35 Ways To Make Money In 2020

It’s our mission to make money matters a little less insane. We provide financial editorial content free for all and are supported by some of our affiliate partners included in this post which earns us a commission. We hope you enjoy our content and subscribe to our newsletter.

Jobs don’t look the way they used to. Thanks to the modern economy and the great technological strides we’ve made in recent years, the way that human beings financially support themselves has tremendously evolved. There are so many more ways to make money these days!

Gone is the era where a single full-time job or a couple of part-time gigs were our only options for earning a living. Nowadays, people can have several streams of money going into their bank account.

Gone is the era where a single full-time job or a couple of part-time gigs were our only options for earning a living. Nowadays, people can have several streams of money going into their bank account.

There are so many ways to make money, with countless diverse options, that it’s almost difficult to choose which cash-generating activities you want to participate in.

That’s why we’re here: to help you sort through the best ways to make money. We’ve compiled a list of simple ways to make money that include everything from delivering food and taking online surveys to renting out a spare bedroom to tourists.

Whether you’re saving up for a major purchase, or simply want some extra disposable income every month, take a look at some of our money-making solutions – and you might just fatten your bank account more than you could have imagined possible!

1. Deliver Just About Anything With Postmates.

Kai Pilger on Unsplash

Postmates allows you to earn money delivering just about everything. You can deliver food, drinks, retail, and more — from anywhere in your city.

Deliver on your schedule and keep 100% off the tips you earn. Get free weekly deposits or cash out instantly anytime you want.

Sign up to deliver with Postmates.

2. Drive With Lyft And Make $1,000 In 30 Days Guaranteed.

Abdiel Ibarra on Unsplash

Unless you live in a city with great public transportation, you probably have a car. Why not use it as an easy way to make money? It can help pay your bills and then some.

Lyft lets its drivers pick up gigs whenever they want, which means they’re always in control. In addition to the regular rate, drivers also have the opportunity to earn bonuses for working during peak periods and accepting 90% of the rides offered to them. Gratuities are also part of the equation, with passengers being able to tip straight from the app on every single journey.

Getting paid is super easy with Lyft’s Express Pay program, which allows drivers to cash out whenever they want. According to Lyft, median earnings are $29.47 per hour, nationwide. That number rises to $31.18 per hour in America’s top 25 markets. Some of its drivers make more than $800 by only working on Friday nights and weekends.

Lyft is currently offering drivers $1,000 in 30 days guaranteed.

3. Borrow Money To Make Money.

Jp Valery on Unsplash

There are times you may need a little cash to do something like start a business.

Personal loans allow you to borrow as little as $1,000 and as much as $100,000 for virtually any reason.

Fiona is a place that will give you personal loan options from multiple lenders in just 60 seconds.

It’s super easy, fast, and secure. Checking your personal loan rate with Fiona won’t affect your credit score either.

4. Deliver Food With DoorDash.

Tim Mossholder on Unsplash

The days of only being able to have pizza and Chinese food delivered to your house are now over, thanks to drivers who pick up delivery gigs through apps like DoorDash.

DoorDash allows anyone to become “dashers” for the company and make money on their free time whenever they’d like. Choose your preferred work days, pick your hours, and start delivering with DoorDash.

The concept is simple – customers order food from restaurants through the DoorDash app, and dashers pick up the food and deliver it to their home or office. You can choose to deliver by car, bike, scooter, or just walk. This is a great way to make money while learning about new restaurants in your city.

Sign up to deliver with DoorDash today.

5. Make Money By Listing Your Extra Room.

deborah cortelazzi on Unsplash

Airbnb has completely changed the accommodation game, as travelers can now stay in cozy, unique, welcoming homes rather than be limited to boring hotel rooms. It’s incredibly easy to list your own place on the popular website and is a great way to make money.

If you have a room in your house that sits empty, or an in-law suite that only hosts your in-laws once a year, you’re missing out on major cash. Listing a section of your house – or your entire house – is simple. Read our ultimate guide to listing your space on Airbnb.

