How To Get A Free Credit Score And Better Your Financial Future With Credit Sesame

We work hard to bring you insightful personal finance and business content for free. This post includes affiliate partners we think you’ll like. This earns us a commission and helps bring you more great content.

Understanding credit can be tricky, especially if you haven’t been paying much attention to your own. Consumers oftentimes don’t think too much about their credit until it’s time to buy a new car or apply for a credit card, but such a passive relationship with your credit score can be detrimental to your personal finances down the road.

There are a number of reasons why staying on top of your credit and keeping track of your score history is important, and putting a renewed focus on your own credit can end up being a financial boost for you down the road.

These days, there is absolutely no excuse for consumers to not stay updated on their credit performance – especially since there are free, reliable resources that pretty much do all the work for you!

Credit Sesame is a site that provides anyone with a free credit score, a free credit report that’s full of details, as well as the tools they need to track their credit, analyze their credit scores, improve their personal finances, and even protect their identities online. Since 2010, Credit Sesame has given help to millions of consumers out there, enabling them to do more than they thought they could with their credit score and helping them find ideal financial products for themselves

Credit Sesame: The Basics

Credit Sesame

Who Credit Sesame is for:

- Those who want a free credit score and a detailed, free credit report

- Anyone who wants reliable, secure free credit monitoring and identity theft protection – but doesn’t want to pay for it.

- Anyone who doesn’t know a whole lot about credit and wants an easy-to-navigate platform that helps them track their credit progress

Pros:

- Free membership jam-packed with features

- Free credit monitoring and ID theft protection

- No credit card required to sign up, no commitments

- Easy-to-use app

It’s pretty easy to mess up your credit – so figuring out your current situation is very important.

Beyond the valuable free solutions that this site offers, more advanced services can be paid for – like premium ID protection. The free membership, however, packs enough of a punch for most people to be satisfied.

Tracking Your Credit is Important – Here’s Why

Credit Sesame

Checking your credit score is something that many of us opt to only do occasionally – which is not enough! In order to get control over your financial health, tracking your credit is something that needs to be done regularly. Why?

- It’s a Necessary Starting Point: The first step in improving your personal finances is knowing where you stand. That’s why getting a free credit score is a crucial first step.

- Get an Early Start: Improving your credit takes time, so the earlier you know how bad (or good) it is, the sooner you can start taking steps to make positive steps forward.

- Check its Accuracy: Your credit score is a reflection of what can be found in your credit report. If something is wrong (like ID theft, for instance) checking your credit report will bring it to the surface.

- Avoid Surprises: Knowing where you stand with a free credit score means that you’ll be prepared when you go to apply for a loan or some other credit application.

- Alert Yourself (and Respond) to Identity Theft: Checking a free credit report regularly or signing up for a free credit monitoring service will enable you to discover potential ID theft threats as soon as they happen – so you can respond accordingly.

- Figure Out a Plan: With a free credit monitoring service like Credit Sesame, you can get custom recommendations specific to your situation that will tell you exactly what to do in order to improve your score.

Maintaining a Healthy Credit Score is also Crucial

So you’ve seen your free credit report and you’ve got a grasp on your credit history, along with a plan to start improving your credit score. Maybe your free credit score was already quite healthy. What’s next?

Keeping your credit score high is just as important as tracking your credit regularly. After all, it only takes a single negative event for your score to take a hit.

It’s all about making sure that you maintain responsible habits with your credit accounts by:

- paying your bills on time

- carrying a balance of no more than 30% of your total available credit (the lower the better)

- not applying for too many new credit accounts, which can slightly decrease your score

- keeping old credit card accounts open to increase your average account length (which is good for your credit score)

- paying attention to alerts from a credit monitoring service, so you can fix any errors as soon as they pop up

So, why is maintaining a high credit score important?

Credit Sesame

Having an excellent credit score comes with a number of benefits, all of which can make your life much easier for years to come.

Keeping a high credit score gives you:

- More Approvals: With a high credit score, you are much more likely to get approved for new credit cards, mortgages, auto loans, personal loans, etc.

