12 Ways To Reduce The Financial Stress In Your Life

It’s our mission to make money matters a little less insane. We provide financial editorial content free for all and are supported by some of our affiliate partners included in this post which earns us a commission. We hope you enjoy our content and subscribe to our newsletter.

Are you in a tough spot, financially?

Maybe you’ve got a barrage of bills hitting you from all directions. Perhaps your debt is piling up to an unmanageable amount.

If you’re struggling with stress related to your finances, the first thing you need to do is keep calm. Continuing to fret can cause even greater levels of stress, and worse yet — it can even prevent you from taking action.

Once you’ve caught your breath, here are 12 ways that you can reduce financial stress.

1. Take Control of Your Expenses

Truebill

Whenever you open up your checking account, are you shocked at just how much money is coming out every month?

From gym memberships to subscriptions to exorbitant bills and all sorts of extras, your monthly spend could be causing you some serious financial anxiety. One of the easiest ways to reduce financial stress is to simply cut out what you’re not using!

But how do you go about cutting some of these expenses? Where do you start? Maybe you’re not even quite sure where all of your money is going.

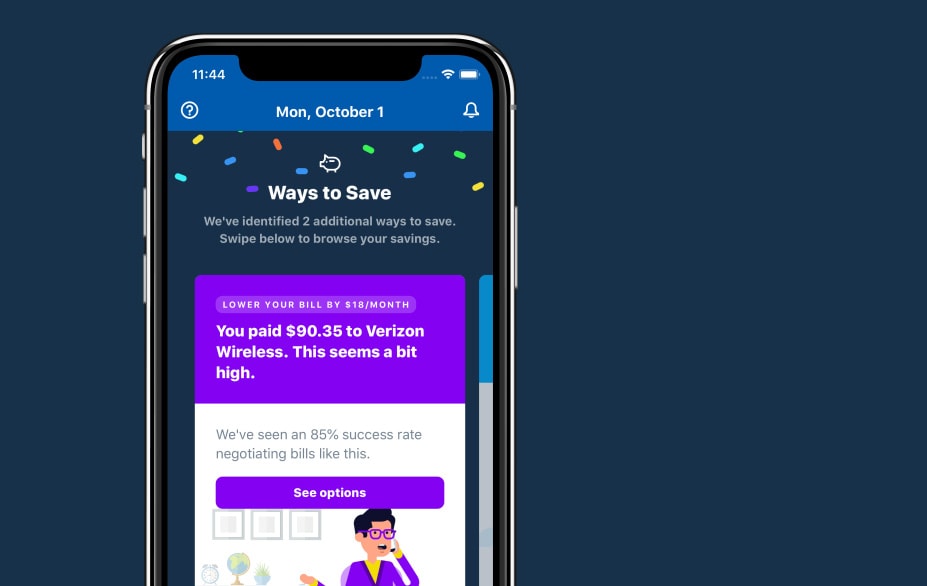

A company like Truebill will help you stay on top of things.

They’ll give you a rundown of all of your current subscriptions in one place. Don’t need subscription “A” or “B?” It will cancel them! With your permission, of course.

What’s more is that Truebill may also be able to help you save on your monthly bills. In fact, they’ll go as far as to negotiate your cable and phone bills for you (among other things), saving you hours on the phone.

Download the Truebill app, start reducing your expenses, and let’s get that heart rate back down!

2. Protect Your Family’s Future

Sai De Silva on Unsplash

Your financial stress might boil down to the uncertainty of your family’s financial future.

Would they be taken care of if you were to pass unexpectedly? Would they have enough money to cover all of life’s expenses? Would leaving them $1,000,000 help them out?

Many people avoid purchasing life insurance because they assume that, due to the large payouts, it’s a costly expense. But that’s not always the case. There are ways to protect your family without breaking the bank.

In fact, with a company like Bestow, get this — you might be able to take out a life insurance policy for as little as just $8 a month!

Coverage ranges from $50,000 to $1,000,000 with 10 or 20-year terms. As long as you’re between the ages of 21 and 54, you can apply!

There are no medical exams required, and no agents to upsell you anything.

Get a free quote from Bestow in seconds, coverage in minutes, and find out how affordable life insurance can be.