If you’re curious about what you could be earning, check out the Airbnb earnings estimator.

6. Invest With Intelligent Automation For Free.

M1 Finance

You work hard, shouldn’t your money do the same for you?

M1 Smart Money Management gives you the freedom to build, invest, and optimize your money — the way you want.

You can crate your own portfolio with any stock and/or ETF, for free. Borrow money at one of the lowest rates in the market, and access spending of your money with an M1 checking and debit card.

Best of all you can enjoy M1 Finance for free.

7. Refinance Student Loans & Immediately Put Cash In Your Pocket.

Credible

Are your monthly student loan payments too high? You might be paying more interest than you need to.

If you refinance your student loans with Credible you may be able to lower your interest rate and save immediately on your student loan payments. Refinancing your student loans simply means replacing your existing student loan with a new lower interest loan. This could save you thousands of dollars.

It takes 2 minutes with Credible to get prequalified student loan rates from up to 10 lenders. It’s well worth the time to check out. Credible also has a best rate guarantee, which means if you find a better rate elsewhere, they will give you $200 (terms apply).

8. Be A Dog Walker.

Chris Benson on Unsplash

If you love dogs, why not get paid to hang out with them? Rover lets you do just that.

Rover lets you set your own schedule and prices, and decide exactly what you want to offer when it comes to pet care – from pet sitting for a week to dog walking for 30 minutes. It’s definitely the best gig out there for animal lovers – and you can earn extra income by doing it part-time. You can manage your availability on the Rover app and you’ll have access to 24/7 support, including vet assistance.

Sign up to make money with Rover while hanging out with some cute furry friends.

9. Make Money Off Your Car When You’re Not Using It.

Kaique Rocha on Pexels

You can make serious cash by listing your car on rental sites, allowing people who temporarily need a set of wheels to use your vehicle and avoid those pesky corporate rental car companies.

List your car on Getaround:

Getaround is a great site that allows you to put your idle car to work, listing your vehicle on the website and turning it into a paycheck with no driving necessary. There are car owners who have pocketed over $30,000 using Getaround.

There’s no reason to be nervous about someone else driving your car, as you’re protected with $1,000,000 primary insurance. Drivers are also screened before getting into your car, ensuring they have a safe driving record. You can earn more than $800 a month by renting your car on Getaround, according to the site.

But you can also earn more. Click here to see real-life testimonials from Getaround members, including Evan G., who has made $37,141 since 2012 by renting out his Honda Civic Hybrid.

Getaround is available in San Francisco, Oakland, Berkeley, Los Angeles, Portland, Chicago, Washington DC, New Jersey, Philadelphia, Seattle, Boston, New York City, Miami, and San Diego.

10. Grocery Shop For Other People.

Gratisography on Pexels

If you’re like most people, you spend a decent amount of time at the supermarket. Becoming an Instacart Shopper is a great way to make money picking up groceries for people.

Instacart is an app where busy people who simply don’t have time to go to the store can order and outsource their shopping to someone else. You can make a big chunk of change by being that “someone else.” In fact, you can make more than $20 an hour during busy periods. Not bad for doing something you already do anyway. This is an easy way to make money, as it involves doing what you already do anyway.

11. Make Money By Taking Online Surveys.

Grzegorz Walczak on Unsplash

Even though you’re just a normal consumer, your opinion matters – and there are people who are willing to pay for your input! Taking online surveys is an easy, straightforward way to make money, and there are a number of reliable, high-paying sites that you can try out:

Survey Junkie: Your honest opinions will help dictate the future consumer landscape. As soon as you accrue $10 worth of points after taking surveys with this site, you can cash out with either a PayPal deposit or by receiving a gift card.

Sign up for at least two survey sites to see what surveys are currently being offered and take advantage of the best ones. It will take less than five minutes. Other great survey sites to make money with include:

12. Get Paid For The Stuff You Already Do Online.

Ellyot on Unsplash

If you’re like most people, you probably spend a lot of time online. Why not get paid for doing what you already do anyway? You can do exactly that with:

→ InboxDollars gives you $5 just for signing up and continues to reward users with real cash for doing a number of online activities. You can play games, read through emails, shop, take surveys and watch videos – plus you get access to cash back deals, coupons, and free samples!