- Lower Interest Rates: When you do get approved for a new line of credit or a new loan, your higher credit score will typically qualify you for a lower interest rate!

- Higher Credit Limits: Your healthy score shows banks that you can handle credit responsibly, so they will likely give you a higher credit limit than if your score wasn’t excellent.

- Negotiating Leverage: When you are negotiating a lower interest, your excellent credit score will give you more power to talk your way into a lower rate.

- Cheaper Auto Insurance: Some car insurance providers charge higher premiums to policyholders with bad credit scores.

- Easier Housing Approval: When you’re applying to rent a new house or apartment, landlords can check your credit – and potentially deny your application if they don’t like what they see.

Apart from the financial perks that come with having excellent credit, the satisfaction of knowing you’ve worked hard to keep your credit score high is a perk all its own!

What You Get with Credit Sesame

Thankfully, nowadays we can take advantage of free online solutions that help us stay on top of our credit scores. These services are more than just a free credit score – they often include free credit monitoring and a whole suite of other features.

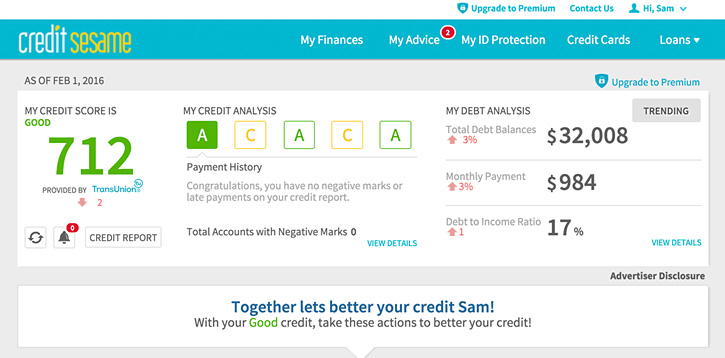

With the free membership offered by Credit Sesame, you get access to a number of valuable services and benefits:

- Free credit score update each month (from only 1 credit reporting bureau)

- View everything on your free credit report, including

- what factors influence your credit score

- how much each factor affects your credit score

- Recommendations for things you can do or services you can use to improve your credit score

- Access to a plethora of financial literacy resources that help you learn more about personal finance

Once you sign up, you get these continued benefits:

- Credit monitoring: you will immediately be alerted if there are any changes to your credit report.

- Identity Theft Protection: If you sign up for the free credit monitoring offered by Credit Sesame, you get an automatic and free $50,000 ID theft insurance policy (at absolutely no cost).

Yes, everything listed above is completely FREE! Credit Sesame doesn’t even require a credit card to sign up for its free membership.

What You Can Get with Premium Features

For those of you willing to shell out a little cash for some extra perks beyond just a free credit score and free credit report, you can sign up for one of the three premium membership options offered by Credit Sesame:

- Advanced Credit ($9.95/month): With this plan, you get all of the features included in the free program, plus

- Daily credit score updates from 1 credit reporting bureau

- Monthly credit score updates from 3 bureaus

- Monthly full credit report from 3 bureaus

- Pro Credit ($15.95): Everything listed above, plus

- Credit monitoring with alerts from 3 bureaus

- 24/7 live support to help resolve inaccuracies found in your credit report

- Platinum Protection ($19.95): All features from the cheaper plans, in addition to

- 24/7 live support for stolen/lost wallet emergencies

- Black market website monitoring

- Public records monitoring

- Social security number monitoring

If you’re interested in any of these advanced Credit Sesame plans that go beyond a free credit score to give you a whole host of additional features, you can sign up for a premium plan.

How to Get Started

Signing up for Credit Sesame is a breeze – you simply go to the Credit Sesame website and enter your email address to get started.

To get started you’ll provide some basic information about yourself, such as your address, date of birth, the last four digits of your social security number, and a few other details (no credit card information needed).

That’s all you have to do!

You will be directed to your new dashboard immediately, where you can get access to your free credit score, free credit report, and you can begin benefitting from Credit Sesame’s free credit monitoring!

Sign up for a free Credit Sesame membership now! Your future self will thank you.