How To Get Out Of Debt: 11 Clever Ways

We work hard to bring you awesome editorial content. Some links on this page are from our amazing affiliate partners which earn us a commission at no cost to you and help make this possible.

It’s extremely easy to let debt pile up and it can happen to anyone. “How to get out of debt?” is a question a lot of people find themselves asking. From daily bills to emergencies to impulse purchases, debt can gradually accumulate until one day it hits you like a ton of bricks. If you’re like everyone else, you’re looking for tips and trips to get out of debt.

Tackling your debt load can involve more than simply figuring out ways to make more money or rigorously cutting down on your expenses. There are several ways to get out of debt that you’ve probably never even heard of!

Even though getting out of debt may seem like a huge task, it can be done!

If you’re ready to start taking serious steps to get out of debt and improve your financial situation, continue reading to check out our clever methods of reducing your current debt load.

1. Gain Control with Credit Monitoring & Reporting

Shutterstock

One of the first things anyone should do when they want to overhaul their personal finances is to improve their credit. Luckily, Credit Sesame is here to give you all the information you could ask for – and it’s free!

When it comes to your credit, starting to make improvements early is the best way to go. Better credit means a lower interest rate on your credit card and lower interest when buying a home or car, which can save you a lot of money.

A free Credit Sesame membership provides you with the tools to better your credit. It gives you a free monthly credit score, a free credit report (with personalized recommendations on where to improve), financial education resources, and free credit monitoring – so you can stay aware of any changes on your credit report.

On top of that you get free ID Theft protection included in the no-cost membership, and there is no credit card required to sign up.

Sign up for a free Credit Sesame membership and take the first step to get out of debt today!

2. Pay Less Interest On Your Debt

Shutterstock

Figuring out how to get out of debt can seem insurmountable, especially if you have less-than-favorable interest rates. From credit card bills to medical bills, you may be paying more in interest each month than you truly need to be. You can save quite a bit by getting a low-interest personal loan — which you can use to pay off different types of high-interest debt.

Getting one low-interest personal loan to pay off one or more types of debt can potentially save you thousands of dollars. It can also make your life simpler, consolidating multiple types of debt into a single loan will mean just one monthly bill and payment to deal with.

Thankfully, there are some great companies that offer low-interest personal loans that will help you get out of debt much faster. You can check your rate without affecting your credit score.

→ Credible: This free service will bring you a whopping 11 personal loan quotes in just a couple of minutes. Credible can hook you up with a personal loan in the range of $1,000 to $100,000, pulling together options from several different lenders to help you find the most appropriate one for you.

→ LendingClub: This site presents you with personal loan options with low, fixed interest rates, zero repayment penalties, and fixed monthly payments. Loans can be as much as $40,000, and the online application takes only minutes. All you need to do is apply, review the personal loan options LendingClub shows you, and select the one that’s most suitable for you. Funds can arrive in as little as 7 business days.

→ Upstart: You can get an Upstart loan to pay your debt in the range of $1,000 to $50,000 (3 and 5-year terms). Upstart, which was founded by ex-Googlers, believes you’re more than your credit score and factors in your education and experience to get you the rate you deserve. It takes 2 minutes to get your rate. You’ll need a minimum credit score of 620 and there is no prepayment penalty.

* Upstart is unavailable in Iowa and West Virginia.

3. Got Student Loans? Refinancing May Be an Option

Shutterstock

Paying off student loans can feel like a never-ending slog, particularly if you are trying to get out of debt as quickly as possible. And, to make matters worse, you may actually be overpaying on interest for your student loan – but Credible can help you get a better rate!

If you have federal, private or ParentPLUS loans that you’re still paying off, Credible can help lower your interest rate and reduce your payments each month by providing you with a list of prequalified rates from as many as 8 vetted lenders. You see, Credible isn’t a lender itself, but it provides you with a list of real rates (not ranges) from other reliable lenders for which you qualify.

It only takes two minutes – and one simple form – to see how much you can save. Checking your rates won’t affect your credit score and Credible’s Client Success team is there to help you every step of the way.