Over $57 million has been paid to InboxDollars users.

→ Swagbucks gives you $5 just for signing up. It then gives you more gift cards and cash for doing things like searching the web, watching videos, playing online games, and answering surveys. You can also get rewarded when you sign up for new services and try free samples of products.

The process is simple – you receive Swagbucks for everything you do, and you cash those in for gift cards or cash back via PayPal. Talk about a simple way to make money.

Swagbucks gives out 7,000 gift cards a day, with members already receiving more than $297 million in rewards.

Pro Tip: Sign up for both Swagbucks and InboxDollars and get $10 just for joining.

13. Stay on top of your credit for free.

This isn’t a direct way to make more money, but by staying on top of your credit and keeping a good credit score you’ll qualify for better interest rates, which will save you money when you do things take out a loan, apply for a credit card, or purchase a home. This can put a lot of otherwise wasted money back in your pocket, so it’s almost like making free money.

Credit Sesame is a way to stay on top of your credit score for free. You’ll be able to see how you score on the most important credit factors and get your free updated score every month. Find out what affects your credit and how to better it. You’ll even get free credit monitoring and ID protection.

Stay on top of your credit for free with Credit Sesame.

14. Get a high-interest money market account.

Pixabay

CIT Bank offers up some of the highest interest around with its Premier High Yield Savings account. It’s a great way to build an emergency fund or save for a home.

The best part is you can open an account with just a $100 deposit.

There’s no account opening fee or maintenance fee, and you’ll benefit from daily compounding interest. Deposit checks remotely and make transfers with the CIT Bank mobile app.

Start making your money work for you.

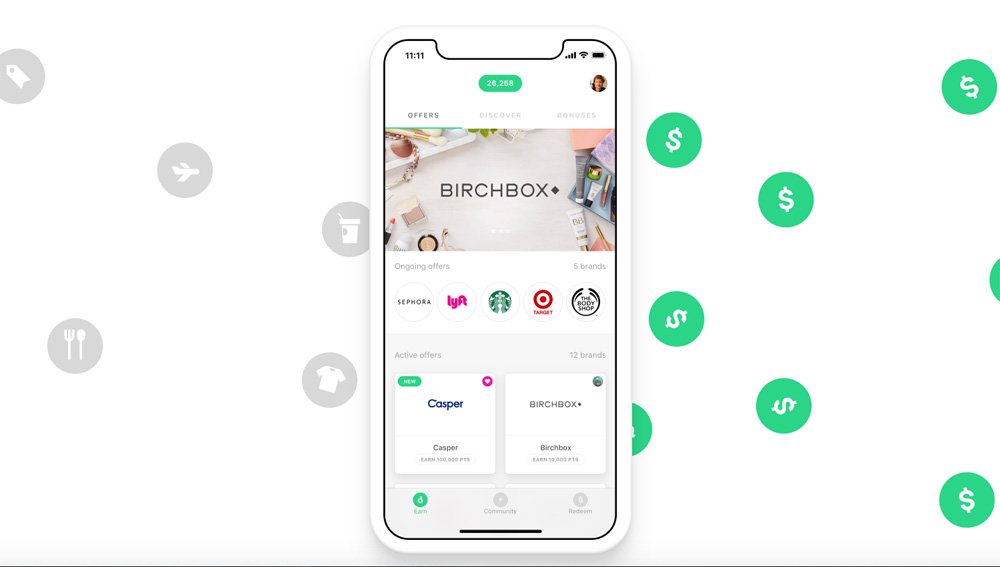

15. Get free gift cards when you shop.

Drop

Drop allows you to turn your purchases into rewards and discounts by using a simple app.