3. Wipe Out Credit Card Debt

Javier Sierra on Unsplash

With credit card debt hanging over your head, you may be wondering how you can possibly escape your credit card companies’ sky-high interest rates.

Would you feel a sense of relief if all of your credit card debt was wiped out in one swift move and you were able to save potentially thousands as a result? Of course you would!

One way to achieve this is by getting a personal loan, with a lower interest rate. Whether you’re $5,000 in debt or $50,000 in debt, you could use these funds to eliminate your credit card debt. Going forward, you’d be able to make payments to one account and pay a whole lot less in interest fees.

Credible might be able to help with this. With a simple rate check that will take just two minutes or less, this company will give you up to 11 personal loan lender options in one place for you to compare.

Not to mention, the company’s “Best Rate Guarantee” means that you’ll get $200 if you find a better rate somewhere else (terms apply).

Check your personal loan options with Credible. It’s free and it won’t impact your credit score!

4. Don’t Pay Full Price

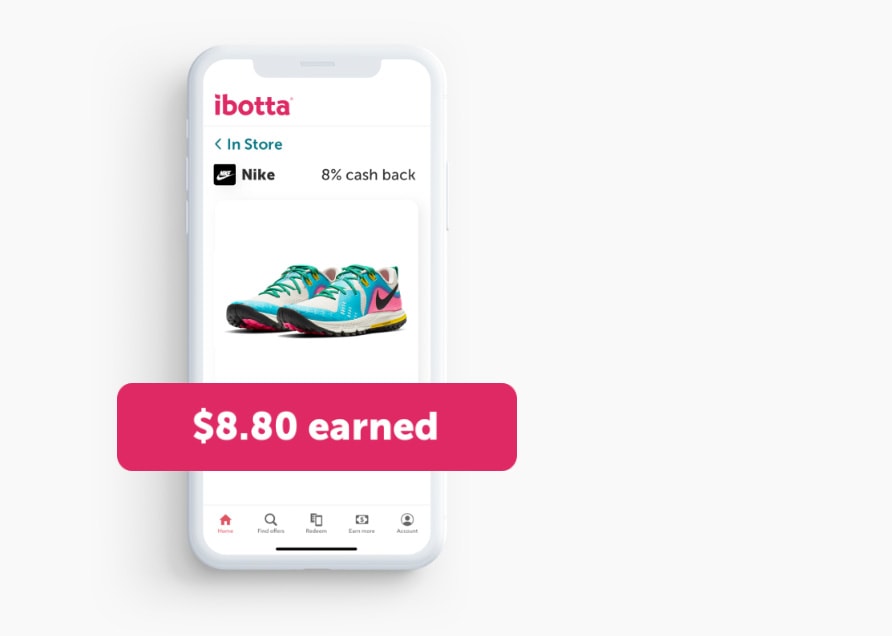

ibotta

Do you freak out a little when you see the total amount on your grocery bill or online shopping receipt?

You add up all of the items to find out that you haven’t been overcharged. Yet you might feel buyer’s remorse in that moment, and maybe even a little anxiety.

Fortunately, there are ways to save money on the stuff you already buy every day.

An app like Ibotta, for example, can help you limit the damage done on your next grocery bill, online splurge, travel expense, or other purchase!

Ibotta allows you to save and earn in three ways. Linking your store loyalty accounts will trigger automatic savings, uploading pictures of your receipts will allow you to earn cashback, and paying with Ibotta will get you instant cashback!

Download the Ibotta app, start saving, and get a $20 welcome bonus just for signing up!

5. Take Advantage of Freebies, Coupons, and Deals

Markus Spiske on Unsplash

How can you experience the thrill of a new purchase without impacting your bank account? With free stuff!

There are different places out there where you can get not only freebies but also coupons and deals. Refusing to settle for full price on your purchases can put your mind at ease and reduce your financial stress.

Where do you find the best deals, though? You probably don’t have time to be scouring the web for the best possible deal on every purchase you make.

With VOICED Market, you can discover some of the hottest freebies, coupons, and deals in one place, and redeem them with the click of a mouse. These offers range from small discounts to deals up to 95% off!