Credible doesn’t stop at helping you with refinancing student loans either, you can also compare up to 11 lenders for a personal loan should you need one.

Compare rates and save with Credible.

4. Reduce Your Bills with Billshark

Billshark

Imagine if you could get your satellite radio, TV, home security, WiFi, or wireless phone company to lower your monthly bills – without having to do any of the negotiating. That could be one of the easiest ways to get out of debt. It’s possible with Billshark!

For negotiating lower prices on your monthly bills, users only have to pay 40% of the savings that Billshark’s hard-working “sharks” manage to score for them. You pay that one time, but your savings may last for years. If your bills don’t get reduced, you don’t have to pay!

In some cases, users can save thousands of dollars annually because of Billshark.

The process is extremely simple: upload a digital copy of your bills via email, Billshark’s website, or the Billshark app, and you get regular updates as their team quickly finds savings in your next round of bills.

Send your bills to Billshark to save money each month.

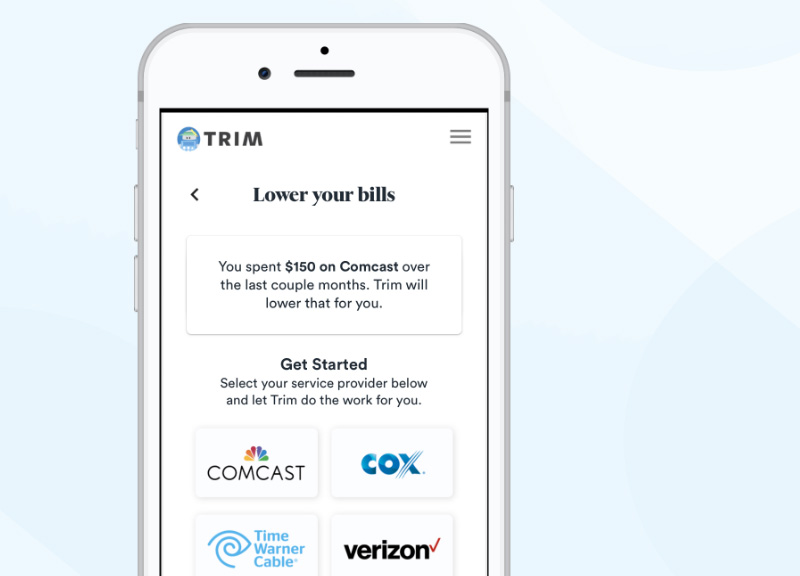

5. Shrink Your Monthly Expenses with Trim

Trim

Wouldn’t it be fabulous to have a personal assistant whose sole job is to help you save money? Personal assistants are out of most people’s price range, but you don’t need one to start saving on your monthly bills – you can just use an automated, bill-slashing service called Trim.

Trim is a totally free online tool that analyzes your monthly expenses and automates ways to save you money – and help you get out of debt faster. In fact, Trim has saved its users more than $1,000,000 in the past month alone.

After securely connecting your financial accounts (a process protected by two-factor authentication, 256-bit SSL encryption, and read-only access), Trim will analyze your spending patterns. Trim then cancels unwanted subscriptions with your approval, and can also negotiate a lower price on your cable or internet bills.

Trim also offers Simple Savings, which automatically transfers funds to a high-yield savings account. On top of that, users get a debt payoff plan, expert advice, and help to lower your APRs. Start saving with Trim for free.

6. Stop Wasting Money on Banking Fees (and Start Earning 2% Interest)

Aspiration

From monthly fees to ATM withdrawals, tiny banking fees here and there can really add up. If you’re trying to navigate how to get out of debt, getting rid of unnecessary costs like this is one of the most effective solutions. With Aspiration, you will never pay another ATM fee again – while knowing that you’re banking with a charitable, forward-thinking financial organization.

This bank charges no monthly fees either. In fact, Aspiration users get to decide how much they pay for their services – which can be $0 if you want! Because of all the awesome, free features included in an Aspiration account, you might just end up wanting to pay them!