You’ll automatically get points by linking your credit and debit cards to the app, and you’ll get more points for shopping at the places you already shop – whether that’s your local grocery store or your favorite restaurant.

You can redeem your points for gift cards once you’ve accumulated enough (1,000 points are worth $1). This is done directly in the app, allowing you to browse the selection of rewards on offer before deciding how to cash in.

Join Drop today and see why more than 1 million people are already using the app. Read our full Drop review here.

16. Get a free $10 and cashback with Rakuten.

Jacek Dylag on Unsplash

Getting cash back is an easy way to make money, and with Rakuten it’s as easy as 1-2-3. You’ll also get a $10 bonus when you signup. Use Rakuten whenever you need to buy something. Simply log in to your Rakuten account, find the store you’re interested in (such as Amazon, Walmart, eBay, and countless others), shop as you normally would, and get paid the amount of cash back specified by Paypal or check.

There are no points to collect, no forms to fill out, and no fees to pay. Rakuten has already helped its 10 million members earn over $1 billion for simply shopping.

Get cash back and a free $10 bonus from Rakuten.

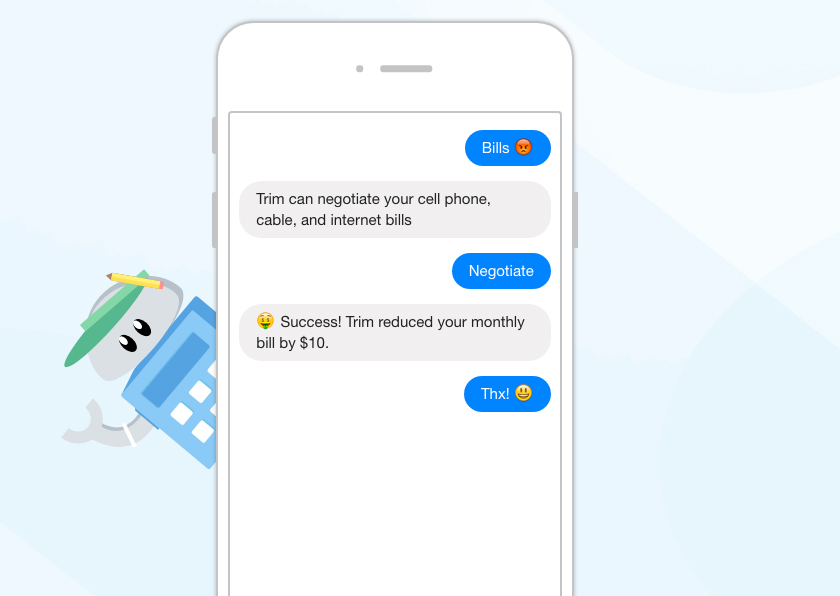

17. Cut your existing bills.

Trim

Even if you’re great at managing money, there are probably still areas where you could use a little help. Sign up free to Trim for the support with that, it’ll literally cut your existing bills.

Trim is a free money-saving assistant that tracks your spending habits, suggests money-saving cuts, and even negotiates lower cable and internet bills on your behalf. It keeps in contact with you via SMS or Facebook Messenger by giving you spending and balance alerts, and automatically applies coupons and discounts. Sign up and watch the savings roll in. Oh, and they’re really serious savings – Trim has saved users over $1,000,000 in the past month alone. Those savings equate to cash in your pocket, making this a simple way to make money by doing basically nothing.

18. More rewards, surveys, and a free $10 gift card.

rawpixel on Unsplash

Browsing online is fun, but it’s even more fun when you get rewards that translate into cash and gift cards.

→ MyPoints allows you to earn free gift cards when you shop online at top retailers like Amazon, eBay, and Walmart. You’ll even earn a $10 Amazon gift card just for making your first purchase. The rewards are legit – 10 million people have already been awarded $236 million in gift cards and Paypal cash.

Join MyPoints and earn a $10 Amazon gift card.

19. Be a stylist.

James Gillespie on Unsplash

Do you love fashion? Become a “stylist” by being an independent seller of Stella & Dot merchandise.