From free streaming TV trials to food delivery deals to discounts on personal fitness programs, you’re not likely to run out of great deals any time soon.

Plus, when you subscribe to the VOICED Market newsletter, you’ll even get the latest deals delivered right to your email inbox!

6. Don’t Overpay the Bank for Your Mortgage

Irene Rego on Unsplash

Your mortgage is likely the largest of all your monthly expenses, so it might very well be causing you the most financial stress.

Whether you’re locked in with a high interest rate or large monthly payment or whether you’re just looking for opportunities to save money on your home, you might be able to refinance your mortgage — a move that allows you to replace your current loan with another loan, ideally with a lower interest rate.

And get this — because your home is such a large investment, you save a whole lot of money through refinancing. Even an interest rate cut of just .5% might help you save thousands!

You can check out your refinancing options right here, comparing up to six top lenders at once.

What’s better? This check will take just three minutes of your time. No paperwork. No fees. Your credit score won’t even be affected.

Fill out the short questionnaire and you might very well be on your way to significant savings on your home!

7. Stop Giving Extra Money to Auto Insurance Companies

Erik Witsoe on Unsplash

Is your auto insurance bill starting to get to you?

While auto insurance is a necessary expense, maybe the amount you’re paying just doesn’t sit well with you. At the same time, shopping around for rates can be a pain; and for many, the process can add to their financial stress.

Well, you don’t have to settle for those high rates month after month, and you don’t have to sit on the phone for hours. There are companies that will provide quick free quotes and perhaps even do all of the shopping for you!

Here are a couple of companies that may be able to help you stop paying more than you need to:

- On average, Liberty Mutual is able to save drivers $509 on their auto insurance each year. Want to check out what your potential savings could look like? Get a free quote online now! They even let you bundle your auto with home or renters insurance for even more savings.

- With Gabi, drivers save an average of $825 on auto insurance each year. This company does all of the dirty work for you, hunting down rates and returning up to 20 different providers at a time. To check out your potential savings, fill out Gabi’s short questionnaire!

8. Grow Your Money Sitting in the Bank

Joshua Hoehne on Unsplash

Are you getting a decent return on the money that’s sitting in your checking or savings account?

Probably not. In fact, the average interest rate on a savings account is embarrassingly low. Maybe this causes you to worry about your long-term financial security — that your money isn’t growing or being protected.

If you’re worried about long-term financial security, consider a certificate of deposit (CD) as a fantastic alternative to a traditional checking or savings account.

The FDIC insures CDs for up to $250,000. So, rest assured that your money is safe.

CIT Bank even offers a no-penalty, 11-month CD with one of the best annual yield percentage (APY) rates going around!

With this CD, you’ll be able to lock in your rate for the full term; but you’ll also be able to withdraw your funds, without penalty, if you find yourself in a pinch.

You can open your CIT Bank CD in three easy steps. Provide your information, fund your account with a minimum of $1,000, and you’ll receive a confirmation. That’s it!

9. Rest Easier by Getting Rid of Credit Card Interest Fees

Webaroo on Unsplash

If credit card debt has already been the source of your financial stress, you’re probably already well aware that credit card companies can get you with their high interest rates.

Rather than falling into that trap again and forking out hundreds or even thousands in interest, opt for a credit card that has a low interest rate — maybe even an interest rate of zero.

There are actually credit cards — like the ones right here — that come with a 0% intro APR. This means that you’ll be able to enjoy no interest fees for a certain period, and potentially a low interest rate thereafter.

10. Lower Your Student Loan Payments

BBH Singapore on Unsplash

Student loans are enough to cause anyone a great deal of financial stress. In fact, there are people who spend their entire lifetime trying to escape the clutches of student loan debt.

Maybe your biggest fear is that this could be you, too. Well, guess what? You might be able to shave thousands of dollars off your student loans through refinancing — the process of replacing your current student loans with one that, preferably, has a lower interest rate.

And with Figure, you can check out your student loan refinancing rate in just minutes.

Refinancing options have no prepayment or late fees. Plus, there is an optional origination fee that could help you reduced your rate and payment. You’ll also get a discount for opting in to auto pay, as well as the flexibility of a 12-month forbearance term.