Aspiration clients earn up to 2.00% APY interest, as well as cash back on all purchases – which is literally free money and one of the most effortless ways to get out of debt!

Aspiration is a new type of bank that serves as an alternative to the greedy, irresponsible behavior that most traditional retail banks have been guilty of. Rather than spending money of lobbyists and political contributions, Aspiration donates 10% of its earnings to charities. They also participate in zero fossil fuel funding!

What about their other banking perks? Aspiration accounts come with free cell phone damage protection worth up to $600, Apple Pay and Android Pay functionality, easy photo-based check deposit right on your phone, and $1000 in identity theft reimbursement.

Get an Aspiration Spend & Save Account now.

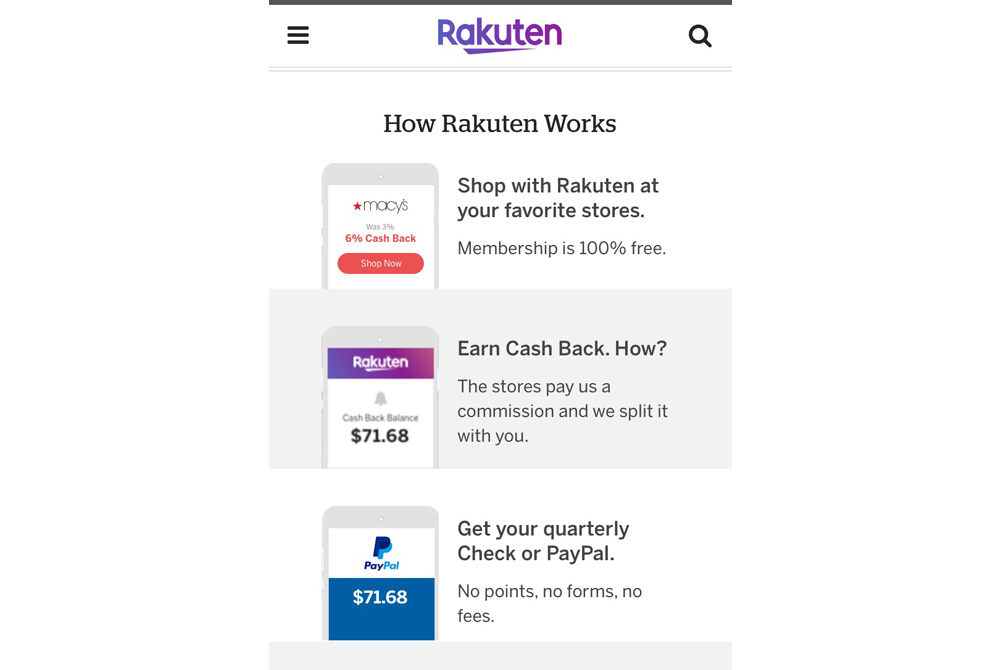

7. Save When You’re Shopping with Cash Back Apps

Rakuten

Figuring out how to get out of debt can be hard, so make your life easy by getting paid to do nothing other than your typical shopping. These days, there are awesome cash back programs that allow you to earn while you shop at all sorts of popular retailers. Not only is this free money that gradually accumulates, but these types of rewards can also be earned in addition to all of the credit card rewards you already might be earning.

→ Ebates (now named Rakuten): Just for signing up with Ebates, users score a free $10 sign-up bonus! After you join, you can earn up to 40% cash back at more than 2,500 online retailers. All you need to do is start your shopping process on the Ebates before clicking through to your desired online store. Every three months, users receive their rewards payment (via check or PayPal) – it’s that simple. On top of that, there are no fees, forms, or points to worry about.

→ Ibotta: Users who sign up for Ibotta can redeem their cash back rewards via PayPal, Venmo, or in the form of gift cards, and cash back is earned at grocery stores, on cosmetics, apparel, phone apps, and much more. So far, Ibotta users have racked up more than $500 million in cash back rewards. Get in on the action and start earning with Ibotta.