The women’s fashion company allows you to sell their products in person and online for a 25%-35% commission. Start a Facebook page, share photos of your pieces on Instagram, or host a Stella & Dot party with all of your friends. How you earn is totally up to you. You’ll also get a 25%-50% discount when you buy a product from the company.

The average Stella & Dot stylist makes $1,400 a year, which is a decent chunk of change. However, some exceptional stylists have been known to make around $43,800 based on 2017 data. As with most things, you get what you put in. The Stella & Dot starter kit is $199 – a small investment with large potential.

Become a Stella & Dot stylist.

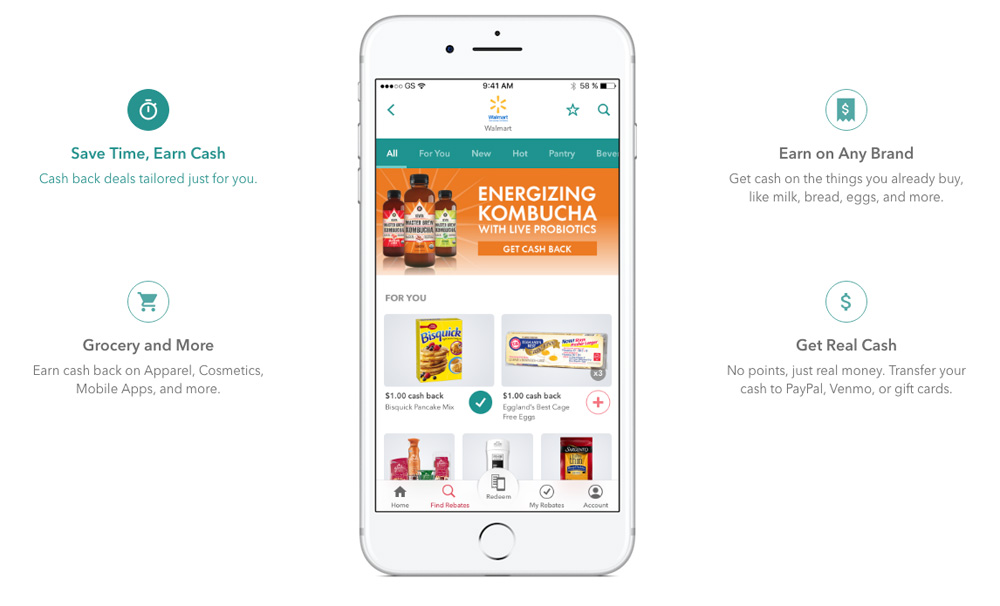

20. Get a free $10 and cash back with Ibotta.

There are multiple cashback sites mentioned in this article, and you should sign up for more than one to take advantage of signup bonuses and compares deals.

Ibotta is cashback site that will give you a $10 signup bonus, plus it’s really awesome.

Ibotta works like this: simply take a photo of your receipt or shop through the app when making regular purchases. The Ibotta app will then work its magic and give you cash back on things like Uber and Lyft rides, grocery purchases and more.

Get your $10 welcome bonus with this link and save on everyday purchases with Ibotta.

21. … Drive with Uber.

Photo by Matthew Henry from Burst

Uber operates on the same model as Lyft, giving drivers the freedom to make their own schedules. Drivers can also make more during busy times of the day, known as surge hours, and the company offers incentives such as volume bonuses.

It doesn’t need to be Uber vs. Lyft, you can drive with both companies to make sure you get as many riders as possible and increase your earning potential. Getting paid is easy and done weekly, and passengers also have the opportunity to leave you tips within the app. Uber is a great way to make money for someone who doesn’t want a 9 to 5 or a boss to answer to.

22. Maximize your 401k.

Fabian Blank on Unsplash

You probably feel pretty good about your 401k contributions, but it may not be performing as well as it could be.

