Zillow: The Ultimate Short Squeeze?

Image via Facebook/ Zillow

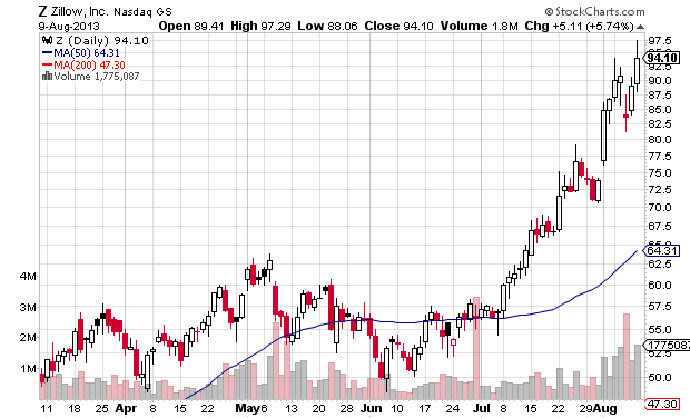

Zillow, Inc. (NASD: Z) has had a meteoric rise since the first of the year. The Company may not yet be turning out regular profitable quarters, but its shareholders have been handsomely rewarded for holding the stock. Those selling the stock short have likely been squeezed out, or have lost significant amounts of money as of late. Zillow even hosted a high profile event last week where President Obama took questions over social media regarding the state of the housing market.

Zillow debuted with its initial public offering in July of 2011. Shares were initially prices at $20, but rose as high as $44 on the first day of trading. The price then dropped and hit a multi-year low of $21.22 in late November of 2011. The price started the year around $29.40, and has since skyrocketed to around $94. This represents a rise of around 239 percent so far this year, with a rise of nearly 52 percent in the past month. All very impressive considering Zillow is posting a loss for the year so far.

Zillow reported revenue for the second quarter of $46.9 million, a record for the company, versus revenue of $27.8 million for the prior year quarter. While revenue increased significantly, expenses outpaced revenue. Zillow reported a loss of $10.3 million, versus a prior year quarter profit of $1.33 million. The Company has realized a loss of $13.98 million so far this year, versus a profit of $3.05 million for the same prior year six month period. Much of the loss may be attributable to sales and marketing costs of $52.71 million for the first six months. Although the company reported a loss, more visitors are using the site. The Company reported increased traffic of 66% year over year, with 61 million monthly unique users. Although the share price dropped over 7 percent on the news, the price proceeded to recover 12 percent over the last two trading days of the past week.

It is difficult to pinpoint the reasons behind the substantial share price growth, especially with the reported losses this year. Traffic for Zillow is growing substantially, and this is clearly important for the future of the Company. Further, Zillow and its competitor, Trulia, Inc. (NYSE: TRLA), may be piggy-backing off of Facebook’s improved performance. Facebook has risen 49.17 percent in the last month. Thus, investors may be willing to get back into the dot.com stocks due to Facebook’s recovery. Zillow has also benefited from the perception of a substantial recovery in the housing market. Still, this is not enough to explain the entire rise.

The share price rise may be in part to a short squeeze. 5.7 million shares were being shorted as of the end of July, on a total share float of 25.24 million. The stock has a very high short float of 24.21 percent and a short ratio of 8.32. The 3-month average volume for the stock is 734,000. The stock has a high monthly volatility of 8.5 percent.

The market may be overvaluing Zillow at this point, as it is difficult to justify the current valuation. Considering the Company reported a loss last week, the substantial share price increase may be due to a massive short squeeze. There do not appear to be fundamental factors at play. And the squeeze may not be over. It is difficult to predict when short sellers will be scared out of the market. It should be interesting to see what happens to the short interest over the next month after the recent rise. More shorts may need to cover before the price stabilizes.

Disclosure: The author has no position in any of the companies mentioned, and does not intend to initiate a position in the next 72 hours.