Apply in five minutes and get refinanced in as soon as five days!

Fill out the company’s digital application to get your rate. The service is free to use and this simple check won’t impact your credit!

11. Take Control of Your Credit and Know Where You Stand

Christina Morillo on Pexels

If you’re experiencing financial stress because it seems that you’re never able to get approved for lending options —whether it’s a personal loan or a good credit card — it might be that your credit score needs a little help.

The reality is that bad credit can get in the way of many of life’s big financial milestones — like financing a car or taking out a mortgage!

Fortunately, there’s always a way to build up your credit again. While you might need to start small, borrowing, spending, and repaying responsibly will help you raise your credit score and put you in better standing with lenders.

Don’t know exactly where your credit stands? With Credit Sesame, you can see your credit score for free, and get free credit monitoring that will help you keep tabs on how you’re progressing.

This service allows you to view your most recent credit score when it becomes available and it even offers personalized pointers that could help you raise it further.

Not to mention, Credit Sesame offers free identity theft protection. That should ease some of your stress!

The best part? It’s free. Sign up for Credit Sesame and starting building that credit!

12. Start Building That Emergency Fund

Colin Watts on Unsplash

Life can be unpredictable. You never know when the next car repair or medical expense is going to pop up. Nonetheless, you’ve got to find the funds to cover these kinds of emergencies.

This might currently be the source of your financial stress, and you’re probably not alone. One survey shows that only 41% of Americans can cover a $1,000 emergency through savings.

So, start contributing to an emergency fund each month, regardless of whether you can only put $20 aside or $200.

Need extra income to make it happen? Start a side hustle or two that will help you put a little more cash in savings.

Once you’ve hit the $1,000 mark (and assuming you have no debt), take your emergency savings to the next level. Aim to cover three to six months’ worth of expenses.

You might find that having this extra padding will lower your blood pressure a bit!

What Is Financial Stress?

Financial stress is a condition caused by anxiety or worry concerning financial or economic events. As it’s very common among adults, you’ve likely experienced it. Maybe you’re experiencing it right now.

If not managed properly, it can not only impact your finances further but also have a negative impact on your health.

How Common Is Financial Stress?

Financial stress is very common. Money is the biggest source of stress for 44% of Americans.

So, if you sense that you’re dealing with financial stress, you probably are, and you’re definitely not alone. Take comfort knowing that you’re in the same boat that many people find themselves in, and that there are ways to effectively manage your financial stress.

How Does Financial Stress Affect Your Health?

Worrying about money can impact your health in a few different ways.

First, it’s been reported that people who are carrying debt have higher rates of mental health issues than those who aren’t carrying debt.

Financial stress can also lead to physical illnesses as conditions, from migraines to heart disease, and much more.

Even beyond the immediate impact on mental and physical health, those who experience financial stress also tend to engage in other health-impacting practices, whether it’s through coping mechanisms or through refusing to seek medical attention for fear of bills.

Needless to say, if you’re stressed as a result of your financial situation, it’s vital to take the necessary measures to limit it.

Quick Tips for Managing Your Financial Stress

- Communicate. Talk with your spouse, significant other, parent, or someone else whom you trust. Bottling up your financial stress can make things worse, while confiding in others can be highly productive.

- Make a budget. Having a plan and setting goals is a necessary step for overcoming the financial stress in your life. A detailed budget will give you a sense of control and a clear path forward.

- Get out of debt. Most people attribute their financial stress to being in debt. Getting out of debt should be high up on your priority list. Becoming debt-free will allow you to raise your credit score again, get better lending opportunities, and breathe a little easier overall.

- Always anticipate the worst. Being prepared for any kind of financial emergency will not only keep you out of debt but also help mitigate the stress caused by these kinds of added expenses.

Don’t Let Your Finances Rule Your Life

Once financial stress begins to invade your life, it can be difficult to eliminate.

Fortunately, there’s always something you can do to move forward. The 12 steps above are some of the fastest ways to start chipping away at the financial burden you’re carrying.

And if you ever feel as though there’s no path forward, it’s wise to seek help from someone who’s good with money — perhaps even a financial advisor.

There are people out there who will not only help you navigate your financial stress but also help you find the light at the end of the tunnel.