The financial professionals at Blooom can help with your goals. Bloom will analyze your 401k for free and get rid of anything that’s not helping your portfolio live up to its full potential. This is done by eliminating hidden fees and moving you to the lowest cost funds available within your plan. Once that’s done, they monitor your portfolio, keeping an eye out for any changes or suspicious activities. You can get a free analysis in a matter of minutes.

Bloom is no joke – its clients have saved a collective $609,000,000 in lifetime fees so far, and that number continues to grow every second.

23. Start an online store.

Shopify Partners on Burst

Have you always dreamed of owning a store and becoming your own boss? Shopify can help turn that dream into a reality.

Shopify has taken care of everything, allowing you to customize your shop to your needs and desires so that you can focus on the fun parts of running your own store.

You can choose from hundreds of graphic themes, easily take credit card payments through Shopify’s payment system, and keep track of orders on the online dashboard. You don’t need to pay for hosting, because Shopify handles that for you. That alone could be worth the small monthly fee of $29. Shopify gives you a free 14-day trial to test it out. Once you sign up, you can set up an Oberlo account (which exclusively works with Shopify) to easily find products for your store.

More than 600,000 businesses are already using Shopify, with $72 billion worth of products sold. There are countless success stories, from the Mom who was laid off and decided to become an entrepreneur, to the naturopathic doctor who needed a way to sell her revolutionary medication patches.

Sign up to start your store, and click here to learn how to launch a Shopify store in just 35 minutes.

24. Start a Website or blog.

LeBuzz on Unsplash

One of the best ways to make money is to turn your passion into cash. Start a blog or website today has never been easier, with many great website builder options available. There are bloggers out there making six and seven-figure incomes.

Bluehost is a top choice to launch your website. It powers over 2 million websites worldwide. For just $3.95 a month (plus a free domain name included for 1-year) you can start your blog.

Bluehost is risk-free with a 30-day money-back guarantee. It offers 24/7 support to help you with all your needs.

You don’t need to have any past experience, read our guide on how to start a blog and start making money.

When you’re ready to make money off your site, you can use Google’s banner advertising service Adsense, earning money based on the number of exposures and clicks each ad gets.

You can also direct people to your blog with Microsoft ads – and we have an extra $100 credit offer to help you get started.

25. Invest in major real estate projects.

Sean Pollock on Unsplash

Fundrise allows you to invest in multi-million dollar real estate projects without actually being a millionaire.

It’s a great way to diversify your investment portfolio, and you only need $500 to get a piece of the pie. Fundrise’s website claims historical annual returns between 8.7%-12.4%

If it sounds too good to be true, it’s not. Fundrise’s success speaks for itself. It recently ranked 35 on Inc.’s top 500 fastest-growing private companies list, after experiencing a three-year growth rate of 7,340 percent. Investing is always risky and past performance is not indicative of future results.

Start investing with Fundrise.

26. Become a translator.

Dan Gold on Unsplash

Do you ever wish you hadn’t stopped studying Spanish once you reached college? Do you envy those who seamlessly switch between two languages without missing a beat? You can be like that, with the help of Babbel.

Babbel is an online language tool that can teach you how to speak a foreign language correctly and with confidence. Brush up on your skills, or learn an entirely new language, and use that knowledge to make extra cash by moonlighting as a translator (which brings in an average salary of around $20 an hour) or getting a job that values and compensates bilingual employees. This is one of the best ways to make money – it allows you to earn cash by enriching that big brain of yours.

27. Build your professional skills with Coursera.

Wes Hicks on Unsplash

Expanding your knowledge will always equal greater income opportunity. That’s why getting a degree, taking classes, and learning new skills will always be a path to more money. You can learn new skills online easily with Coursera.

The website offers a range of opportunities to grow your skills, giving you the chance to take online courses from top universities and organizations from the comfort of your own home. Each course features pre-recorded videos, quizzes, and projects, so you can study on your own schedule. You’ll also be able to connect with other learners just like you.

Courses are offered in just about every discipline, from photography to starting your own business. You can even earn a master’s degree in computer science from the University of Pennsylvania (yes, that’s an Ivy League school). The cost is about one-third of the cost of earning the same degree on campus, but your diploma will not indicate that it was earned online.

