gym membership contract.

As long as you have Trim, it will continue to scan for subscriptions like this, making sure you stay on top of them.

But Trim doesn’t just cancel subscriptions for you. Once you’re done with that, Trim becomes a full-time financial planning assistant. Trim connects to your online banking information and communicates with you via Facebook Messenger or on your phone with regular spending and balance alerts. Trim connects to over 15,000 financial institutions, so chances are, your bank is covered. If you’re balancing multiple accounts, Trim can connect to all of them for you.

Worried about security? Trim accesses your financial information safely and securely.

If you’re worried about security (as you should be), rest easy — Trim uses 256-bit SSL encryption, encrypted databases, and two-factor authentication when you sign in. One big worry with apps is what they’ll do with all this data they’re getting from you. With Trim, that’s not a concern — your data is constantly protected, by bank-level security. It’s also never sold to any third parties.

Trim helps you up your financial health — automatically.

According to the folks at Trim, their mission is to help you become 100% financially healthy. They’re only just beginning to work on the “hard stuff” — like long-term financial planning, sifting through credit card and insurance offers, and wide-ranging financial decisions — but they promise it’s all on the way.

One recent addition to Trim’s repertoire is the Bill Negotiator, which automatically negotiates your Comcast bill for you. This is one place where Trim admits they take a cut — if they help lower your bill, they take 25% of the savings for the first billing month. After that, though, your savings are yours to keep.

Another new feature is Trim Savings, which automatically applies special savings and offers to purchases you make with linked Visa cards. Activated offers are immediately redeemed to your card with a statement credit. Say goodbye to Google searching coupon codes!

According to Trim’s website, Trim users saved over $1,000,000 — just last month.

Ready to sign up? Get started with Trim here.