→ Drop: With the free Drop app, you can easily earn free gift cards from some of the most popular online stores in the country. After downloading the app and signing up, users simply link their credit or debit card and pick out which of Drop’s retail partners they’d like to start earning points from. When you redeem your points, you can select from a wide variety of e-gift cards from top US retailers.

8. Automate Your Savings with Digit

Digit

Are you learning how to get out of debt, and still struggling with saving money on a consistent basis? You’re not alone. Saving is difficult on its own, let alone figuring out the perfect amount to set aside each month. Thankfully, Digit is here to help – by automating your savings so that you don’t even have to think about it!

Digit helps its users save money without using much mental energy. The app analyzes your spending patterns, then automatically saves the perfect amount of money every single day. Digit users have already stashed more than $1 billion in the bank using the app.

Want to save for something specific, like tackling your credit card balances to get out of debt? Just tell Digit what you’re saving for, and it will take care of the rest. It can budget for an upcoming vacation, an emergency fund, paying off your student loan, etc.

Get a free 30-day trial with Digit.

9. Pick Up a Side Hustle – or Multiple Side Hustles

Matt Nelson on Unsplash

One of the best ways to get out of debt is to add a little extra to your monthly income, which can be put directly toward your current debt obligations. These days, there is an endless supply of non-traditional ways to make money. They’re called side hustles, and they’re one of the easiest methods of boosting your earnings so that you can pay off debt.

There are several types of side hustles out there, from delivering food to blogging – and so much more!

For example:

→ Rover: If you’re a dog lover, this side hustle might sound too good to be true. By becoming a “sitter” with Rover, you can earn up to $1,000 per month by helping busy dog parents ensure that their beloved pets are healthy and happy. You can walk dogs, board them in your home, check in on them, or watch them at their owner’s home – and get paid while you do it! Sitters pick their own schedules and can limit the types and sizes of dogs they’re willing to work with.

→ Instacart: If you know your way around a supermarket, you can turn grocery shopping into a side hustle by becoming an Instacart shopper. Users can make their own schedules, get paid each week, receive tips from each customer, and even boost their earnings by working during peak hours. No vehicle is necessary, either, as you can work solely as an in-store shopper. Sign up to be an Instacart shopper in just 5 minutes.

Check out our full list of 15 side hustles you can start doing to earn extra money.

10. Hire a Credit Repair Service

Shutterstock

It’s easy to hurt your credit score. Having a less-than-optimal score can be a constant setback for your financial life – leaving you paying higher interest rates than you would be paying if your score were higher. This is why improving your credit is one of the first moves you should make when you are figuring out how to get out of debt. Thankfully, Lexington Law can help you boost your credit score!

Lexington Law, which is the #1 ranked credit repair company, offers a free personalized credit consultation as well as a free TransUnion credit report summary (along with recommended solutions).

The process is simple. Lexington Law works with you to identify any questionable negative items currently harming your credit score, then challenges them with your creditors and the credit reporting bureaus.

A single mistaken negative item on your credit report can reduce your score by 110 points, and Lexington Law achieves millions of negative item removals per year. Resolving an issue like this can be one of the best ways to get out of debt, after you leverage your boosted credit score to land lower interest rates.

Right now, there are more than 500,000 active Lexington Law clients. Get in on the action yourself.

11. Consider Getting Debt Relief

rawpixel on Pexels

When you’re figuring out how to get out of debt, sometimes it’s hard to know where to start and which methods to use – especially when you’re juggling different types of debt. If you are struggling with paying down your debt, debt relief from CuraDebt may be one of your most cost-effective options.

CuraDebt has counseled over 180,000 clients nationwide since 2000, providing debt relief solutions for medical bills, credit card debt, tax debt, and other types of unsecured debt.

You can get a free debt relief consultation, which includes a personalized estimate on how much you could save by taking advantage of the legal debt-reducing strategies that CuraDebt recommends. CuraDebt tells you how many months it might take to resolve your debt, an explanation of the benefits compared to other debt relief options, and gives you a new low monthly payment calculation.