Meshram, who lives in India, used Coursera courses to help him get into Cornell University’s master’s program in Industrial and Labor Relations. “Since my mathematics education ended after 10th grade, I was finding it difficult to get accepted into grad programs,” he told India Today, stressing that Coursera allowed him to fill in his academic gaps.

28. … Or 360training.

NESA by Makers on Unsplash

360training offers more than 6,000 online courses, several of which are completely free. There’s an option for everyone, regardless of your career or professional goals.

From learning about the rules of serving alcohol in Texas to real estate appraisals and mortgages, you’re bound to find countless ways to broaden your skills and make you that much more desirable when it comes time to apply for a job (or get a raise at your current employment).

More than four million learners in 67 countries are already using 360training to improve their career skills. You can do the same, get started with 360training.

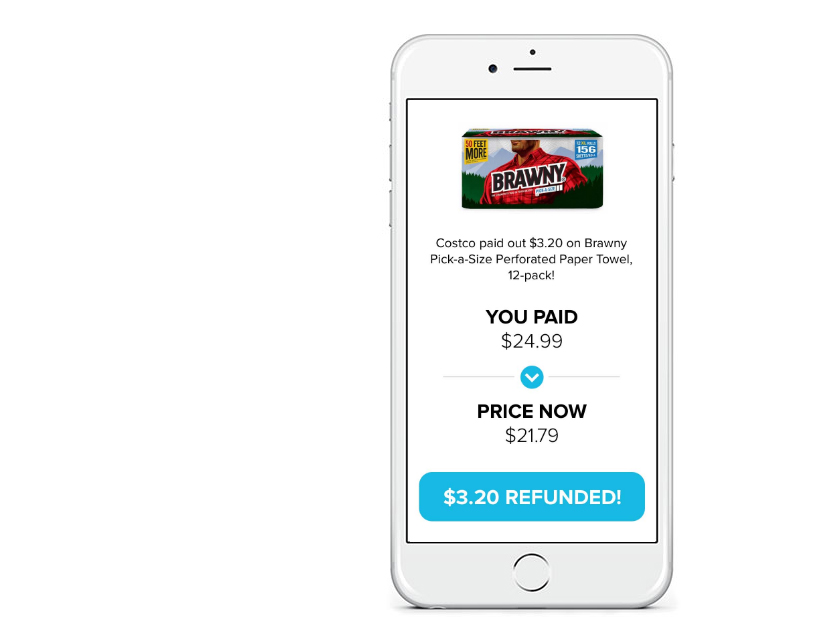

29. Make money by getting refunds on the things you buy automatically.

Paribus

Isn’t it the worst when you buy a laptop or a phone and then a week later the price magically decreases for everyone else?

Not if you have Paribus. Meet the app you never knew you needed, but will want to get it right now.

Paribus is a free app that tracks price drops at stores with price adjustment policies for you. Stores covered by Paribus range from L.L. Bean and J. Crew to Walmart and Costco to Target and Office Depot to Wayfair and Anthropologie. Even Home Depot is covered!

When prices drop, you’re eligible a refund. Most of us don’t keep track of our receipts and price drops at all, though. Paribus keeps track of both, so when price drops come along for items you’ve already purchased, you get cash. It’s an incredibly easy way to make money.

When you sign up for Paribus, your mailbox is connected to the Paribus Receipt Fetcher. As you shop, Paribus logs your purchases. Whenever you’re eligible for a price adjustment claim, Paribus files the claim on your behalf. Once the claim has gone through, you earn 100% of the savings.

Paribus compensates us when you sign up for Paribus using the links provided.

30. Get paid to lose weight.

i yunmai on Unsplash

Losing weight can be hard, so any kind of motivation is usually welcomed. HealthyWage lets you bet on your own success while giving you the opportunity to earn up to $2,000 by shedding pounds.

The way it works is that you sign up for a team challenge. You can come with your own team of five, or be assigned to one. You pay $25/month for three months and start your weightloss journey. At the end of the three months, the team which has lost the most amount of body fat wins $10,000 to be split between all five members. So you’re basically putting in $75 for the chance to win $2,000. You can even earn your entry fees back if you weigh-in after six months and you’ve kept the weight off.

There are no guarantees that your team will win, but even if you lost the $75, you were still motivated to lose the weight (and a gym membership or personal trainer would have been more expensive).

Bet on your weight goals at HealthyWage.

31. Score a flexible job.

Tim Gouw on Unsplash

Have you ever dreamed of having a flexible job, but didn’t know where to look? Wonder no more. FlexJobs is a one-stop shop for just about every type of job – from remote work to freelance work, full-time jobs to temporary and part-time jobs.

There’s something for every career level on FlexJobs, whether you’re an entry-level professional or a seasoned supervisor. There are more than 50 career categories featuring job posts from companies that have been hand-screened by the team at FlexJobs. This means all of the posts you see are legitimate – there are no dodgy ads or scams.

FlexJobs is great for people who dream of working from home, as well as digital nomads, parents seeking flexible hours, and freelancers looking to gain more clients. People who are seeking a more traditional office environment will also find what they’re looking for.

Get started finding a job with FlexJobs.

32. Get paid to save energy.

RawFilm on Unsplash

If you care about the environment and want to reduce your carbon footprint, that’s awesome. What’s even more awesome is that you can get paid for doing it.

OhmConnect is a revolutionary concept which allows you to be contacted when dirty, expensive power plants switch on nearby (something that happens when the grid is stressed).

You’ll receive a notification about once a week to save energy for an hour. If you seize that opportunity, you’ll get paid. The concept is simple – the cash is paid by the grid to OhmConnect, which then passes the cash onto you and other eco-warriors via PayPal.

The average member makes between $100 and $300 a year just by saving energy a few times a week. If you have a large home, you can expect to earn more because you have more opportunities to reduce your consumption.

Interested? All you have to do is link your utility accounts to OhmConnect – free of charge. It’s an easy way to earn money while doing something good.

OhmConnect is currently only available to residents in California, Texas or Toronto, Canada.

Get started saving the planet with OhmConnect.

33. Cash In On Any Extra Storage Space You Might Have

Erda Estremera on Unsplash

Got some unused closet space? Basement or attic space? How about an empty garage or driveway?

Thanks to Neighbor you can now make money off of all that.

Neighbor lets you rent out your unused space to store your neighbors’ belongings. It’s free to list any space. Once you do that, respond to interested renters. You can see what they will be storing and ask them any questions you may have. Once you agree, you start getting paid.

34. Sell your old stuff online.

It doesn’t matter if you live in a tiny studio apartment or a huge six-bedroom house. There’s absolutely stuff sitting around your home that you don’t use. Why not make money by getting rid of it?

Decluttr is an app that will give you money for the stuff collecting dust around your home, from used cell phones to CDs and books. All you have to do is create an account and tell Decluttr what you’re selling. If it’s a phone, just give them the make, model, and condition. If it’s something else, scan the barcode.

You’ll immediately see what Decluttr will give you for those items. Once you accept their offer, you pack up your items and mail them – completely free of charge – to the Decluttr warehouse. You get paid the day after your items arrive. No hassle, and no auction fees (we’re looking at you, eBay).

35. Sell your unwanted gift cards.

Rebecca Aldama on Unsplash

It was very nice of your aunt to buy you a gift card to Bass Pro Shops, but she seems to have forgotten that you hate the outdoors and you’ve never touched a fishing rod in your entire life. Luckily, you can sell that gift card online.

Websites like Cardpool make it easy to unload your unwanted gift cards, allowing you to simply go online and enter the details of each card (such as the merchant and its monetary value). The amount you’ll get for your card varies by brand, and you’ll receive an offer once the balance of your card is verified. On Cardpool, you can get up to 92% of the card’s value. Both physical and online gift cards are typically accepted.